If you’re in the real estate world, you’ve probably heard of 1031 exchanges. But did you know that there can be penalties for violating the rules? Yep, that’s right! Violating 1031 exchange rules can lead to some not-so-pleasant consequences. So, let’s dive in and find out what those penalties are.

Now, I know what you might be thinking: “What exactly is a 1031 exchange?” Well, my friend, it’s a tax-deferred exchange that allows you to sell a property and reinvest the proceeds into another property of equal or greater value. It’s a nifty way to potentially save on taxes. But, like with any tax-related matter, there are rules you must follow.

But here’s the thing: rules can be tricky, and sometimes we unintentionally slip up. So, what happens if you accidentally violate a 1031 exchange rule? Are there any penalties involved? That’s what we’re here to explore. Let’s take a closer look and find out what you need to watch out for.

Contents

- Are There Any Penalties for Violating 1031 Exchange Rules?

- 1. Failure to Identify Replacement Properties Within the Timelines

- 2. Selling Replacement Property Too Soon After the Exchange

- 3. Mixing Personal Use with Investment Use

- 4. Failure to Complete the Exchange within the Allowed Timeframe

- 5. Failure to Follow the Like-Kind Requirement

- 6. Consequences of Violating 1031 Exchange Rules

- 7. Conclusion:

- Key Takeaways: Are There Any Penalties for Violating 1031 Exchange Rules?

- Frequently Asked Questions

- What are the potential penalties for violating 1031 exchange rules?

- Are there any exceptions or leniency for unintentional violations?

- Can violations of 1031 exchange rules lead to audits?

- Can the IRS void my 1031 exchange if rules are violated?

- How can I avoid penalties for violating 1031 exchange rules?

- Summary

Are There Any Penalties for Violating 1031 Exchange Rules?

In the world of real estate investing, 1031 exchanges are a common strategy used to defer capital gains taxes. However, like any tax code, there are specific rules and regulations that must be followed in order to qualify for the benefits of a 1031 exchange. But what happens if these rules are violated? Are there any penalties for non-compliance? In this article, we will explore the consequences of violating 1031 exchange rules and provide valuable insights for real estate investors.

