Are you wondering if it’s worth it to leap into the world of education with a 1031 exchange? Well, buckle up and get ready for an exciting ride as we explore this topic! Whether you’re a curious student, a parent considering education investments, or just someone interested in the world of finance, this article will break down the ins and outs of combining education with a 1031 exchange.

Now, you might be wondering what exactly a 1031 exchange is. Don’t worry, we’ve got you covered! A 1031 exchange is a powerful tax strategy that allows investors to defer capital gains taxes on the sale of an investment property if they reinvest the proceeds into a similar property. But how does this tie into education? Well, imagine using a 1031 exchange to sell a property and invest the funds in an educational institution or facility. It opens up a world of possibilities!

So, is it worth it to jump into the world of education with a 1031 exchange? That’s the question we’re here to answer. From the potential tax benefits to the educational opportunities that await, we’ll dive deep into the pros and cons of this exciting venture. So, grab your notebooks and get ready to learn about the fascinating intersection of finance and education!

Considering a 1031 exchange for investing in education? Definitely! Jumping into the world of education with a 1031 exchange can offer numerous benefits. With tax-deferred exchanges, you can sell your investment property and reinvest the proceeds into qualified educational properties. By doing so, you can potentially save on taxes and generate income from the education sector. It’s a smart move that combines financial growth with a meaningful investment in the future.

Contents

- Is It Worth It to Jump into the World of Education with a 1031 Exchange?

- Key Considerations When Investing in Education

- Conclusion

- “Is It Worth It to Jump into the World of Education with a 1031 Exchange?” – Key Takeaways

- Frequently Asked Questions

- 1. How does a 1031 exchange work in the context of investing in education?

- 2. What are the potential benefits of using a 1031 exchange for investing in education?

- 3. Are there any limitations or restrictions for using a 1031 exchange in the education sector?

- 4. What are some potential risks or challenges of using a 1031 exchange for education investments?

- 5. Should I consider a 1031 exchange for investing in education?

- Summary

Is It Worth It to Jump into the World of Education with a 1031 Exchange?

Considering a 1031 exchange for investing in the world of education? It can be an enticing prospect, but is it truly worth it? In this article, we will explore the benefits, risks, and considerations of using a 1031 exchange to jump into the world of education. Whether you’re a real estate investor looking to diversify your portfolio or an entrepreneur seeking a stable income stream, this article will provide you with the information you need to make an informed decision.

The Benefits of Jumping into the World of Education with a 1031 Exchange

There are several advantages to using a 1031 exchange to invest in the education sector. One key benefit is the potential for stable, long-term income. Educational institutions often have a steady stream of students and reliable tuition payments, which can provide a consistent cash flow for investors.

Additionally, investing in education can offer a sense of fulfillment and make a positive impact in the community. By supporting educational facilities, you are contributing to the growth and development of future generations, which can be personally fulfilling.

Furthermore, the education sector is known for its resilience, even during economic downturns. People always prioritize education, making it a relatively safe investment choice. With the right due diligence and market research, investing in education can provide stability and long-term financial growth.

The Risks and Considerations of Jumping into the World of Education with a 1031 Exchange

While there are benefits to investing in education, it is important to be aware of the risks and considerations involved. One potential risk is the volatility of the regulatory environment. Education policies and requirements can change, potentially impacting the profitability and operations of educational institutions.

Another consideration is the potential for competition. The education sector can be highly competitive, especially in densely populated areas. It is essential to analyze the market landscape and understand the demand for educational services in a particular location before making an investment decision.

Additionally, investing in education requires careful due diligence and research. It is crucial to evaluate the financial health and reputation of an educational institution before committing to an investment. Understanding the specific market dynamics and demographics of the target area is also key to making an informed decision.

The Role of a 1031 Exchange in Jumping into the World of Education

Now, let’s explore the role of a 1031 exchange in the context of investing in education. A 1031 exchange allows real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into a like-kind property. This tax advantage can help investors free up funds to invest in educational facilities or properties.

By utilizing a 1031 exchange, investors can potentially save a significant amount on taxes, allowing them to allocate more capital towards their education-focused investments. This can increase the sustainability and profitability of their ventures in the education sector.

