Are you wondering how to stay on track with your education goals while utilizing a 1031 exchange? Well, you’re in the right place! We’ve got some valuable tips to share with you.

Whether you’re saving for college, vocational training, or any other educational pursuit, it’s important to make the most of your resources. A 1031 exchange allows you to defer capital gains taxes when exchanging one investment property for another. With the potential tax savings, you can keep your education goals moving forward.

But how exactly can a 1031 exchange help you achieve your educational aspirations? We’ll delve into that in this article. So, get ready to discover some smart strategies for staying focused on your education while making the most of a 1031 exchange.

Let’s dive right in and explore how to optimize your 1031 exchange to keep those education goals on track!

- Set Clear Education Goals: Define what you aim to achieve in your academic journey.

- Research 1031 Exchange: Understand the concept and benefits of a 1031 exchange for tax-deferred investments.

- Identify Qualified Investments: Find suitable investment properties that align with your education goals.

- Complete the Exchange Process: Follow the IRS rules and regulations to execute a successful 1031 exchange.

- Monitor and Adjust: Continuously evaluate your progress and make necessary adjustments to stay on track.

Contents

- How to Keep Your Education Goals on Track with a 1031 Exchange?

- Understanding the Basics of a 1031 Exchange

- Benefits of Utilizing a 1031 Exchange for Your Education Goals

- The Power of a 1031 Exchange in Supporting Your Education Goals

- Key Takeaways: How to Keep Your Education Goals on Track with a 1031 Exchange?

- Frequently Asked Questions

- 1. What is a 1031 exchange and how can it help me keep my education goals on track?

- 2. Can I use a 1031 exchange to fund any type of education goal?

- 3. Are there any time limits I need to be aware of when using a 1031 exchange for education goals?

- 4. What are the potential tax implications of using a 1031 exchange for education goals?

- 5. Can I use a 1031 exchange multiple times to fund different education goals?

- Summary

How to Keep Your Education Goals on Track with a 1031 Exchange?

Welcome to a comprehensive guide on how to keep your education goals on track with a 1031 exchange! Education is a valuable investment in oneself, but it can often come with significant financial burdens. However, by leveraging the benefits of a 1031 exchange, you can potentially save money and redirect those funds towards your educational pursuits. In this article, we will explore what a 1031 exchange is, how it works, and how you can utilize it to keep your education goals on track. Let’s dive in!

Understanding the Basics of a 1031 Exchange

Before we delve into the specifics of how a 1031 exchange can support your education goals, it’s crucial to grasp the fundamentals of this powerful tax-deferral strategy. At its core, a 1031 exchange allows you to defer capital gains taxes on the sale of investment or business property by reinvesting the proceeds into another like-kind property. In essence, the IRS recognizes that you are merely exchanging one investment for another, and thus allows you to defer paying taxes on the realized gains.

