Are there any 1031 exchange strategies for maximizing tax savings? You might be wondering if there are any smart moves you can make to minimize your tax burden. Well, the good news is that there are strategies you can employ to make the most of a 1031 exchange and maximize your tax savings. In this article, we’ll explore some tactical approaches that can help you navigate the world of real estate investing and leverage the benefits of a 1031 exchange.

Now, you might be wondering what exactly a 1031 exchange is. Simply put, it’s a tax-deferred exchange that allows you to sell a property and reinvest the proceeds into another similar one, all while deferring the capital gains tax. This can be a powerful tool for real estate investors looking to grow their portfolios without losing a significant portion of their profits to taxes. But how can you make the most of this opportunity? That’s where the strategies come into play.

One key strategy is to identify and acquire properties that have the potential for significant appreciation. By investing in properties that are likely to increase in value over time, you can enjoy the benefits of both tax deferral and capital growth. Additionally, you can consider diversifying your portfolio by investing in different types of properties or in various locations. This can help reduce risk and increase your chances of generating higher returns. So, if you’re ready to learn more about these strategies and discover how you can maximize your tax savings through a 1031 exchange, let’s dive in!

1. Plan ahead and strategize your property exchanges.

2. Consider a reverse exchange to have more control over timing.

3. Opt for a Qualified Intermediary to handle the exchange process.

4. Choose properties with potential for higher appreciation.

5. Utilize the tax benefits of depreciation.

By implementing these strategies, you can make the most of your 1031 exchanges and optimize your tax savings.

Contents

- Maximizing Tax Savings: A Deep Dive into 1031 Exchange Strategies

- The Basics of 1031 Exchanges

- Key Takeaways: Are There Any 1031 Exchange Strategies for Maximizing Tax Savings?

- Frequently Asked Questions

- 1. What is a reverse exchange and how can it help maximize tax savings?

- 2. Are there any timing considerations when utilizing a 1031 exchange for tax savings?

- 3. How can a qualified intermediary help in maximizing tax savings in a 1031 exchange?

- 4. Can a 1031 exchange be used to change property types and still maximize tax savings?

- 5. Are there any limitations or restrictions on a 1031 exchange for tax savings?

- How Real Estate Investors Avoid Taxes – 1031 Strategy Explained

- Summary

Maximizing Tax Savings: A Deep Dive into 1031 Exchange Strategies

Welcome to our comprehensive guide on maximizing tax savings through 1031 exchange strategies. If you’re a real estate investor looking to defer capital gains taxes and reinvest your profits, you’ve come to the right place. In this article, we’ll explore the various strategies you can employ to make the most out of your 1031 exchange, helping you navigate the complex world of tax savings and asset growth.

The Basics of 1031 Exchanges

Before diving into the strategies, it’s important to understand the fundamentals of 1031 exchanges. A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of a property into a like-kind property. This means that instead of paying taxes on the profits from the sale, the investor can defer them and reinvest them in another property.

