Planning a vacation and considering a 1031 exchange? Wondering if there are any special rules for including vacation rentals in this process? Well, you’ve come to the right place! In this article, we’ll explore the ins and outs of vacation rentals and how they relate to a 1031 exchange. So, let’s dive in and find out if there are any special rules you need to know!

If you’re not familiar with a 1031 exchange, it’s a tax-deferred strategy that allows you to sell an investment property and reinvest the proceeds into another property. But what about vacation rentals? Are there any special considerations for these properties? That’s what we’re here to find out. Join us as we unravel the complexities and provide you with the answers you need to make informed decisions.

So, whether you’re a property investor or simply someone looking to turn their vacation home into an income-generating asset, understanding the special rules for vacation rentals in a 1031 exchange is essential. And that’s exactly what we’re going to cover in this article. Get ready to gain valuable insights and discover how to navigate the world of vacation rentals within the context of a 1031 exchange. Let’s get started!

Contents

- Special Rules to Consider When Including Vacation Rentals in a 1031 Exchange

- The Importance of the 14-Day Rule

- The Importance of Proper Documentation

- Key Takeaways

- Frequently Asked Questions

- Are vacation rentals eligible for a 1031 exchange?

- Are there any restrictions on the replacement property for a vacation rental in a 1031 exchange?

- Are there time limits for completing a 1031 exchange involving a vacation rental?

- Can I use a vacation rental property as my personal residence after a 1031 exchange?

- What happens if I can’t find a replacement property for my vacation rental in a 1031 exchange?

- Summary

Special Rules to Consider When Including Vacation Rentals in a 1031 Exchange

Are you considering a 1031 exchange for your vacation rental property? It’s important to understand that there are some special rules and considerations you need to be aware of. A 1031 exchange allows you to defer capital gains taxes on the sale of your property by reinvesting the proceeds into a similar property. However, vacation rentals are subject to certain restrictions and requirements in order to qualify for this tax benefit. In this article, we will explore these special rules and provide you with the information you need to navigate a 1031 exchange for your vacation rental.

The Importance of the 14-Day Rule

One of the key special rules to be aware of when it comes to vacation rentals and 1031 exchanges is the 14-day rule. According to this rule, if you rent out your vacation home for 14 days or less in a year, it is considered a personal use property and not a rental property for tax purposes. This means that any income generated from these short-term rentals is not subject to taxes and does not need to be reported on your tax return. However, if you exceed the 14-day limit, your vacation home will be classified as a rental property, and you will need to report the rental income.

It’s worth noting that if you rent out your vacation home for more than 14 days and use it for personal purposes as well, you may still be eligible for a 1031 exchange. In this case, you will need to apportion the property’s use between personal and rental purposes based on the number of days used for each. The rental portion of the property can still qualify for a 1031 exchange, while the personal use portion would be subject to capital gains taxes.

Understanding the “Like-Kind” Requirement

Another important rule to consider when including vacation rentals in a 1031 exchange is the “like-kind” requirement. In a 1031 exchange, the property you sell and the property you acquire must be of “like-kind.” This means that the properties must be of the same nature or character, even if they differ in quality or grade. In the context of vacation rentals, this means that the properties involved in the exchange must both be used for rental purposes.

It’s crucial to understand that the definition of “like-kind” properties for 1031 exchanges is relatively broad. For vacation rentals, this means that you can exchange your vacation property for other types of rental properties, such as residential rental properties or commercial properties. However, you cannot exchange your vacation rental for a property that you intend to use for personal purposes, such as a primary residence or a second home for your personal use.

Keep in mind that the rules regarding “like-kind” properties can be complex, and it’s always recommended to consult with a tax professional or 1031 exchange expert to ensure compliance with these requirements.

