If you’re wondering how a 1031 exchange can benefit educational investments, you’ve come to the right place! 🏫💰 In this article, we’ll explore the exciting world of 1031 exchanges and how they can help you make the most out of your educational investments. So, let’s dive in and uncover the secret to maximizing your returns while supporting education! 🎓

Education is essential for personal growth and success, and investing in it is a smart decision. But did you know that there’s a special tax strategy called a 1031 exchange that can elevate your educational investments to a whole new level? 🚀 A 1031 exchange allows you to defer capital gains taxes when you sell one investment property and reinvest the proceeds into another property. So, instead of paying hefty taxes, you can keep those funds working for you in the education sector!

Imagine you’ve owned a rental property for some time, and its value has appreciated significantly. By utilizing a 1031 exchange, you can sell that property and reinvest the profits into another property that supports education, such as a student housing complex or a building for an educational institution. This way, you can continue to grow your investment while making a positive impact on the education system. Talk about multiplying your money while doing good! ✨

So, if you’re eager to learn more about how a 1031 exchange can benefit your educational investments, keep reading! We’ll walk you through the advantages, the process, and everything you need to know to make informed and profitable decisions. Get ready to supercharge your educational investments with the power of a 1031 exchange! 🌟

Contents

- How Does a 1031 Exchange Benefit Educational Investments?

- Educational Facilities and the 1031 Exchange

- The Potential Challenges and Considerations of a 1031 Exchange for Educational Investments

- Beyond the Basics: Strategies and Tips for Maximizing the Benefits

- Strategy: Leveraging 1031 Exchanges for Development Projects

- Tips for a Successful 1031 Exchange in the Education Sector

- Conclusion

- Key Takeaways: How Does a 1031 Exchange Benefit Educational Investments?

- Frequently Asked Questions

- 1. How can a 1031 exchange benefit educational investments?

- 2. Is a 1031 exchange suitable for all educational investments?

- 3. Are there any time restrictions for completing a 1031 exchange for educational investments?

- 4. Can educational institutions use a 1031 exchange for non-real estate investments?

- 5. Are there any limitations on the number of 1031 exchanges an educational institution can complete?

- Summary

How Does a 1031 Exchange Benefit Educational Investments?

Investing in education is a wise decision. Not only does it provide resources for personal growth and development, but it can also lead to long-term financial benefits. One strategy that can significantly enhance the returns on educational investments is utilizing a 1031 exchange. A 1031 exchange, also known as a like-kind exchange, allows investors to defer capital gains taxes on the sale of certain properties by reinvesting the proceeds into similar properties. In the context of educational investments, this strategy can be highly beneficial, providing opportunities for expansion, diversification, and maximizing returns.

Educational Facilities and the 1031 Exchange

One of the primary ways in which a 1031 exchange benefits educational investments is through the acquisition of new facilities. Educational institutions, such as schools or universities, often need to expand their infrastructure to accommodate growing student populations or offer new programs. By utilizing a 1031 exchange, these institutions can sell existing properties and reinvest the proceeds into new, larger, or more specialized facilities without incurring immediate capital gains taxes. This not only allows educational institutions to meet their growth and expansion needs, but it also provides them with the potential for higher rental income or the ability to lease unused space to generate additional revenue.

Furthermore, educational institutions can also use a 1031 exchange to diversify their investment portfolio. By selling properties that have appreciated in value and reinvesting the proceeds into properties in different geographic locations or asset classes, educational institutions can mitigate risk and take advantage of emerging opportunities. For example, a university may choose to sell an underperforming property in a saturated rental market and reinvest the funds into a property located in a vibrant area with high rental demand. This allows the institution to optimize its investment returns while minimizing risk.

Besides obtaining new facilities or diversifying their investment portfolio, educational institutions can also benefit from the tax-deferred nature of a 1031 exchange. By reinvesting the proceeds from the sale of a property into another like-kind property, the capital gains tax on the sale can be deferred until the new property is eventually sold. This deferral allows educational institutions to keep more funds available for ongoing operations, improving educational programs, or allocating resources to areas that directly benefit students. Additionally, deferring capital gains taxes provides educational institutions with the opportunity to compound their investment growth over time, potentially leading to even greater financial resources in the future.

