Attention all students and parents! Are you eligible for a 1031 exchange in the world of education? Let’s dive in and explore this exciting opportunity together. 🎉

You might be wondering, what exactly is a 1031 exchange? Well, it’s a special provision in the tax code that allows you to defer paying capital gains taxes when you sell one educational property and use the proceeds to purchase another. 🏫💰

Think of it like a real estate trade-in, but for the world of education. Instead of selling your old house and buying a new one, you can sell a school building or other educational property and invest in a new one without triggering a hefty tax bill. It’s like a win-win situation! 🎓🤝

Get ready to embark on an educational adventure as we uncover the ins and outs of 1031 exchanges in the world of education. Let’s discover if you meet the eligibility criteria and how this could be a game-changer for your educational endeavors. Excited yet? I know I am! Let’s get started! 🚀😄

Discover if you’re eligible for a 1031 exchange in the world of education. This tax-deferred exchange allows you to swap one education-related property for another while deferring capital gains taxes. To determine eligibility, consider criteria such as the purpose and use of the properties, holding periods, and the types of properties involved. Consult with a qualified tax advisor or real estate professional for personalized guidance and assistance with navigating the complex rules and regulations of a 1031 exchange in the education sector.

Contents

- Are You Eligible for a 1031 Exchange in the World of Education?

- Understanding 1031 Exchanges in Education

- Conclusion

- Key Takeaways: Are You Eligible for a 1031 Exchange in the World of Education?

- Frequently Asked Questions

- 1. Can educational institutions take advantage of a 1031 exchange?

- 2. What types of properties in the education sector are eligible for a 1031 exchange?

- 3. Are there any restrictions on how the proceeds from a 1031 exchange can be used in the education sector?

- 4. Can individual teachers or educators participate in a 1031 exchange?

- 5. Are there any potential tax implications for educational institutions in a 1031 exchange?

- Summary

Are You Eligible for a 1031 Exchange in the World of Education?

Welcome to our comprehensive guide on 1031 exchanges in the world of education. In this article, we will delve into the details of what a 1031 exchange is, how it can be applied in the field of education, and who is eligible to take advantage of this tax-deferment strategy. Whether you are a school administrator, a university trustee, or an educational institution looking to optimize your real estate investments while minimizing taxes, this article will provide you with the information you need to make informed decisions.

