When it comes to a 1031 exchange, timing is everything. But what exactly is a 1031 exchange, and why is timing important in this process? Let’s dive in and find out! 🕒

If you’re not familiar with the term, a 1031 exchange is a real estate transaction that allows investors to defer capital gains taxes when selling one property and purchasing another similar one. It’s like a tax deferral strategy that helps investors make the most of their profits. 💰

But here’s the catch: In order to qualify for the tax benefits of a 1031 exchange, there are strict timing rules that you need to follow. Missing these deadlines could cost you dearly. So, buckle up and let’s explore why timing is crucial in a 1031 exchange! ⏰

Contents

- Is Timing Important in a 1031 Exchange?

- Benefits of a 1031 Exchange

- 1031 Exchange FAQ: Common Questions Answered

- 1. Can I 1031 exchange my primary residence?

- 2. Can I exchange one property for multiple properties in a 1031 exchange?

- 3. How do I identify replacement properties in a 1031 exchange?

- 4. Can I exchange a property outside the United States in a 1031 exchange?

- 5. What happens if I cannot identify or acquire a replacement property within the specified timeline?

- 6. Can I complete a partial 1031 exchange?

- 7. Can I use a 1031 exchange for property held in an LLC or partnership?

- 8. How long do I have to hold the replacement property acquired through a 1031 exchange?

- 9. Can I do a reverse 1031 exchange?

- 10. How can a qualified intermediary assist in the 1031 exchange process?

- When Should You Consider a 1031 Exchange?

- Maximizing Your 1031 Exchange: Tips and Strategies

- 1. Work with Experienced Professionals

- 2. Start the Process Early

- 3. Thoroughly Research Potential Replacement Properties

- 4. Consult with Local Real Estate Professionals

- 5. Keep an Eye on Market Trends

- 6. Don’t Rush the Process

- 7. Consider Multiple Replacement Property Options

- 8. Evaluate Long-Term Investment Potential

- 9. Maintain Accurate Records

- 10. Stay Informed and Adapt to Changing Regulations

- Debunking Common Misconceptions About 1031 Exchanges

- 1. Misconception: 1031 exchanges are only for large-scale real estate investors.

- 2. Misconception: 1031 exchanges are complex and only for experts.

- 3. Misconception: 1031 exchanges are only for real estate professionals.

- 4. Misconception: The replacement property must be of equal value or greater.

- 5. Misconception: 1031 exchanges are only for deferring taxes indefinitely.

- 6. Misconception: The 45-day identification period is inflexible.

- 7. Misconception: 1031 exchanges are always a guaranteed way to save on taxes.

- 1031 Exchange Checklist: Key Steps for a Successful Exchange

- 1. Familiarize Yourself with 1031 Exchange Rules

- 2. Identify Potential Replacement Properties

- 3. Engage a Qualified Intermediary

- 4. Prepare and Sign the Exchange Agreement

- 5. Notify All Relevant Parties

- 6. Complete the Sale of the Relinquished Property

- 7. Identify Replacement Properties within 45 Days

- 8. Conduct Due Diligence on Replacement Properties

- 9. Secure Financing for the Replacement Property

- 10. Consult with Tax Advisors

- 11. Acquire the Replacement Property

- 12. File Appropriate Tax Forms

- 13. Maintain Accurate Exchange Records

- 14. Consider Future 1031 Exchanges

- Key Takeaways: Is Timing Important in a 1031 Exchange?

- Frequently Asked Questions

- 1. How does timing impact a 1031 exchange?

- 2. Can I extend the deadlines for a 1031 exchange?

- 3. Is it better to sell the original property before or after identifying a replacement property?

- 4. Can I start looking for replacement properties before selling my original property?

- 5. What happens if I miss the deadlines for a 1031 exchange?

- Summary

Is Timing Important in a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred strategy that allows individuals to sell a property and reinvest the proceeds into another property of equal or greater value, all while deferring capital gains taxes. The benefits of a 1031 exchange are well-known, but one question that often arises is whether timing plays a significant role in the success of the exchange. In this article, we will explore the importance of timing in a 1031 exchange and how it can impact the outcome of your investment.