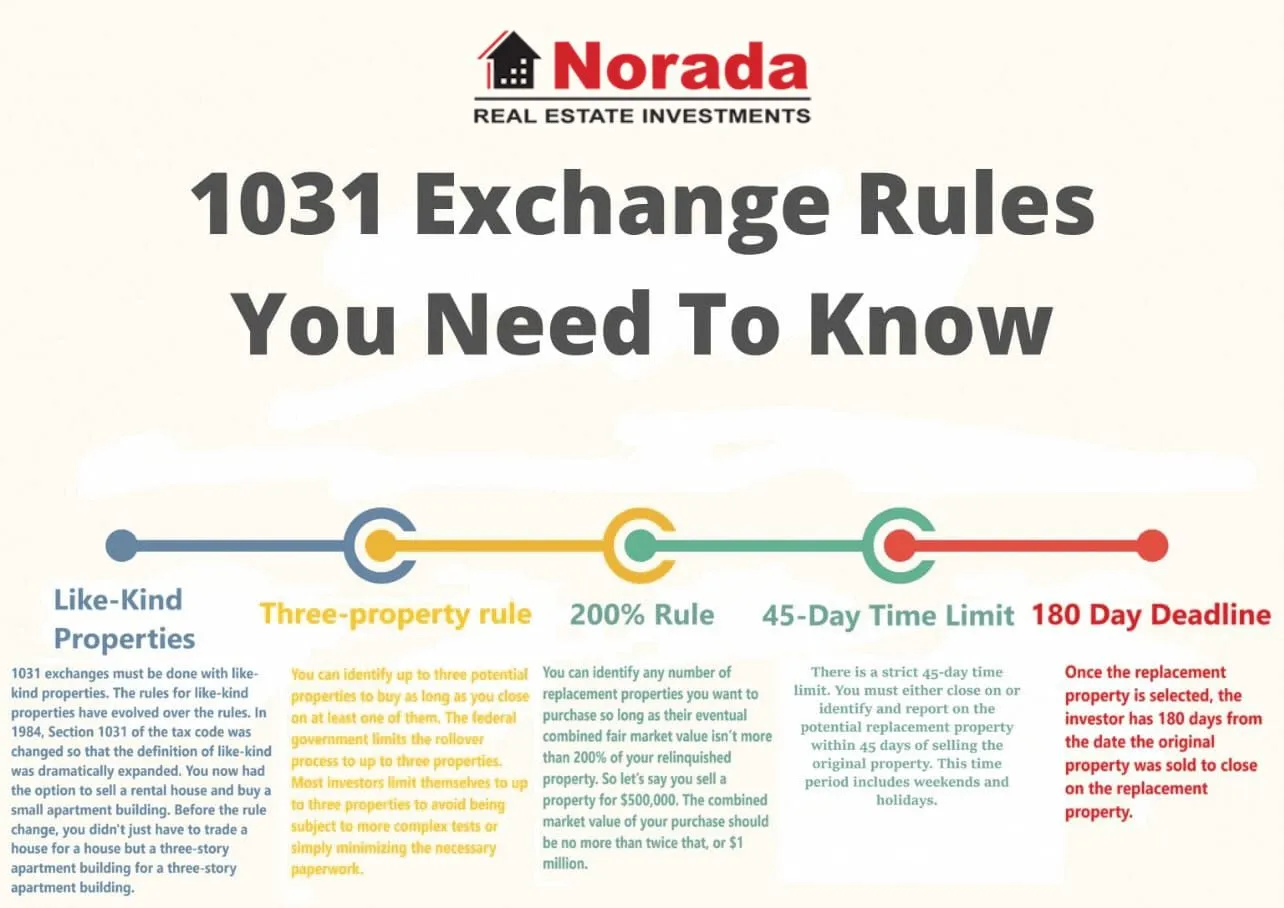

It is important to note that a 1031 exchange has specific rules and regulations, including time limits and property eligibility requirements. Consulting with a qualified intermediary or tax professional is essential to ensure compliance with the IRS guidelines and maximize the benefits of a 1031 exchange.

Key Considerations When Investing in Education

Understanding Market Demand and Demographics

Before jumping into the world of education with a 1031 exchange, it is crucial to thoroughly understand market demand and demographics. Analyze the local population, income levels, and educational needs of the target area. This information will help you determine the potential demand for your educational services and evaluate the feasibility of your investment.

Conducting market research and feasibility studies can provide valuable insights into the existing educational landscape, competition, and growth potential in the area. Consider factors such as population growth, demographic trends, and the presence of other educational institutions. These insights will help you determine if investing in education is a viable option in a particular location.

Evaluating the Financial Health of Educational Institutions

Investing in education requires assessing the financial health and stability of the educational institution you are considering. Review their financial statements, enrollment numbers, and projections for future growth. Evaluate their operational efficiency and any potential liabilities or risks that may impact their long-term sustainability.

Meeting with key stakeholders, such as school administrators or board members, can provide further insights into the institution’s vision, goals, and financial strategies. Additionally, seek out testimonials from current or past students, parents, and faculty to gauge the institution’s reputation and quality of education.

Complying with Regulatory Requirements

The education sector is subject to various regulatory requirements at the local, state, and federal levels. It is crucial to familiarize yourself with these regulations and ensure that the educational institution you plan to invest in is compliant. Failure to comply with regulations can result in financial penalties and reputational damage.

Engage legal counsel with expertise in education law to navigate the regulatory landscape and ensure your investment meets all necessary legal criteria. They can advise you on zoning and land use regulations, licensing and accreditation requirements, and any other legal considerations specific to the education sector.

Conclusion

Investing in the world of education with a 1031 exchange can offer stability, long-term income, and a sense of fulfillment. However, it is important to carefully evaluate the benefits, risks, and considerations associated with this investment strategy. Understanding market demand, assessing the financial health of educational institutions, and complying with regulatory requirements are key elements of a successful investment in the education sector. By conducting thorough research and seeking professional guidance, you can make an informed decision and potentially reap the rewards of investing in education.