1. Failure to Identify Replacement Properties Within the Timelines

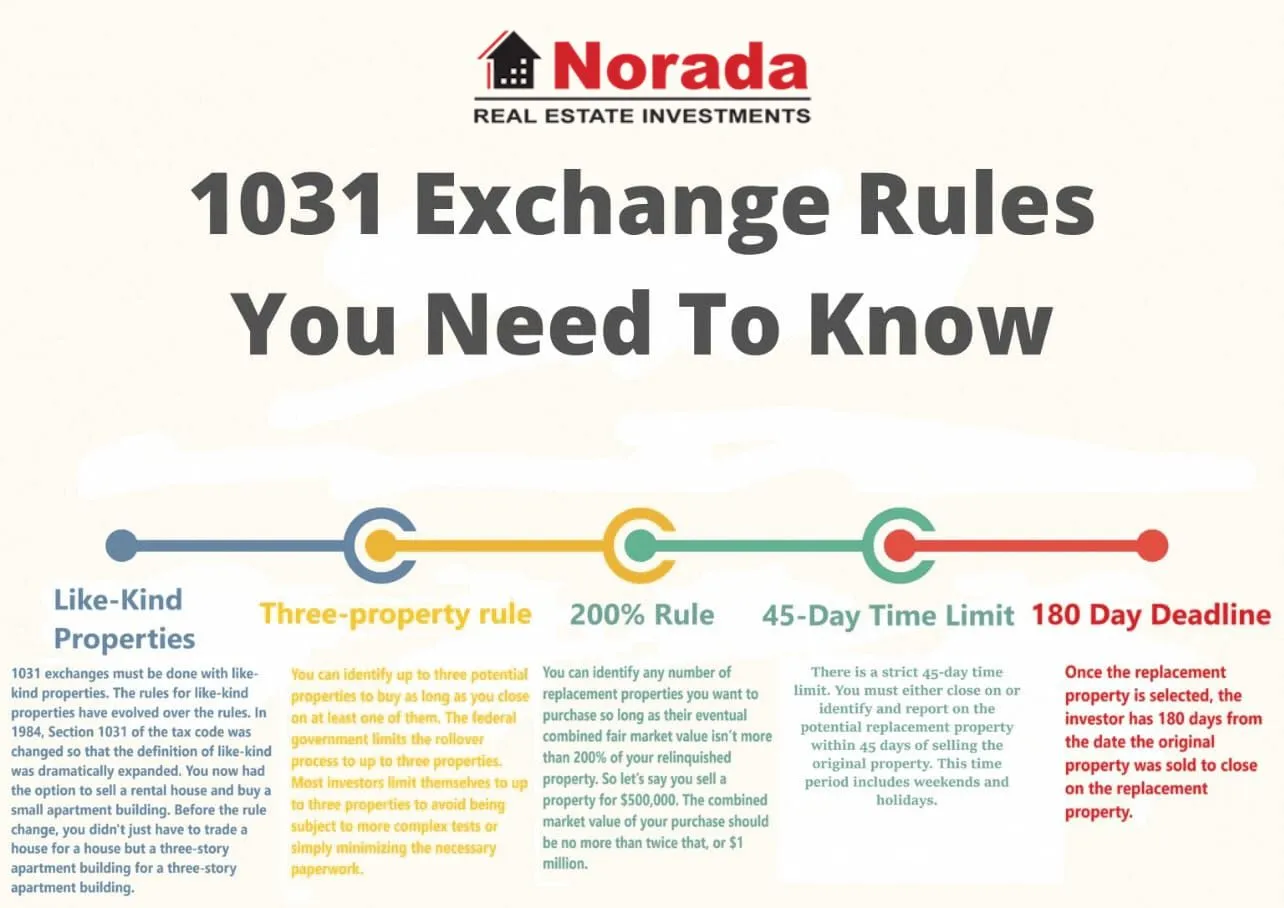

One of the key requirements of a 1031 exchange is the identification of replacement properties within certain timelines. Typically, investors have 45 days from the date of the sale of their relinquished property to identify up to three potential replacement properties. If this timeline is not met, the IRS may disallow the exchange. Additionally, if more than 200% of the value of the relinquished property is identified as potential replacements, the exchange may also be disqualified.

It is essential for investors to carefully adhere to the identification deadlines and ensure that they are within the allowed parameters. Failure to do so may result in the recognition of capital gains tax and potential penalties for non-compliance.

Benefits:

- Deferral of capital gains tax

- Flexibility in choosing replacement properties

- Potential for increased investment portfolio

2. Selling Replacement Property Too Soon After the Exchange

Another rule of a 1031 exchange is that the replacement property must be held for investment or for productive use in a trade or business. If an investor sells the replacement property too soon after the exchange, it may raise red flags with the IRS. While there is no specific timeline that must be followed, it is generally recommended to hold the replacement property for at least one year to demonstrate the intent to hold it for investment purposes.

If the IRS determines that the replacement property was not held for investment, the exchange may be considered invalid, and the investor will be responsible for capital gains taxes on the original relinquished property.

Benefits:

- Potential for long-term appreciation

- Ability to generate rental income

- Flexibility in portfolio diversification

3. Mixing Personal Use with Investment Use

In order to qualify for a 1031 exchange, the property being sold must be held for investment or for productive use in a trade or business. If an investor mixes personal use with investment use, it can complicate the exchange and potentially invalidate it.

For example, if an investor uses a property as both a vacation home and a rental property, only the portion used for rental purposes would be eligible for a 1031 exchange. Any personal use portion would be subject to capital gains tax. It is crucial for investors to clearly establish the investment intent of the property and avoid significant personal use that may raise concerns with the IRS.

4. Failure to Complete the Exchange within the Allowed Timeframe

A 1031 exchange must be completed within a specific timeframe to qualify for tax deferral. Once the relinquished property is sold, the investor has 45 days to identify potential replacement properties and 180 days to complete the exchange by acquiring the replacement property.

If the exchange is not completed within these timeframes, the investor may be subject to taxation on the capital gains from the sale of the relinquished property. It is essential for investors to plan and execute the exchange in a timely manner to avoid any potential penalties or disqualification.

5. Failure to Follow the Like-Kind Requirement

A key requirement of a 1031 exchange is that the relinquished property and the replacement property must be of like-kind. This means that they must be of the same nature or character, regardless of the current or future use. For example, a residential property can be exchanged for a commercial property, as long as they are both investment properties.

If an investor fails to follow the like-kind requirement and exchanges a property for something that is not of like-kind, the exchange may be disqualified, and the investor may owe capital gains tax on the original property. It is crucial for real estate investors to understand the like-kind requirement and seek professional advice if they are unsure about the eligibility of the properties involved in the exchange.

Tips:

- Consult with a tax advisor or 1031 exchange specialist

- Keep detailed records of all exchange-related transactions

- Research and fully understand the 1031 exchange rules and requirements

- Work with reputable professionals who specialize in 1031 exchanges

6. Consequences of Violating 1031 Exchange Rules

If an investor violates the rules of a 1031 exchange, there can be significant consequences. The most immediate consequence is the recognition of capital gains tax on the original relinquished property. This can result in a substantial tax liability that may have been deferred through the exchange.

In addition to the tax liability, the IRS may also impose penalties and interest on the outstanding tax amount. These penalties can add up quickly and further increase the financial burden on the investor.

Furthermore, if the violation of the 1031 exchange rules is seen as intentional or fraudulent, it could potentially lead to an audit or investigation by the IRS. This can further complicate the situation and result in additional penalties and legal consequences for the investor.