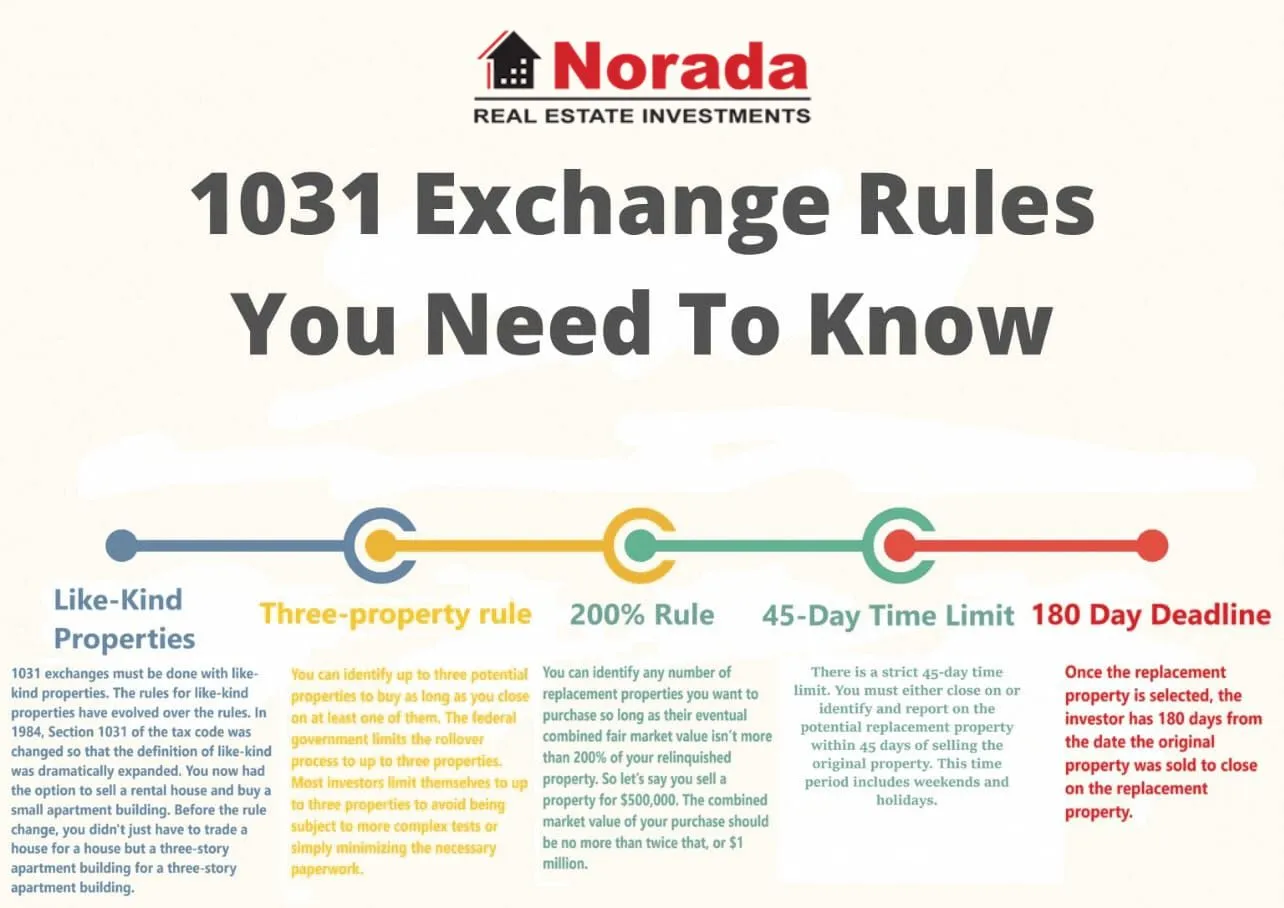

To qualify for a 1031 exchange, you must adhere to certain IRS guidelines. Firstly, both the property being sold (relinquished property) and the property being acquired (replacement property) must be held for productive use in your trade, business, or for investment purposes. Additionally, you must identify the replacement property within 45 days of selling your relinquished property and complete the exchange by acquiring the replacement property within 180 days.

In summary, a 1031 exchange is a powerful tax planning tool that allows you to defer capital gains taxes by reinvesting the proceeds from the sale of an investment property into another like-kind property within specific timeframes. Now that we have a good understanding of the basics of a 1031 exchange, let’s explore how it can help you stay focused on your education goals.

Benefits of Utilizing a 1031 Exchange for Your Education Goals

1. Tax Deferral: One of the primary benefits of a 1031 exchange is the ability to defer capital gains taxes on the sale of your investment property. By deferring these taxes, you can allocate more funds towards your educational pursuits and reduce the financial strain.

2. Increased Cash Flow: By exchanging your current investment property for a more favorable one, such as a property with higher rental income potential, you can potentially increase your cash flow. This increased cash flow can be used to cover educational expenses such as tuition, books, and living costs.

3. Diversification of Investments: Another advantage of a 1031 exchange is the opportunity to diversify your investment portfolio. You can exchange a property in one location for a property in a different city or state, allowing you to tap into different real estate markets and potentially increase your overall returns. This diversification can provide a solid financial foundation for pursuing your education goals.

Tips for Successfully Executing a 1031 Exchange to Support Your Education Goals

1. Plan Ahead: Start planning for your 1031 exchange well in advance to ensure a smooth transition. Research the market and identify potential replacement properties that align with your educational aspirations.