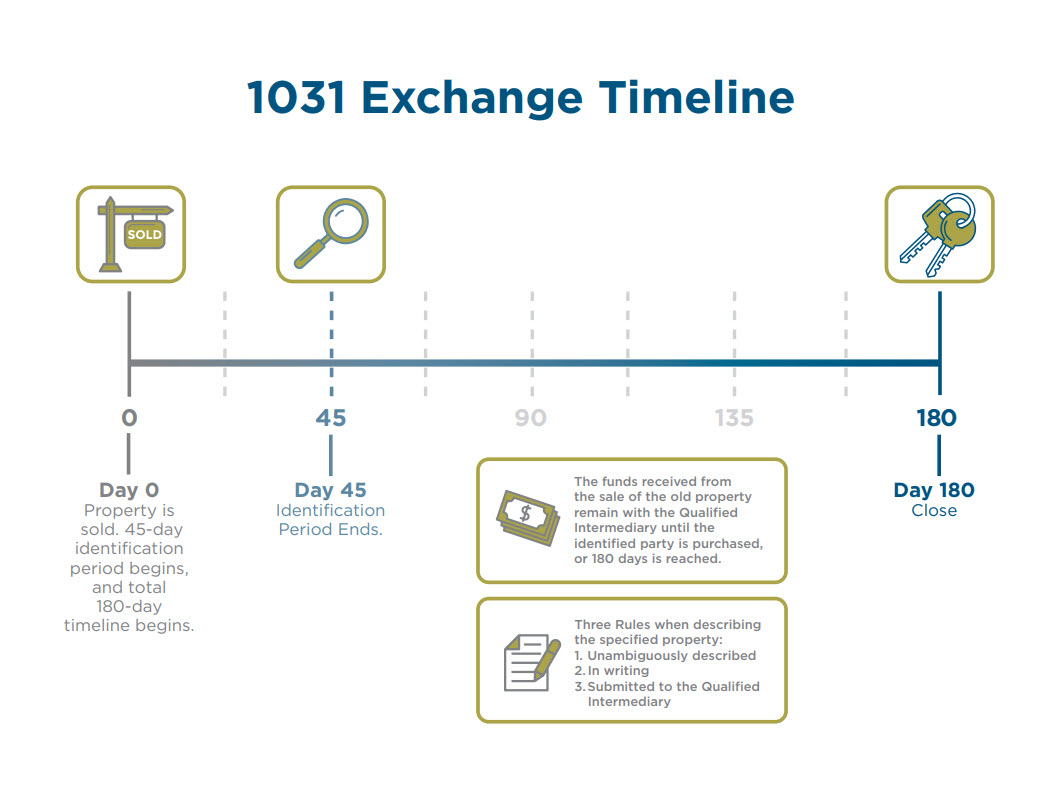

The Exchange Period: Maximizing Your Timeline

Timing is crucial in a 1031 exchange, particularly when it comes to the exchange period, which begins on the day the relinquished property is transferred and ends 180 calendar days later. Within this timeframe, the investor must identify potential replacement properties within 45 days and acquire one or more of them by the end of the 180th day. Failing to meet these deadlines can result in disqualification from the tax benefits of a 1031 exchange.

To maximize your timeline, it is essential to start the process promptly and engage experienced professionals who can guide you through the various stages. Having a clear plan in place and working with a qualified intermediary can help ensure that you identify suitable replacement properties within the 45-day window and complete the acquisition within the allotted 180-day timeframe.

Additionally, being proactive, conducting thorough research, and staying informed about market conditions can provide you with a competitive advantage, enabling you to identify and secure desirable properties more efficiently.

Market Conditions and Timing

Market conditions can significantly impact the success of a 1031 exchange. Timing your exchange to take advantage of favorable market conditions can lead to increased profits and better investment opportunities. However, predicting market trends with absolute certainty is challenging, as market conditions can fluctuate unexpectedly.

Monitoring the real estate market is crucial when considering a 1031 exchange. Keep an eye on key indicators, such as interest rates, supply and demand, rental rates, and property values in your desired investment areas. Analyzing these factors can help you determine the optimal time to initiate a 1031 exchange to maximize your return on investment.

Working with a knowledgeable real estate agent or investment advisor who understands market trends and has a pulse on the local market can provide valuable insights and guidance in determining the most opportune moment to initiate your exchange.