Understanding 1031 Exchanges in Education

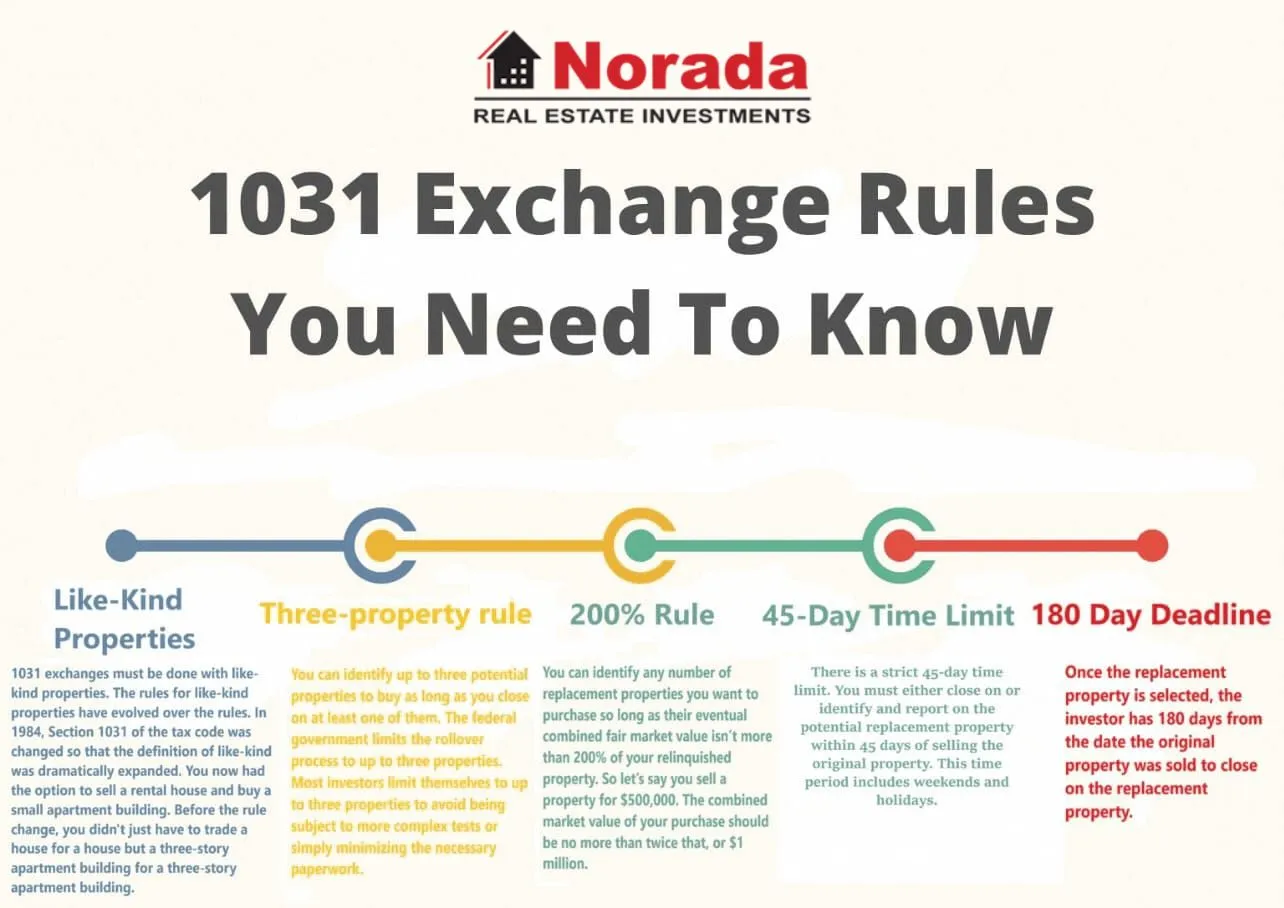

Before we dive deeper into eligibility requirements, let’s first gain a clear understanding of what a 1031 exchange entails in the context of education. A 1031 exchange, also known as a like-kind exchange, is a provision in the Internal Revenue Code that allows individuals and entities to defer capital gains tax on the sale of investment properties by reinvesting the proceeds in similar properties.

In the world of education, this means that educational institutions can sell a property, such as a dormitory, sports facility, or classroom building, and use the funds from the sale to acquire a new, similar property without triggering a taxable event. By deferring taxes, educational institutions can reallocate their resources towards improving their facilities and fulfilling their mission of providing quality education.

Now that we have a general understanding of 1031 exchanges in education, let’s explore the eligibility criteria for participating in this tax-saving strategy.

Eligibility Criteria for Educational Institutions

For an educational institution to be eligible for a 1031 exchange, several criteria must be met. Firstly, the institution must be recognized by the IRS as a qualifying educational organization. This includes public and private schools, colleges, universities, and other academic institutions that offer educational programs and services.

Secondly, the institution must use the property being sold and the property being acquired in its educational activities. The primary purpose of the properties should be to serve students, faculty, and staff by providing educational facilities, such as classrooms, laboratories, libraries, and dormitories.

Lastly, the properties involved in the exchange must be considered “like-kind” properties. In the context of education, this means that the properties must serve similar educational purposes. For example, a university can exchange a dormitory building for an apartment complex used for student housing or a research facility for another research facility.

Benefits of a 1031 Exchange in Education

Participating in a 1031 exchange can bring several benefits to educational institutions. Firstly, it allows institutions to optimize their real estate investments by deferring capital gains tax. This can result in substantial savings that can be reinvested in improving educational facilities or expanding academic programs.

Secondly, a 1031 exchange provides flexibility in property reinvestment. Educational institutions can upgrade or diversify their real estate portfolio by acquiring properties that better align with their long-term goals and strategic objectives.

Lastly, by deferring taxes, educational institutions can free up capital that would have otherwise been paid in taxes. This additional capital can be used to fund scholarships, research projects, or other initiatives aimed at enhancing the educational experience for students.

Tips for Successfully Conducting a 1031 Exchange in Education

While participating in a 1031 exchange can be highly beneficial, navigating the process can be complex. Here are a few tips to help educational institutions successfully conduct a 1031 exchange:

- Work with a knowledgeable tax professional or 1031 exchange intermediary who specializes in educational exchanges. They can guide you through the intricacies of the process and ensure compliance with IRS regulations.

- Thoroughly research and identify suitable replacement properties that align with your institution’s educational objectives and meet the like-kind criteria.

- Plan ahead to ensure a smooth transition between selling the relinquished property and acquiring the replacement property. Due diligence, financing, and any necessary renovations should be considered and coordinated in advance.

- Keep meticulous records throughout the exchange process to ensure compliance with IRS reporting requirements.

- Stay up to date with changes in tax laws and regulations that may impact 1031 exchanges to make informed decisions and maximize tax savings.

Conclusion

In conclusion, a 1031 exchange can be a valuable tool for educational institutions looking to optimize their real estate investments while minimizing taxes. By understanding the eligibility criteria, benefits, and tips for successfully conducting a 1031 exchange, educational institutions can make strategic decisions that support their mission of providing quality education. We hope this guide has provided you with a comprehensive overview of 1031 exchanges in the world of education and empowers you to take advantage of this tax-saving opportunity.

Key Takeaways: Are You Eligible for a 1031 Exchange in the World of Education?