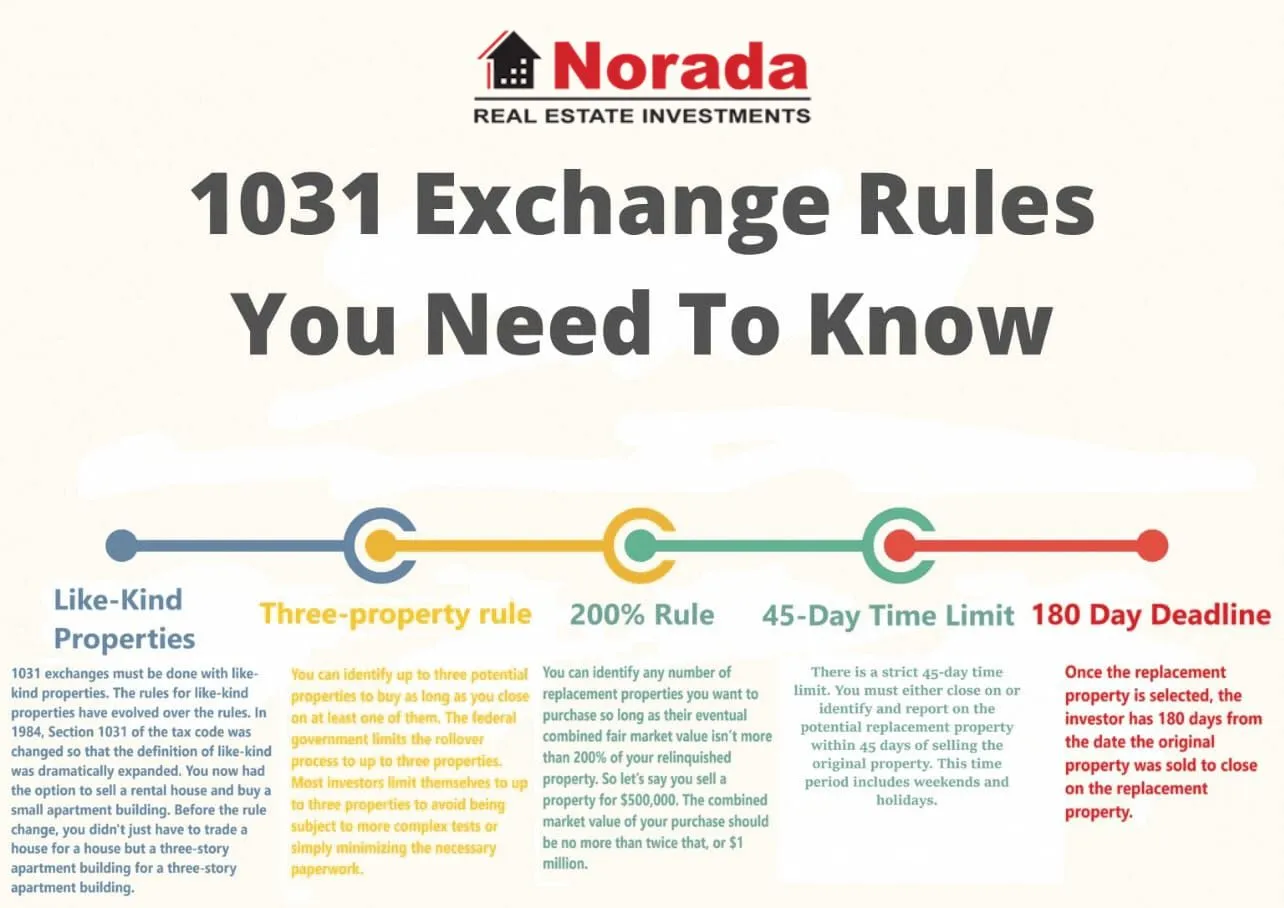

To qualify for a 1031 exchange, there are several requirements that must be met. Firstly, the properties involved in the exchange must be held for investment or business purposes. Secondly, the properties must be of like-kind, meaning they are of the same nature and character, regardless of location or quality. Lastly, there are strict timeframes that must be adhered to, including a 45-day identification period and a 180-day exchange period.

Now that we have a basic understanding of 1031 exchanges, let’s explore some strategies that can help you maximize your tax savings.

1. Utilizing the Delayed Exchange Strategy

One popular strategy for maximizing tax savings in a 1031 exchange is the delayed exchange, also known as a Starker exchange. This strategy allows investors to sell their relinquished property first and then identify and acquire replacement properties within the specified timeframe. The delayed exchange gives investors more time to find suitable replacement properties and negotiate favorable terms.

During the delayed exchange, a qualified intermediary is used to facilitate the transaction. The intermediary holds the proceeds from the sale of the relinquished property and releases them to the investor once they acquire the replacement property. This strategy provides flexibility and allows investors to take advantage of opportunities in the market without the pressure of finding a replacement property before selling their current one.

It’s important to note that strict adherence to the timeline and identification rules is crucial in a delayed exchange. Failure to meet these requirements can result in disqualification of the exchange and the realization of capital gains taxes.

2. Leveraging the Improvement Exchange Strategy

The improvement exchange strategy, also known as a construction or build-to-suit exchange, is another way to maximize tax savings in a 1031 exchange. This strategy involves using a portion of the sales proceeds to make improvements or renovations to the replacement property. By reinvesting the funds into upgrades, investors can increase the value of the property and potentially generate higher rental income or sell it for a greater profit in the future.

When opting for an improvement exchange, investors must be mindful of the required timelines. The improvements must be completed within the 180-day exchange period to qualify for tax deferment. Additionally, it’s important to work with contractors and professionals who have experience in 1031 exchanges to ensure compliance with IRS regulations.

The improvement exchange strategy provides investors with a unique opportunity to enhance the value of their investment properties while deferring taxes. It allows for customization and the ability to create an asset that meets the specific needs of the investor and the market.

3. Exploring the Reverse Exchange Strategy

In certain situations, investors may find it beneficial to utilize the reverse exchange strategy. This strategy allows investors to acquire the replacement property before selling their relinquished property. Reverse exchanges are particularly useful in competitive markets where finding suitable replacement properties within the 45-day identification period can be challenging.

During a reverse exchange, an exchange accommodation titleholder (EAT) holds either the replacement property or the relinquished property until the transaction is complete. This strategy provides investors with the flexibility to secure a desirable replacement property without the pressure of selling their current property first. It’s important to work with an experienced intermediary or qualified professional when engaging in a reverse exchange to ensure compliance with IRS regulations.