1031 Exchange vs. Regular Real Estate Transactions

Timing is more critical in a 1031 exchange compared to regular real estate transactions due to the stringent deadlines involved. In a traditional real estate transaction, buyers and sellers have more flexibility in negotiating closing dates and can adjust the timeline based on their preferences and needs.

However, in a 1031 exchange, adhering to the strict exchange period and identification deadlines is essential for a successful transaction. Deviating from these timelines can result in the disqualification of the exchange and the incurrence of capital gains taxes.

It is crucial to consult with a qualified intermediary who specializes in 1031 exchanges to ensure that you meet all necessary requirements and deadlines. Their expertise can help you navigate the intricate process of a 1031 exchange and ensure that you successfully complete your transaction while maximizing your tax benefits.

Benefits of Proper Timing in a 1031 Exchange

Proper timing in a 1031 exchange can yield several benefits for investors, including:

- Tax Deferral: By meeting all necessary deadlines and requirements, investors can defer capital gains taxes, potentially saving a significant amount of money.

- Portfolio Growth: Successfully executing a 1031 exchange allows investors to continually reinvest in like-kind properties, leading to portfolio growth and increased wealth.

- Asset Diversification: Timing the exchange strategically provides the opportunity to diversify your real estate holdings, potentially reducing risk and increasing overall investment stability.

- Increased Cash Flow: Acquiring properties with better rental potential or higher income streams can lead to increased cash flow, generating long-term financial benefits.

By carefully considering timing and working with knowledgeable professionals, investors can take full advantage of these benefits and position themselves for long-term success in their 1031 exchange ventures.

Benefits of a 1031 Exchange

A 1031 exchange is a powerful tax strategy that offers various benefits to real estate investors. By deferring capital gains taxes on the sale of an investment property, investors can optimize their financial positions and grow their wealth through the acquisition of like-kind properties. Let’s explore the key benefits of a 1031 exchange in more detail.

Tax Deferral

One of the primary advantages of a 1031 exchange is the ability to defer capital gains taxes. When selling a property, investors typically incur significant tax liabilities on the profit generated from the sale. However, a like-kind exchange allows investors to defer those taxes by reinvesting the proceeds into another property of equal or greater value.

By deferring taxes, investors can retain more money to reinvest and maximize their potential for wealth accumulation. These tax savings can be reinvested into larger properties, additional real estate investments, or other ventures, allowing investors to amplify their financial growth.

It’s important to note that while a 1031 exchange provides tax deferral benefits, it does not eliminate the tax liability altogether. When the investor eventually sells the replacement property without initiating another exchange, the deferred taxes will become due. However, the ability to defer taxes indefinitely while continuing to grow your investment portfolio is a valuable advantage of the 1031 exchange.

Portfolio Growth and Wealth Accumulation

A 1031 exchange allows investors to continually grow their real estate portfolio without incurring immediate tax consequences. By deferring capital gains taxes, investors can allocate more funds toward acquiring like-kind properties of equal or greater value. This strategy empowers investors to leverage their profits and reinvest them into properties with higher income potential, enhanced appreciation prospects, or better long-term investment prospects.

Over time, this compounding effect can significantly accelerate portfolio growth and wealth accumulation. By consistently executing 1031 exchanges, investors can access larger and more lucrative investment opportunities, build a diverse portfolio, and achieve long-term financial success.

Furthermore, a larger real estate portfolio can provide investors with increased stability, diversification, and the potential for generating substantial passive income. The ability to continually reinvest capital and expand one’s investment holdings is a cornerstone benefit of the 1031 exchange.

Asset Diversification and Risk Mitigation

The 1031 exchange strategy also allows investors to diversify their real estate holdings. By exchanging into different types of properties, such as residential, commercial, industrial, or even vacant land, investors can reduce their exposure to risk and disrupt unfavorable market fluctuations.

Diversification is a fundamental principle of investment, and it applies to real estate as well. By spreading investments across various property types and geographical locations, investors can protect themselves from localized market downturns or changes in industry dynamics. This diversification can enhance the overall stability and resilience of their portfolios.

Additionally, diversifying property types may also provide opportunities for passive income from different sources. For example, residential properties generate rental income, while commercial properties offer the potential for higher cash flow and long-term appreciation. Through careful diversification, investors can access multiple income streams and mitigate risk.