“Is It Worth It to Jump into the World of Education with a 1031 Exchange?” – Key Takeaways

- Educational investments can be made using a 1031 exchange, which allows you to defer capital gains taxes.

- It’s crucial to thoroughly research and understand the rules and regulations surrounding 1031 exchanges before jumping in.

- Education can be a profitable investment, but it requires careful planning and consideration.

- A 1031 exchange offers potential tax benefits, but it’s important to consult with professionals and financial advisors for guidance.

- Consider the long-term goals and potential risks involved before deciding to invest in education with a 1031 exchange.

Frequently Asked Questions

Are you considering a 1031 exchange to invest in the field of education? Here are some commonly asked questions to help you make an informed decision.

1. How does a 1031 exchange work in the context of investing in education?

In a 1031 exchange, also known as a like-kind exchange, you can defer capital gains taxes by selling a property and reinvesting the proceeds into a similar property. When it comes to investing in education, a 1031 exchange can be used to defer taxes on the sale of a property used for educational purposes, such as a school building or a student housing facility. By reinvesting the proceeds into another education-related property, you can potentially grow your investment and defer taxation on the capital gains.

However, it’s important to consult with a tax advisor experienced in 1031 exchanges to ensure you meet all the requirements and understand the implications for your specific situation. While a 1031 exchange can provide tax benefits, it may not be suitable for everyone, and there may be other factors to consider.

2. What are the potential benefits of using a 1031 exchange for investing in education?

One of the major benefits of a 1031 exchange for education-related investments is the ability to defer capital gains taxes. By reinvesting the proceeds into another education property, you can maintain your investment and potentially generate additional income or growth without immediately paying taxes on the sale. This can provide financial flexibility and allow you to allocate funds towards enhancing your educational investment portfolio.

In addition to tax deferral, a 1031 exchange can also provide an opportunity to optimize your investment strategy. By exchanging into a property that better aligns with your goals, such as a larger school facility or a more strategic location, you can potentially increase your returns and improve your educational investment portfolio overall. It’s essential to consult with professionals who specialize in education real estate and 1031 exchanges to better understand the potential benefits and evaluate if it’s worth it for your specific investment goals.

3. Are there any limitations or restrictions for using a 1031 exchange in the education sector?

While a 1031 exchange can be a valuable tool for investing in education, there are some limitations and restrictions to consider. First, both the property you sell and the property you acquire must be held for productive use in a trade or business or for investment purposes. In the education sector, properties like school buildings, student housing facilities, or even vacant land intended for future educational development may qualify.

Additionally, there are specific timeframes that must be adhered to in a 1031 exchange. You have 45 days from the sale of your property to identify potential replacement properties and 180 days to complete the exchange by acquiring the replacement property. Meeting these deadlines is crucial to ensure the tax deferral benefits of a 1031 exchange.

4. What are some potential risks or challenges of using a 1031 exchange for education investments?

Like any investment strategy, there are risks and challenges associated with using a 1031 exchange for education investments. One main challenge is finding a suitable replacement property within the designated timeframe. The demand for specific education properties can vary by location and market conditions, making it essential to have a well-researched plan and potentially work with a real estate professional who specializes in education properties.

Additionally, there may be some limitations on the type of properties you can acquire as a replacement in a 1031 exchange. It’s crucial to consider the specific requirements and regulations for educational properties in your desired location to ensure compliance and avoid any potential setbacks.

5. Should I consider a 1031 exchange for investing in education?

Deciding whether to pursue a 1031 exchange for education investments depends on various factors, including your individual goals, financial situation, and risk tolerance. It’s crucial to consult with professionals who specialize in both education real estate and 1031 exchanges to assess your specific circumstances and evaluate the potential benefits and drawbacks.

By working with knowledgeable advisors, you can gain a better understanding of the tax implications, investment opportunities, and risks involved in using a 1031 exchange for education investments. Ultimately, the decision should align with your long-term investment strategy and support your goals in the world of education.

Summary

So, let’s wrap this up! If you’re thinking about using a 1031 exchange for education, here’s what you need to know. A 1031 exchange allows you to defer paying taxes on the sale of an investment property if you use the proceeds to purchase another like-kind property. This can be a good option if you want to invest in education and potentially save money on taxes. However, there are some important considerations to keep in mind. First, make sure you qualify for a 1031 exchange by using the proceeds to buy a property that is similar in nature and purpose to your current investment. Additionally, be aware of the time limitations – you must identify your replacement property within 45 days and complete the exchange within 180 days. Finally, consult with a tax professional to fully understand the tax implications and make an informed decision.

In conclusion, a 1031 exchange can be a valuable tool for those looking to invest in education. However, it’s important to carefully consider the eligibility requirements, time constraints, and seek advice from a tax professional. By doing so, you can make a well-informed decision about whether jumping into the world of education with a 1031 exchange is worth it for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?