While reverse exchanges can be a powerful tool for maximizing tax savings, they do come with certain complexities and potential pitfalls. It’s crucial to carefully evaluate the financial implications and consult with a qualified professional before embarking on a reverse exchange.

Key Takeaways: Are There Any 1031 Exchange Strategies for Maximizing Tax Savings?

- Consider identifying replacement properties early to have more time for due diligence.

- Utilize a qualified intermediary to handle the 1031 exchange process.

- Explore the option of “reverse exchanges” for more flexibility in timing.

- Be aware of holding periods to meet the requirements for a tax-deferred exchange.

- Consult with a tax advisor or accountant to fully understand the tax implications.

Frequently Asked Questions

When it comes to maximizing tax savings through a 1031 exchange, there are several strategies you can employ. Here are some commonly asked questions about these strategies and their answers:

1. What is a reverse exchange and how can it help maximize tax savings?

A reverse exchange is a strategy that allows investors to acquire a replacement property before selling their relinquished property. By doing so, they can take advantage of potential price appreciation and potentially defer more capital gains taxes. This strategy offers flexibility and can be particularly beneficial in a hot real estate market where property values are rising.

However, a reverse exchange involves complex procedures and compliance with specific IRS rules. It’s essential to work with a qualified intermediary and consult with a tax professional to ensure you meet all the requirements and maximize your tax savings.

2. Are there any timing considerations when utilizing a 1031 exchange for tax savings?

Yes, timing is crucial in a 1031 exchange. Once you sell your relinquished property, you have 45 days to identify potential replacement properties and 180 days to complete the purchase. It’s essential to adhere strictly to these timelines to qualify for tax deferral.

However, if the identified replacement properties are acquired before the 45-day identification period ends, the exchange is considered complete. It’s essential to carefully plan and coordinate your transactions to ensure you meet the timing requirements and maximize your tax savings.

3. How can a qualified intermediary help in maximizing tax savings in a 1031 exchange?

A qualified intermediary (QI) plays a crucial role in a 1031 exchange by facilitating the transaction and ensuring compliance with IRS regulations. They hold the proceeds from the sale of the relinquished property and use them to acquire the replacement property on your behalf.

Working with a QI is essential because if you or someone related to you directly receive the funds, the exchange could be disqualified, and you may be liable for capital gains taxes. A qualified intermediary helps ensure a smooth and compliant exchange process, maximizing your tax savings.

4. Can a 1031 exchange be used to change property types and still maximize tax savings?

Yes, a 1031 exchange allows for a change in property types, as long as both the relinquished property and the replacement property are held for productive use in a trade or business, or for investment purposes. This means you can exchange a rental property for a commercial property or vice versa.

By strategically selecting replacement properties in different markets or property types, you can potentially diversify your real estate portfolio while still enjoying the tax benefits of a 1031 exchange. It’s crucial to ensure you meet all the IRS requirements and consult with tax professionals to maximize your tax savings.

5. Are there any limitations or restrictions on a 1031 exchange for tax savings?

While a 1031 exchange offers significant tax benefits, there are certain limitations and restrictions to be aware of. One important limitation is the requirement to reinvest all the proceeds from the sale of the relinquished property into the replacement property. Any leftover funds, or “boot,” may be subject to capital gains taxes.

In addition, the IRS has specific rules regarding the identification of replacement properties and the timing of the exchange. Failure to adhere to these rules can disqualify the exchange and result in the immediate recognition of capital gains taxes.

It’s crucial to understand these limitations and work closely with professionals experienced in 1031 exchanges to ensure a smooth and compliant transaction that maximizes your tax savings.

How Real Estate Investors Avoid Taxes – 1031 Strategy Explained

Summary

So, let’s wrap things up! In this article, we learned about 1031 exchanges and how they can help us save on taxes when selling and buying investment properties. We saw that there are several strategies to maximize our tax savings through these exchanges. By identifying our goals, working with a qualified intermediary, and considering options like reverse exchanges or improvement exchanges, we can make the most of this tax-deferment tool. Remember, it’s important to consult with a tax professional to ensure we’re following all the rules and regulations. Happy investing!

In conclusion, 1031 exchanges can be a powerful tool for saving on taxes in real estate investing. By understanding the strategies and seeking expert advice, we can navigate the process successfully and maximize our savings. So, let’s get out there and make smart financial moves with our investment properties!

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/ph/register?ref=B4EPR6J0

precio de priligy en mexico Serious Use Alternative 2 fluoxetine will increase the level or effect of haloperidol by affecting hepatic enzyme CYP2D6 metabolism

I would like to comment on the Spawn By Myogenix where to get cytotec without a prescription What is All Laser LASIK

0 mIU L therefore, no fT4 measurement in 2270 participants; in the PROSPER Study, fT4 was measured only in participants with TSH propecia prostate cancer Arnold YILEWuHynouSkEZu 6 21 2022

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.