Estate Planning and Wealth Preservation

Another significant advantage of a 1031 exchange is its utility in estate planning and wealth preservation. Upon passing away, a property owner’s heirs typically inherit the property at its current fair market value, potentially triggering substantial capital gains taxes.

However, if the property owner had engaged in 1031 exchanges throughout their lifetime, the heirs inherit the property at a stepped-up basis, effectively erasing any unrealized capital gains. This allows the heirs to sell the property immediately without incurring capital gains taxes.

By implementing 1031 exchanges as part of an overall estate plan, real estate investors can efficiently pass on their wealth to future generations while minimizing the tax burden. The ability to preserve wealth through tax-efficient strategies is a valuable component of the 1031 exchange.

1031 Exchange FAQ: Common Questions Answered

As a real estate investor considering a 1031 exchange, you may have several questions about the process and its implications. In this section, we will address some common questions that arise regarding 1031 exchanges to provide clarity and guidance.

1. Can I 1031 exchange my primary residence?

No, the primary residence does not qualify for a 1031 exchange. The IRS has specific guidelines that define what qualifies as like-kind property, and personal residences do not meet these requirements. However, if you own a rental property, commercial property, or any other property held for investment or business purposes, you can initiate a 1031 exchange.

2. Can I exchange one property for multiple properties in a 1031 exchange?

Yes, it is possible to exchange one property for multiple properties as part of a 1031 exchange. This strategy is known as a “three-property exchange” or “four-property exchange,” depending on the number of replacement properties involved. However, it is crucial to adhere to the IRS rules regarding identification and the value of the properties involved in the exchange.

3. How do I identify replacement properties in a 1031 exchange?

Within the 45-day identification period of a 1031 exchange, you must provide a written list of potential replacement properties to the qualified intermediary. The list can include up to three properties of any value or any number of properties as long as their combined fair market value does not exceed 200% of the value of the relinquished property. It is crucial to consult with your qualified intermediary to ensure compliance with the identification requirements.

4. Can I exchange a property outside the United States in a 1031 exchange?

No, 1031 exchanges are limited to properties located within the United States. International properties do not qualify as like-kind properties for the purpose of a 1031 exchange. However, there are other tax strategies and structures that may be applicable for international investors seeking to defer taxes on real estate transactions.

5. What happens if I cannot identify or acquire a replacement property within the specified timeline?

If you fail to identify suitable replacement properties within the 45-day identification period or to acquire any replacement properties within the 180-day exchange period, your 1031 exchange may be disqualified. In such cases, your transaction will be treated as a regular sale, and you will be liable for capital gains taxes on the sale of the relinquished property. It is crucial to work with experienced professionals and follow the established timelines to ensure a successful 1031 exchange.

6. Can I complete a partial 1031 exchange?

Yes, it is possible to complete a partial 1031 exchange. If the value of the replacement property is less than the total proceeds from the sale of the relinquished property, you can complete a partial exchange and receive cash (referred to as “boot”) in addition to the replacement property. However, the boot received will be subject to capital gains taxes.

7. Can I use a 1031 exchange for property held in an LLC or partnership?

Yes, a 1031 exchange can be utilized for property held in an LLC or partnership. However, certain guidelines and requirements must be met. Each member or partner must complete their own exchange, and the new property should be acquired in the same proportionate interest as the original property. Consultation with a qualified tax advisor and experienced intermediary is crucial when navigating a 1031 exchange involving LLCs or partnerships.

8. How long do I have to hold the replacement property acquired through a 1031 exchange?

There is no specific time requirement for holding the replacement property acquired through a 1031 exchange. However, it is generally recommended to hold the property for at least one year to demonstrate the intent of holding it for investment or business purposes. The IRS may scrutinize shorter hold periods and challenge the validity of the exchange.

9. Can I do a reverse 1031 exchange?

Yes, a reverse 1031 exchange is also possible. In a reverse exchange, an investor acquires the replacement property before selling the relinquished property. Reverse exchanges require careful planning and coordination with a qualified intermediary to comply with the IRS guidelines. It is advisable to consult with professionals experienced in reverse exchanges to facilitate a successful transaction.