Qualifying for the Full Tax Deferral

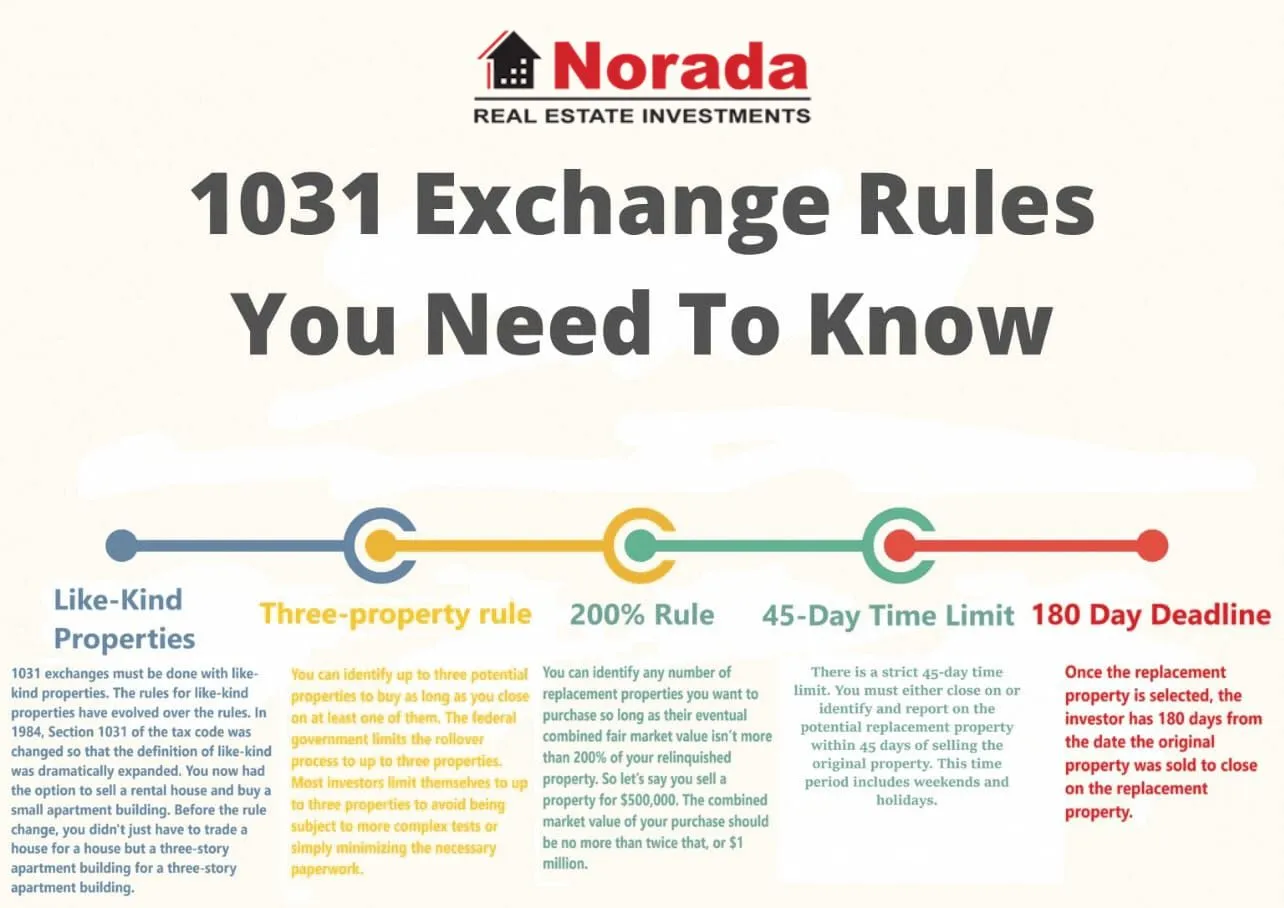

One of the primary benefits of a 1031 exchange is the ability to defer capital gains taxes on the sale of your property. However, in order to qualify for the full tax deferral, there are certain requirements that must be met. First and foremost, the exchange must be completed within a specified timeframe. From the date of the sale of your vacation rental property, you have 45 calendar days to identify potential replacement properties and 180 calendar days to complete the exchange.

Additionally, to qualify for the full tax deferral, the value of the replacement property or properties must be equal to or greater than the value of the relinquished property. Any cash or other proceeds received during the exchange can be considered “boot” and may be subject to taxes.

It’s important to work closely with a qualified intermediary when conducting a 1031 exchange to ensure that all of the necessary requirements are met and to maximize the tax benefits of the exchange.

The Importance of Proper Documentation

When it comes to including vacation rentals in a 1031 exchange, proper documentation is key. It’s essential to maintain detailed records of your rental income and expenses, as well as any personal use of the property. This documentation will not only help you accurately report your rental income for tax purposes but also provide proof of the property’s rental use in the event of an IRS audit.

Furthermore, documenting the fair market value of your vacation rental property, as well as any improvements made over time, is crucial when determining the value of your replacement property in a 1031 exchange. Appraisals or other professional valuations can help support your claim and ensure compliance with IRS regulations.

In conclusion, while there are special rules and considerations to keep in mind when including vacation rentals in a 1031 exchange, it is still possible to take advantage of the tax benefits offered by this tax strategy. By adhering to the 14-day rule, understanding the “like-kind” requirement, qualifying for the full tax deferral, and maintaining proper documentation, you can successfully navigate a 1031 exchange for your vacation rental property. Always consult with a tax professional or 1031 exchange expert to ensure compliance and maximize the benefits of your exchange.