7. Conclusion:

Understanding and complying with the rules of a 1031 exchange is crucial for real estate investors looking to defer capital gains taxes and maximize their investment potential. Violating these rules can have significant financial consequences and may result in the disqualification of the exchange. It is important for investors to seek professional advice, keep accurate records, and carefully follow all guidelines to ensure a successful and compliant 1031 exchange.

Key Takeaways: Are There Any Penalties for Violating 1031 Exchange Rules?

- Violating 1031 exchange rules can result in serious penalties, so it’s important to abide by them.

- One potential penalty is disqualification of the exchange, which means losing the tax benefits.

- Another penalty is being subject to immediate tax liability on the gains from the exchange.

- Failure to properly identify replacement properties within the specified time frame can also lead to penalties.

- Engaging in a prohibited transaction, such as using exchange funds for personal use, can result in penalties too.

Frequently Asked Questions

In this section, we will answer some common questions related to violating the rules of a 1031 exchange and the potential penalties involved.

What are the potential penalties for violating 1031 exchange rules?

Violating the rules of a 1031 exchange can lead to several penalties. Firstly, you may have to pay capital gains tax on the entire realized gain from the sale of your property. This could significantly increase your tax liability. Additionally, you may also have to pay penalties and interest for incorrectly reporting your transaction or failing to meet the completion deadlines. These penalties can add up and impact your overall financial situation.

Furthermore, if the IRS determines that you deliberately violated the rules of the 1031 exchange, you may be subject to additional penalties, such as accuracy-related penalties or even criminal charges in extreme cases. It is essential to adhere to the rules and guidelines to avoid these potential penalties.

Are there any exceptions or leniency for unintentional violations?

In some cases, the IRS may provide leniency for unintentional violations of the 1031 exchange rules. The IRS recognizes that mistakes can happen, and if you can demonstrate that your violation was unintentional, you may have the opportunity to rectify the issue without severe penalties. However, to qualify for leniency, you will need to take immediate action to correct the violation and comply with the appropriate rules. It is crucial to consult with a tax professional who specializes in 1031 exchanges to navigate the process successfully.

Keep in mind that leniency for unintentional violations does not guarantee complete exemption from all penalties. You may still be required to pay any applicable taxes, interest, or penalties, but they may be reduced depending on the circumstances. It is always better to act promptly and work with tax experts to address any unintentional violations and minimize potential penalties.

Can violations of 1031 exchange rules lead to audits?

While not all violations of 1031 exchange rules will automatically trigger an audit, they can increase the likelihood of being audited by the IRS. The IRS has specific criteria for selecting tax returns for audit, and if your transaction raises any red flags due to non-compliance with the rules, there is a higher chance of being audited.

However, it is important to note that even if you follow all the rules correctly, there is still a chance of being audited randomly. Audits are a part of the IRS’s effort to ensure compliance with tax laws. If you do get audited, having proper documentation, including complete records of your 1031 exchange transactions, will help substantiate your claims and reduce potential penalties or negative consequences.

Can the IRS void my 1031 exchange if rules are violated?

If you violate the rules of a 1031 exchange, the IRS has the authority to disqualify your transaction and void the benefits of a tax-deferred exchange. This means that the gain from the sale of your property will become immediately taxable, and you will lose the opportunity to defer taxes. It is crucial to follow the rules meticulously to ensure the validity of your 1031 exchange transaction.

In some cases, the IRS may allow you to correct the violation retroactively through a process called “1031 exchange rescission.” This involves undoing the transaction within a certain timeframe and reinitiating it correctly to qualify for tax deferral. Consulting with a tax professional who specializes in 1031 exchanges is crucial if you find yourself in a situation where you have violated the rules and need to explore your options.

How can I avoid penalties for violating 1031 exchange rules?

The best way to avoid penalties for violating 1031 exchange rules is to ensure that you have a thorough understanding of the requirements and guidelines before initiating any transactions. It is crucial to work with a qualified intermediary who specializes in 1031 exchanges and can guide you through the process.

Additionally, maintaining complete and accurate records of your 1031 exchange transactions is essential. Keep all relevant documentation, including purchase and sale agreements, settlement statements, and exchange agreements. This documentation will be vital in substantiating your compliance with the rules in case of an audit or a need to demonstrate that any violations were unintentional. Finally, consult with a knowledgeable tax professional who can provide you with expert advice and help structure your exchange properly to minimize the risk of penalties.

Summary

Breaking the rules of a 1031 exchange can have serious consequences. If you don’t meet the deadlines or use the money for personal reasons, you may have to pay taxes and penalties. It’s important to follow the rules and work with professionals to avoid any issues.

Remember, the purpose of a 1031 exchange is to defer taxes on your real estate investments. So, make sure you understand the rules, keep accurate records, and consult with a qualified intermediary to ensure a smooth and successful exchange. By doing so, you can maximize your profits and avoid unnecessary penalties.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.