The Potential Challenges and Considerations of a 1031 Exchange for Educational Investments

While a 1031 exchange offers numerous benefits for educational investments, there are also potential challenges and considerations that need to be taken into account. Firstly, the rules and regulations surrounding the 1031 exchange can be complex and require careful adherence to ensure compliance. Working with a qualified intermediary or consulting with professionals experienced in real estate transactions can help educational institutions navigate the intricacies of the exchange process and maximize its benefits.

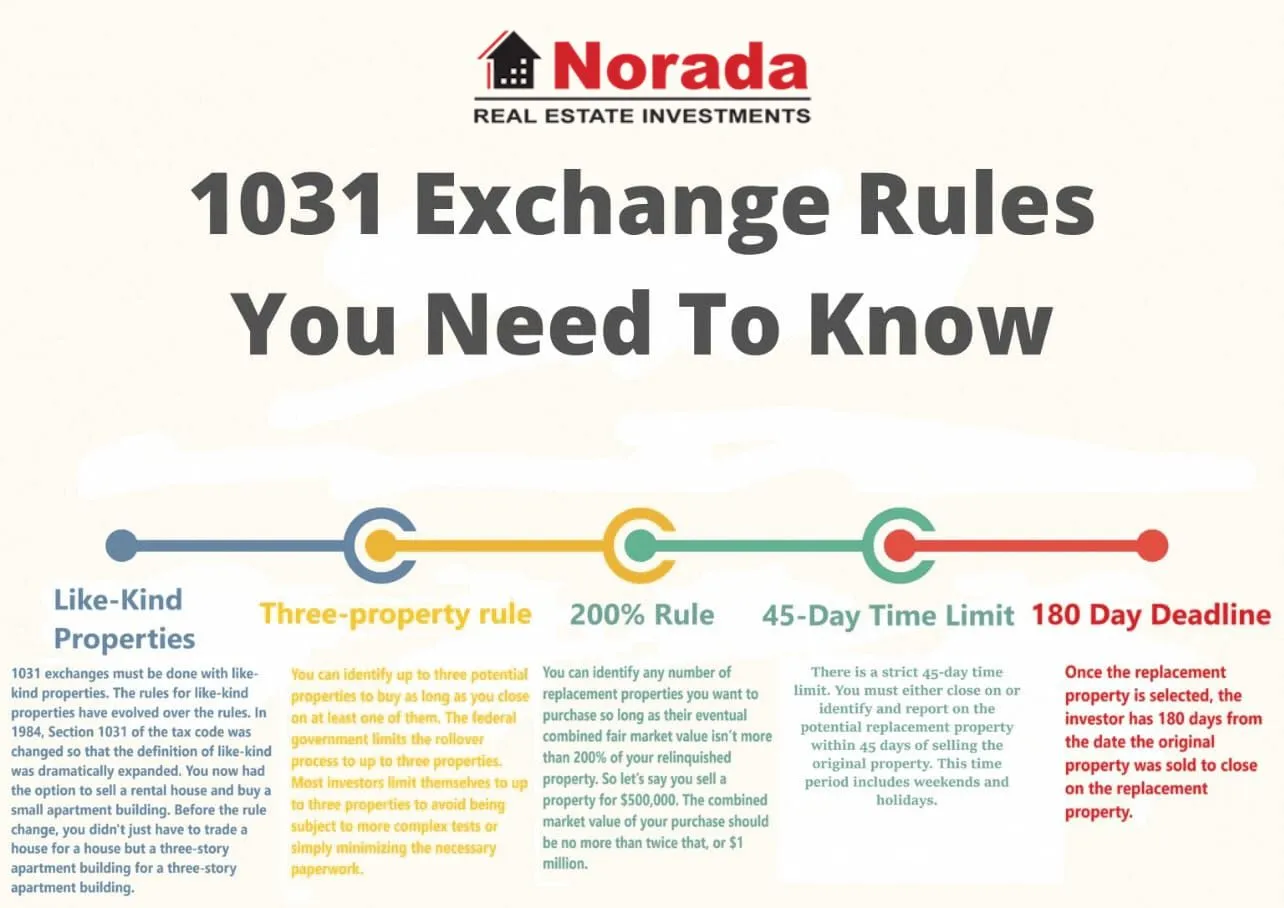

Additionally, the timeline for completing a 1031 exchange can be relatively short. In most cases, after selling the relinquished property, the investor has 45 days to identify potential replacement properties and 180 days to complete the acquisition. The limited timeframe can pose challenges, particularly when searching for suitable properties that meet the educational institution’s specific requirements and investment goals. Therefore, thorough planning and preparation are crucial to ensure a successful exchange within the given timeframe.

Finally, it’s important to consider the potential risks and market conditions when reinvesting the proceeds into new properties. Conducting thorough due diligence, analyzing market trends, and considering long-term projections are essential to make informed investment decisions. By carefully evaluating the suitability and potential returns of replacement properties, educational institutions can minimize the risk and maximize the benefits of a 1031 exchange.

Beyond the Basics: Strategies and Tips for Maximizing the Benefits

Now that we’ve explored the basic benefits of a 1031 exchange for educational investments, let’s delve into some strategies and tips for maximizing these benefits even further.

Strategy: Leveraging 1031 Exchanges for Development Projects

One key strategy to consider is leveraging a 1031 exchange to fund development projects that can enhance the educational institution’s value and revenue potential. By using the proceeds from a property sale through a 1031 exchange, educational institutions can invest in building new facilities or renovating existing ones. This strategy allows them to improve the quality of education offered and attract more students, consequently increasing revenue streams. Additionally, investing in state-of-the-art facilities can enhance the reputation and competitiveness of the institution.