10. How can a qualified intermediary assist in the 1031 exchange process?

A qualified intermediary (QI) plays a vital role in the 1031 exchange process. They are responsible for holding the proceeds from the sale of the relinquished property and facilitating the exchange by acquiring the replacement property. The QI ensures that all necessary documentation is processed correctly, timelines are adhered to, and the transaction meets the IRS requirements. Engaging a reputable and experienced QI is crucial to ensuring a seamless and successful 1031 exchange.

When Should You Consider a 1031 Exchange?

Considering a 1031 exchange involves careful evaluation of various factors and determining whether it aligns with your investment objectives and financial goals. While there is no one-size-fits-all answer, several situations may indicate that a 1031 exchange is worth exploring:

1. Appreciation Potential

If you own property that has seen significant appreciation in value, a 1031 exchange can enable you to leverage that growth into acquiring a more lucrative property. By exchanging into a property with higher appreciation potential, you can further enhance your investment growth and long-term wealth accumulation.

2. Cash Flow Improvement

If you currently own properties with low rental income or low cash flow potential, a 1031 exchange provides an opportunity to shift into properties with better income streams. By exchanging into properties that generate higher rental income or possess the potential for increased cash flow, you can enhance your monthly cash flow and long-term financial benefits.

3. Asset Diversification

Asset diversification is a prudent investment strategy that mitigates risk and enhances portfolio stability. If your current real estate holdings are concentrated in a specific type of property or a particular geographic area, a 1031 exchange can enable you to diversify your portfolio. By exchanging into different property types or investing in new locations, you can reduce risk and weather market fluctuations more effectively.

4. Retirement Planning

If you are approaching retirement or already retired, a 1031 exchange can be a valuable tool for retirement planning. By exchanging property investments into income-generating properties or properties with a higher potential for appreciation, you can secure a steady income stream during retirement or enhance your wealth preservation for future generations.

5. Capital Gains Tax Savings

If you anticipate incurring significant capital gains taxes upon the sale of a property, a 1031 exchange can help you defer those taxes. By reinvesting the proceeds from the sale into a like-kind property, you can defer the tax liability and continue growing your investment portfolio without the immediate burden of capital gains taxes.

6. Upgrading or Downsizing

If you are considering upgrading or downsizing your property, a 1031 exchange can provide a tax-efficient solution. By selling your current property and acquiring a larger or smaller property through a 1031 exchange, you can avoid capital gains taxes and optimize your financial position while achieving your desired property size or lifestyle change.

7. Wealth Preservation

A 1031 exchange can also be used as part of a wealth preservation strategy. By deferring taxes and being able to transfer your property holdings to future generations with a stepped-up basis, you can minimize tax liabilities for your heirs. This can help preserve your wealth and allow your family to inherit valuable real estate assets without immediate tax consequences.

It is important to consult with qualified tax advisors, real estate professionals, and qualified intermediaries to evaluate your specific circumstances and determine if a 1031 exchange is the right strategy for you. Each investor’s situation is unique, and thorough analysis is crucial to make informed decisions and maximize the benefits of a 1031 exchange.

Maximizing Your 1031 Exchange: Tips and Strategies

As a real estate investor, you want to make the most of your 1031 exchange. Optimizing your exchange requires careful planning and execution. Here are some tips and strategies to help you maximize the benefits of your 1031 exchange:

1. Work with Experienced Professionals

A successful 1031 exchange relies on the expertise and guidance of experienced professionals. Engaging a qualified intermediary, real estate agent, and tax advisor who specialize in 1031 exchanges is crucial. Their knowledge and experience will ensure that you meet all requirements, navigate complex rules, and maximize the advantages of a 1031 exchange.

2. Start the Process Early

Timing is key in a 1031 exchange. Start the process as early as possible to avoid any unnecessary time pressure or missed deadlines. Research potential replacement properties and identify suitable options ahead of time. By initiating the exchange promptly, you give yourself ample time to complete the necessary steps and make informed decisions.

3. Thoroughly Research Potential Replacement Properties

Investigate and analyze potential replacement properties extensively. Consider factors such as location, rental demand, potential for appreciation, market conditions, and cash flow potential. Conduct property inspections, review financial statements, and investigate any relevant legal or zoning issues. The more thorough your research, the better equipped you will be to make an informed decision and select the most suitable replacement property.