Key Takeaways

2. The property must be held for investment or business purposes, not solely for personal use.

3. The rental income must be reported on your tax return and you must actively manage the property.

4. You cannot use the vacation rental for more than 14 days or 10% of the total days it is rented.

5. It is important to consult with a qualified tax advisor to ensure compliance with all 1031 exchange rules.

Frequently Asked Questions

Vacation rentals can be a great investment opportunity, and if you’re considering a 1031 exchange, there are some special rules to be aware of. Here, we answer some commonly asked questions about vacation rentals and 1031 exchanges.

Are vacation rentals eligible for a 1031 exchange?

Yes, vacation rentals can be eligible for a 1031 exchange as long as they meet certain criteria. It’s important to note that the property must be held for investment or for productive use in a trade or business, and not for personal use or enjoyment. So if you exclusively use your vacation rental for personal purposes, it may not qualify for a 1031 exchange. However, if you rent it out most of the time and treat it as an investment property, it could be eligible.

Keep in mind that there are additional requirements to satisfy, such as the “held for investment” period, which typically means owning the property for at least one year before initiating the exchange. It’s best to consult with a qualified tax advisor or attorney for specific guidance on your situation.

Are there any restrictions on the replacement property for a vacation rental in a 1031 exchange?

When it comes to the replacement property in a 1031 exchange for a vacation rental, there are a few rules to keep in mind. First, the property must be of “like-kind” which means it needs to be of the same nature, character, or class as the vacation rental you’re relinquishing. This doesn’t mean it has to be the same type of property, though. For example, you can exchange a vacation rental for a commercial property or a different type of investment property.

Another important rule is that the value of the replacement property must be equal to or greater than the value of the relinquished vacation rental. If the value is less, you may end up with taxable boot, which is the value of any non-like-kind property or cash you receive in the exchange. To avoid unexpected tax consequences, it’s crucial to work with a professional who can guide you through the process and ensure compliance with all the rules.

Are there time limits for completing a 1031 exchange involving a vacation rental?

Yes, there are time limits that must be followed when completing a 1031 exchange involving a vacation rental. From the date of selling your vacation rental property, also known as the relinquished property, you have 45 days to identify potential replacement properties. This identification period starts ticking on the day of the sale and includes weekends and holidays.

Once you’ve identified the replacement properties, you have a total of 180 days from the date of the sale to complete the exchange. Both the identification period and the exchange period are rigid, so it’s important to act swiftly and diligently to meet the deadlines. Working with a qualified intermediary can help ensure a smooth process and help you stay within the required time frames.

Can I use a vacation rental property as my personal residence after a 1031 exchange?

If you’ve completed a 1031 exchange with a vacation rental property, it’s important to adhere to the guidelines set forth by the IRS. Generally, the property you acquire through the exchange needs to be held for investment or for productive use in a trade or business. Using the property as your personal residence immediately after the exchange could be seen as a violation of the exchange requirements.

However, if you intend to convert the replacement property into your personal residence, you can do so. There is no specific holding period you need to meet before making it your primary residence. Just be aware that if you decide to sell the property, any gain attributed to the time it was used as your primary residence may be subject to capital gains tax. Consulting with a tax advisor is essential to fully understand the implications and potential tax consequences of using the property as a personal residence after a 1031 exchange.

What happens if I can’t find a replacement property for my vacation rental in a 1031 exchange?

In the event that you can’t find a suitable replacement property for your vacation rental within the designated timeframe of a 1031 exchange, there are a few options available. First, you can still complete a partial exchange by identifying and acquiring replacement properties for a portion of the proceeds from the sale of your vacation rental. The remaining portion that is not reinvested would be subject to capital gains tax.

Alternatively, if you fail to identify any replacement properties within the 45-day identification period or are unable to complete the exchange within the 180-day exchange period, the transaction will not qualify for a 1031 exchange. In this case, you’ll owe capital gains tax on the entire proceeds from the sale of your vacation rental property. It’s important to work closely with a qualified intermediary and explore all options to maximize the benefits of a 1031 exchange.

Summary

Vacation rentals can be included in a 1031 exchange if they meet certain criteria. To qualify, the rental property must be held for investment purposes and not used as a personal residence. Additionally, the rental income must be reported on tax returns. It’s important to consult with a tax advisor for guidance on the specific rules and regulations regarding vacation rentals in a 1031 exchange.

In summary, while vacation rentals can be part of a 1031 exchange, there are special rules to consider. These include using the property for investment, reporting rental income, and seeking professional advice to ensure compliance with tax regulations.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.