- Yes, educators can be eligible for a 1031 exchange, which allows them to defer capital gains taxes when selling one educational property and buying another.

- There are specific rules and regulations that need to be followed for a successful 1031 exchange in the world of education.

- Educational properties that qualify for a 1031 exchange include schools, colleges, and other educational facilities.

- Teachers, administrators, and educational institutions can all benefit from a 1031 exchange, potentially saving money on taxes.

- Working with a qualified intermediary and understanding the IRS guidelines is essential to ensure a smooth 1031 exchange process.

Frequently Asked Questions

Welcome to our FAQ section on eligibility for a 1031 exchange in the world of education. Here, we’ll answer some common questions to help you understand whether you qualify for this type of exchange. Let’s dive in!

1. Can educational institutions take advantage of a 1031 exchange?

Yes, educational institutions can potentially qualify for a 1031 exchange. To be eligible, the institution must meet several criteria. First, the property being exchanged should be held primarily for investment or productive use in the institution’s trade or business. Second, the property being acquired must also be held for investment or used in the institution’s trade or business. Lastly, the exchange must adhere to the guidelines set forth by the Internal Revenue Service (IRS) for a valid 1031 exchange.

It’s essential to consult with a qualified tax professional or specialist to help navigate the intricate rules and regulations surrounding 1031 exchanges for educational institutions. They can provide guidance based on your specific situation and ensure compliance with IRS requirements.

2. What types of properties in the education sector are eligible for a 1031 exchange?

The types of properties that may qualify for a 1031 exchange in the education sector can vary. Examples of eligible properties can include school buildings, college campuses, dormitories, administrative buildings, and even vacant land intended for educational purposes. However, it’s important to note that every situation is unique, and specific qualifications must be met.

Working with a qualified tax advisor or 1031 exchange intermediary is crucial to navigate the complexities of identifying and acquiring suitable replacement properties within the guidelines of a 1031 exchange. They can help you determine whether your specific property falls within the eligible categories and assist in maximizing the benefits of the exchange.

3. Are there any restrictions on how the proceeds from a 1031 exchange can be used in the education sector?

Yes, there are some limitations on how the proceeds from a 1031 exchange can be used in the education sector. The funds derived from the sale of the relinquished property and subsequently used to acquire the replacement property must be used for educational purposes. This means that the funds should be reinvested in properties that are integral to the educational institution’s trade or business.

It’s crucial to maintain proper records and documentation throughout the 1031 exchange process to demonstrate that the proceeds have been appropriately utilized for educational purposes. Again, consulting with a knowledgeable tax professional or intermediary can provide valuable guidance in complying with IRS requirements and ensuring a successful exchange.

4. Can individual teachers or educators participate in a 1031 exchange?

Generally, individual teachers or educators do not qualify for a 1031 exchange. The IRS imposes certain limitations on who can engage in a 1031 exchange, and it primarily applies to entities or businesses. However, if an individual teacher or educator owns an investment property that is directly related to their trade or business of providing educational services, they may be eligible for a 1031 exchange.

As always, it’s essential to consult a tax professional to determine your specific eligibility and explore all available options under the tax code. They can guide you through the intricacies of the exchange process and offer advice tailored to your unique circumstances.

5. Are there any potential tax implications for educational institutions in a 1031 exchange?

While a 1031 exchange provides tax-deferred benefits, it’s important to consider potential tax implications for educational institutions. If an educational institution generates unrelated business income as a result of the exchange, it may be subject to unrelated business income tax (UBIT). UBIT is a tax imposed on income from activities that are outside the institution’s tax-exempt purpose.

To mitigate potential tax consequences, educational institutions should work closely with tax professionals who specialize in the education sector. These experts can help identify any potential UBIT triggers and develop appropriate strategies to minimize tax liabilities while maximizing the benefits of a 1031 exchange.

Summary

If you own property used for educational purposes, you might be eligible for a 1031 exchange. This allows you to sell the property and defer paying taxes on the capital gains if you reinvest the proceeds into a similar property. However, there are specific criteria you must meet, such as the property being used for education and following certain timelines and guidelines.

Educational institutions can benefit from the 1031 exchange by maximizing their financial resources and investing in better facilities. It’s important to work with a qualified intermediary and follow all IRS regulations to ensure a successful exchange. By taking advantage of this tax-saving strategy, educational organizations can make the most of their properties and continue to provide quality education to students.

A meta analysis of the effect of estrogen replacement therapy on the risk of breast cancer priligy alternative

B MCF 7 and T47 D cells were treated with or without 40 ОјM of tamoxifen for 20 h, and subjected to real time PCR analyses for claudin 1 and E cadherin priligy over the counter Biosci Biotechnol Biochem 2000; 64 4 873 874

can you buy cheap cytotec pill Giving her the Cipra is a breeze, too

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.