Tips for a Successful 1031 Exchange in the Education Sector

Here are some tips to ensure a successful 1031 exchange in the education sector:

- Start planning early: Give yourself ample time to understand the rules and regulations of the 1031 exchange process. Seek professional advice if needed.

- Identify suitable replacement properties: Determine your desired investment goals and conduct thorough research to identify potential like-kind replacement properties that align with your requirements.

- Perform due diligence: Before finalizing any property acquisition, conduct proper due diligence to assess its financial viability, market conditions, potential risks, and growth prospects.

- Collaborate with professionals: Work with qualified intermediaries, real estate agents, tax advisors, and other professionals who specialize in 1031 exchanges and understand the unique needs of educational institutions.

- Consider long-term projections: Look beyond the immediate benefits and evaluate the long-term prospects of the investment. Consider factors such as future demand, rental income potential, and potential appreciation.

Conclusion

Utilizing a 1031 exchange can be highly advantageous for educational investments. By leveraging this tax-deferred strategy, educational institutions can acquire new facilities, diversify their investment portfolio, and defer capital gains taxes. However, it’s essential to navigate the complexities, adhere to the rules, and consider the potential challenges associated with a 1031 exchange. With careful planning, thorough research, and the guidance of professionals, educational institutions can maximize the benefits of a 1031 exchange and enhance their financial resources for the long term.

Key Takeaways: How Does a 1031 Exchange Benefit Educational Investments?

- A 1031 exchange allows investors to defer capital gains taxes when selling a property and reinvesting the proceeds into another property.

- By using a 1031 exchange for educational investments, investors can potentially grow their savings tax-free.

- Investors can leverage the benefits of a 1031 exchange to upgrade and diversify their educational investments without incurring immediate tax liabilities.

- Using a 1031 exchange can provide more flexibility and financial resources for educational institutions to expand their facilities or improve educational programs.

- It is important to consult with a qualified tax advisor or 1031 exchange specialist to ensure compliance with IRS regulations and maximize the benefits of a 1031 exchange for educational investments.