4. Consult with Local Real Estate Professionals

Local real estate professionals have invaluable insights into the specific market conditions and opportunities in your desired investment areas. Consult with local real estate agents, property managers, and investment advisors to gain a deeper understanding of the local real estate landscape. Their expertise and perspective can help you make more informed decisions and identify properties with growth potential.

5. Keep an Eye on Market Trends

Stay informed about market trends, interest rates, economic indicators, and other factors that can impact the real estate market. Monitor supply and demand dynamics, rental rates, vacancy rates, and any legislative or regulatory changes that may affect real estate investments. By staying up-to-date with market conditions, you can assess the optimal timing for your 1031 exchange and capitalize on favorable opportunities.

6. Don’t Rush the Process

Avoid rushing into a 1031 exchange without careful consideration. Take the time to analyze potential replacement properties, conduct due diligence, and consult with professionals. A well-planned and thought-out exchange is more likely to yield successful results and maximize your investment potential.

7. Consider Multiple Replacement Property Options

When identifying replacement properties, consider multiple options to increase your chances of finding the most suitable property. Explore various locations, property types, and investment strategies to diversify your portfolio and mitigate risk. Having multiple potential replacement properties can provide flexibility and negotiation leverage during the exchange process.

8. Evaluate Long-Term Investment Potential

When considering replacement properties, focus on their long-term investment potential. Look beyond the current market conditions and assess factors such as population growth, job opportunities, infrastructure development, and projected economic trends. Choosing properties with favorable long-term prospects can contribute to sustained investment growth and ongoing success.

9. Maintain Accurate Records

Throughout the 1031 exchange process, meticulously maintain accurate and organized records of all transactions, correspondence, timelines, and documentation. This will facilitate compliance with IRS regulations, simplify reporting, and help defend your exchange in case of an audit.

10. Stay Informed and Adapt to Changing Regulations

IRS regulations regarding 1031 exchanges may change over time. Stay informed about any updates or modifications to the rules to ensure ongoing compliance. Consulting with tax professionals who specialize in 1031 exchanges will help you stay up-to-date and ensure that you adhere to the most current regulations.

By implementing these tips and strategies, you can optimize your 1031 exchange and maximize your investment potential. Remember, careful planning, thorough research, and professional guidance are essential for a successful exchange.

Debunking Common Misconceptions About 1031 Exchanges

As with any investment strategy, there are several misconceptions and misunderstandings surrounding 1031 exchanges. To help you make informed decisions, let’s debunk some common misconceptions about 1031 exchanges:

1. Misconception: 1031 exchanges are only for large-scale real estate investors.

Reality: 1031 exchanges can be utilized by investors of all sizes. Whether you own a single investment property or a large portfolio, a 1031 exchange can provide tax and investment benefits. The key is to identify suitable replacement properties and navigate the exchange process effectively.

2. Misconception: 1031 exchanges are complex and only for experts.

Reality: While 1031 exchanges involve specific guidelines and requirements, they can be successfully executed with the guidance of experienced professionals. By working with a qualified intermediary and leveraging the expertise of real estate agents and tax advisors, investors can navigate the exchange process efficiently and maximize their benefits.

3. Misconception: 1031 exchanges are only for real estate professionals.

Reality: 1031 exchanges are not limited to real estate professionals. Any individual or entity that owns investment or business property can engage in a 1031 exchange. From rental property owners to small business owners with real estate assets, anyone can reap the tax benefits and wealth accumulation potential of a 1031 exchange.

4. Misconception: The replacement property must be of equal value or greater.

Reality: While the IRS requires the acquisition of a replacement property of equal or greater value to the relinquished property, there are other factors to consider. The fair market value and equity of the replacement property, as well as the debt and equity of the relinquished property, play a role in meeting the like-kind requirement. Consult with a qualified intermediary to ensure compliance with the IRS guidelines.

5. Misconception: 1031 exchanges are only for deferring taxes indefinitely.

Reality: While one of the primary advantages of a 1031 exchange is tax deferral, it is not the only purpose of the strategy. 1031 exchanges offer investors opportunities for portfolio growth, asset diversification, increased cash flow, and wealth preservation. By leveraging the benefits of a 1031 exchange, investors can optimize their investment portfolios and financial positions.