2. Consult with Professionals: It’s crucial to seek guidance from qualified tax advisors, real estate professionals, and legal experts who specialize in 1031 exchanges. They can help you navigate the complexities of the process and ensure you comply with all IRS regulations.

3. Understand Your Educational Financing Options: While a 1031 exchange can provide additional funds for your education goals, it’s essential to be aware of other financing options available to you, such as scholarships, grants, and student loans. Evaluate all your options to make informed decisions.

The Future of Education and the Role of 1031 Exchanges

As the landscape of education continues to evolve, finding creative ways to finance one’s educational pursuits becomes increasingly important. A 1031 exchange offers a unique opportunity to leverage your investment property’s financial benefits to support your education goals. By deferring capital gains taxes, increasing cash flow, and diversifying your investment portfolio, you can create a solid foundation for your future education. Don’t let financial constraints hinder your educational dreams – explore the possibilities of a 1031 exchange today!

The Power of a 1031 Exchange in Supporting Your Education Goals

Now that we’ve covered the basics of a 1031 exchange and explored the benefits of utilizing this powerful tax-deferral strategy for your education goals, let’s dive deeper into how you can make the most of this opportunity. In this section, we’ll discuss three key aspects: identifying the right investment property, maximizing your tax benefits, and long-term planning for educational success.

Identifying the Right Investment Property

When utilizing a 1031 exchange to support your education goals, it’s important to carefully consider the replacement property you select. Here are some tips to help you identify the right investment property:

- Research Potential Market: Conduct thorough market research to identify areas with strong rental demand and potential for appreciation. Look for locations with reputable educational institutions to ensure future demand for rental properties.

- Consider Rental Income Potential: Look for properties that have the potential to generate strong rental income. This additional cash flow can help cover your educational expenses and provide a stable financial foundation.

- Long-Term Investment: Choose a property that aligns with your long-term investment goals. Consider factors such as property value appreciation, potential for renovation or expansion, and overall market trends.

Maximizing Your Tax Benefits

While a 1031 exchange provides valuable tax benefits, it’s essential to maximize these benefits to support your education goals. Here are some strategies to consider:

- Work with Experienced Professionals: Collaborate with qualified tax advisors and real estate professionals who specialize in 1031 exchanges. They will help you navigate the complexities of the process and ensure you comply with all IRS regulations.

- Explore Multiple Properties: Consider diversifying your investment portfolio by exploring multiple replacement property options. This allows you to tap into different real estate markets and potentially maximize your returns.

- Understand Tax Implications: While a 1031 exchange defers capital gains taxes, it’s essential to understand the future tax implications. Consult with tax professionals to create a long-term tax strategy that aligns with your educational goals.

Long-Term Planning for Educational Success

Lastly, it’s crucial to incorporate long-term planning into your educational journey. Here are some key considerations:

- Set Clear Education Goals: Establish clear, achievable education goals and create a timeline for completion. This will help you stay focused and motivated throughout the process.

- Create a Budget: Develop a detailed budget that takes into account your educational expenses, including tuition, books, housing, and other associated costs. This will provide a roadmap for financial success.

- Continued Monitoring and Adjustments: Regularly review your investment portfolio, educational expenses, and financial plan. Make adjustments as necessary to ensure you stay on track to achieve your education goals.

In conclusion, by identifying the right investment property, maximizing your tax benefits, and incorporating long-term planning, you can effectively utilize a 1031 exchange to support your education goals. Take advantage of this powerful tax-deferral strategy and create a solid foundation for your educational success. Good luck!

Key Takeaways: How to Keep Your Education Goals on Track with a 1031 Exchange?

- 1. Understand the concept of a 1031 exchange as a way to defer taxes when selling and buying real estate properties.

- 2. Research and consult with a qualified intermediary to ensure compliance with the IRS rules and regulations.

- 3. Set specific education goals and identify how a 1031 exchange can help you achieve them, whether it’s funding college tuition or pursuing advanced degrees.

- 4. Work with a real estate professional who specializes in 1031 exchanges to identify suitable investment properties that align with your education goals.

- 5. Keep track of important deadlines and documentation required for a successful 1031 exchange to avoid any potential setbacks or penalties.