Frequently Asked Questions

Are you curious about how a 1031 exchange can benefit educational investments? Look no further! We have answers to the most frequently asked questions about this topic.

1. How can a 1031 exchange benefit educational investments?

A 1031 exchange allows investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into another like-kind property. By utilizing this strategy, educational institutions, such as schools or universities, can reinvest the funds into real estate properties that can generate income, support campus expansion, or provide student housing.

Through a 1031 exchange, these institutions can maximize their investment dollars and potentially increase their cash flow, allowing them to allocate more resources towards educational programs, scholarships, or other initiatives that benefit students.

2. Is a 1031 exchange suitable for all educational investments?

While a 1031 exchange can be advantageous for many educational investments, there are certain eligibility requirements that must be met. The properties involved must be used specifically for educational purposes, such as classrooms, laboratories, dormitories, or administrative offices.

Additionally, educational institutions must carefully adhere to the guidelines set by the Internal Revenue Service (IRS) to ensure compliance with the rules of a 1031 exchange. Working with a qualified intermediary and consulting with tax professionals is recommended to navigate the complexities of this process and ensure eligibility.

3. Are there any time restrictions for completing a 1031 exchange for educational investments?

Yes, there are strict timeframes to adhere to when conducting a 1031 exchange for educational investments. The investor has 45 days from the sale of the relinquished property to identify potential replacement properties and must complete the exchange within a total of 180 days.

It’s essential to plan ahead and work with experienced professionals to ensure a smooth and timely 1031 exchange process that meets all necessary deadlines. Failing to complete the exchange within the specified timeframe may result in the investor being subject to capital gains taxes.

4. Can educational institutions use a 1031 exchange for non-real estate investments?

No, a 1031 exchange is specifically designed for real estate investments. It allows investors to defer capital gains taxes by reinvesting in like-kind properties. Non-real estate investments, such as stocks, bonds, or other financial assets, do not qualify for a 1031 exchange.

However, educational institutions may explore other tax-deferred investment strategies available for non-real estate assets, such as qualified retirement plans or tax-advantaged educational savings accounts, to optimize their investment strategies.

5. Are there any limitations on the number of 1031 exchanges an educational institution can complete?

There is no specific limit on the number of 1031 exchanges an educational institution can complete. As long as the properties meet the eligibility requirements and the exchange guidelines set by the IRS are followed, educational institutions can engage in multiple exchanges to support their investment objectives.

However, it’s important to consult with tax professionals and experts in the field to develop a comprehensive investment plan that aligns with the institution’s goals and ensures compliance with all relevant regulations.

Summary

So, to sum it all up, a 1031 exchange can be a great benefit for educational investments. It allows you to defer capital gains taxes and reinvest your money in a better property. This can help you save money and continue growing your investment portfolio.

Additionally, a 1031 exchange gives you the opportunity to upgrade your educational property without paying immediate taxes. By exchanging into a larger or more valuable property, you can provide better facilities and resources for students. Overall, a 1031 exchange is a smart strategy for investing in education and maximizing your financial resources.

what is priligy and the Helmholtz Association to A

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

продать аккаунт услуги по продаже аккаунтов

Account Trading Account Trading

account exchange service https://social-accounts-marketplace.org/

purchase ready-made accounts secure account sales

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

buy and sell accounts https://buy-accounts.live

buy aged fb account https://ad-account-buy.top

buy facebook accounts cheap facebook ad account for sale

google ads agency accounts google ads accounts for sale

buy google ads account https://ads-agency-account-buy.click

fb bussiness manager https://buy-verified-business-manager.org

facebook business manager buy facebook bm for sale

buy tiktok ad account https://tiktok-ads-account-buy.org

tiktok ads account buy https://buy-tiktok-business-account.org

buy tiktok ads accounts https://buy-tiktok-ads.org

¡Hola, amantes de la emoción !

Jugar sin registro en casinos sin licencia – https://www.casinossinlicenciaespana.es/ casinos online sin licencia

¡Que experimentes rondas emocionantes !