Frequently Asked Questions

When it comes to keeping your education goals on track with a 1031 exchange, it’s important to have a clear understanding of how this process works. Below are some commonly asked questions and answers to help you navigate this topic.

1. What is a 1031 exchange and how can it help me keep my education goals on track?

A 1031 exchange is a tax-deferred exchange that allows you to sell an investment property and reinvest the proceeds into a new property without immediately paying taxes on the capital gains. By utilizing a 1031 exchange, you can potentially save a significant amount of money on taxes, which can then be used to fund your education goals. This can include paying for tuition, books, or other educational expenses.

However, it’s important to note that 1031 exchanges have specific rules and requirements that must be followed. It’s crucial to consult with a qualified tax professional or financial advisor who can guide you through the process and ensure that you are in compliance with all regulations.

2. Can I use a 1031 exchange to fund any type of education goal?

While a 1031 exchange can be a valuable tool for funding education goals, it’s important to understand that there are limitations on how the proceeds from the exchange can be used. Generally, the funds must be used for like-kind property, which means investing in a property that is similar in nature, such as exchanging one rental property for another.

Additionally, the Internal Revenue Service (IRS) has specific guidelines on what constitutes qualified educational expenses. It’s important to consult with a tax professional or financial advisor to determine if your education goals meet the criteria for using 1031 exchange funds.

3. Are there any time limits I need to be aware of when using a 1031 exchange for education goals?

Yes, there are strict time limits associated with a 1031 exchange. From the date of the sale of your investment property, you have 45 days to identify potential replacement properties and 180 days to complete the exchange by acquiring a new property. It’s important to start the process as soon as possible to ensure you have enough time to find a suitable replacement property and complete the exchange within the required timeframe.

It’s also worth noting that the identification rules for a 1031 exchange can be complex, and there are certain requirements that must be met. Working with a knowledgeable tax professional or financial advisor can help ensure that you meet all the necessary deadlines and requirements.

4. What are the potential tax implications of using a 1031 exchange for education goals?

While a 1031 exchange can offer tax benefits, it’s essential to understand that the taxes on the capital gains from the original investment property will not be permanently avoided. Instead, they will be deferred until you sell the replacement property. When the replacement property is eventually sold, the deferred taxes will become due.

It’s important to consult with a tax professional or financial advisor to fully understand the tax implications of using a 1031 exchange for your education goals. They can help you evaluate your individual circumstances and provide guidance on how to navigate the tax implications effectively.

5. Can I use a 1031 exchange multiple times to fund different education goals?

Yes, it is possible to use a 1031 exchange multiple times to fund different education goals. As long as the replacement properties meet the requirements of a 1031 exchange and the proceeds from each exchange are used for qualified educational expenses, you can continue to benefit from the tax-deferred exchange.

However, it’s important to be aware of the rules and limitations surrounding 1031 exchanges. Consulting with a tax professional or financial advisor can help ensure that you are using the exchange correctly and in compliance with all regulations.

Summary

Hey there! So, here’s a quick summary of what we talked about in this article. We learned that a 1031 exchange can help you keep your education goals on track by allowing you to defer paying taxes on your real estate investments. This means that you can reinvest your money into education without worrying about a big tax bill. It’s like a win-win situation!

Also, we found out that there are some rules and requirements for a 1031 exchange that you need to follow. You have to identify a replacement property within a certain timeframe and make sure the value of the replacement property is equal to or greater than the property you’re selling. It may sound a bit complicated, but with the help of a qualified intermediary, you can navigate through the process smoothly.

In a nutshell, using a 1031 exchange can be a smart move to keep your education goals in focus. It’s all about making the most of your real estate investments while avoiding the burden of taxes. So, if you’re thinking about investing in education, consider exploring the possibilities of a 1031 exchange. You got this!

where can i buy ventolin online: Ventolin inhaler best price – buy cheap ventolin online

buy ventolin inhaler online

buy ventolin canada: Ventolin inhaler price – ventolin tablets

prednisone in mexico: canada buy prednisone online – 3000mg prednisone

Online medicine home delivery: Online medication home delivery – world pharmacy india

pharmacies in mexico that ship to usa: mexican drugstore online – mexican drugstore online

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!