6. Misconception: The 45-day identification period is inflexible.

Reality: The 45-day identification period does pose some challenges, but it is not entirely inflexible. Investors have options to identify potential replacement properties, including exploring multiple options, identifying more than one property, or using specific identification rules. Working with experienced professionals will help you navigate the identification process effectively.

7. Misconception: 1031 exchanges are always a guaranteed way to save on taxes.

Reality: 1031 exchanges provide tax deferral benefits, but they do not eliminate tax liability entirely. At some point, if the investor sells the replacement property without initiating another exchange, the deferred taxes become due. However, by continually utilizing 1031 exchanges or planning for stepped-up basis upon inheritance, investors can significantly minimize their tax burden and preserve wealth.

By understanding the reality behind these misconceptions, you can make more informed decisions and harness the full potential of a 1031 exchange. Consult with professionals and conduct thorough research to dispel any misconceptions and maximize the benefits of this powerful tax strategy.

1031 Exchange Checklist: Key Steps for a Successful Exchange

Navigating a 1031 exchange requires careful planning, organization, and adherence to specific guidelines. To ensure a successful exchange, follow this comprehensive checklist:

1. Familiarize Yourself with 1031 Exchange Rules

Understand the basic rules and requirements of a 1031 exchange. Educate yourself about the timelines, identification rules, like-kind property requirements, and other essential aspects of the exchange process. Conduct research, consult with professionals, and obtain a clear understanding of how 1031 exchanges work.

2. Identify Potential Replacement Properties

Begin the process by identifying potential replacement properties within the 45-day identification period. Consider relevant factors such as location, property type, market conditions, and income potential. Research, analyze, and compare various options to ensure they meet the requirements of a like-kind property.

3. Engage a Qualified Intermediary

Select a qualified intermediary (QI) to facilitate the exchange process. Ensure they are experienced in handling 1031 exchanges and possess the necessary knowledge to guide you through each step. The QI will hold the sale proceeds from the relinquished property and facilitate the acquisition of the replacement property.

4. Prepare and Sign the Exchange Agreement

Draft and sign an exchange agreement with the qualified intermediary, clearly outlining the terms and conditions of the exchange. Ensure that the agreement complies with IRS regulations and covers all crucial aspects of the exchange. Consult with legal professionals to ensure the agreement meets all legal requirements.

5. Notify All Relevant Parties

Notify all relevant parties, such as the buyer of the relinquished property, the closing agent, and any other stakeholders, about your intent to engage in a 1031 exchange. Provide them with the necessary information and documentation to ensure a smooth transition of the sale proceeds to the qualified intermediary.

6. Complete the Sale of the Relinquished Property

Initiate the sale process of the relinquished property. Work closely with the closing agent to ensure all necessary documentation, including the assignment of the sales contract to the qualified intermediary, is prepared and executed correctly. Coordinate the transfer of funds from the sale of the property to the qualified intermediary.

7. Identify Replacement Properties within 45 Days

Within the 45-day identification period, provide written notice to the qualified intermediary, indicating the potential replacement properties you have identified. Adhere to the identification rules and guidelines provided by the IRS to ensure compliance with the regulations. Keep accurate records and copies of all notices and correspondence.

8. Conduct Due Diligence on Replacement Properties

Thoroughly investigate and analyze potential replacement properties within the 45-day identification period. Conduct property inspections, review financial statements, assess market conditions, and evaluate their suitability for your investment goals. Consult with real estate professionals and gather all the necessary information to make an informed decision.

9. Secure Financing for the Replacement Property

If you plan to finance the replacement property, secure the necessary financing within the exchange timelines. Work closely with lenders and mortgage professionals to ensure a smooth financing process. It is crucial to consider financing options and requirements early in the process to avoid delays or complications.

10. Consult with Tax Advisors

Throughout the exchange process, consult with qualified tax advisors familiar with 1031 exchanges. They can provide guidance on tax consequences, requirements, and implications specific to your situation. Ensure that you comply with all IRS regulations and seek professional advice to minimize tax liabilities and maximize your benefits.

11. Acquire the Replacement Property

Within the 180-day exchange period, complete the acquisition of the replacement property. Coordinate with the qualified intermediary, closing agents, and any other parties involved to ensure a smooth closing process. Review all necessary documentation and ensure compliance with all legal and regulatory requirements.

12. File Appropriate Tax Forms

File all necessary tax forms with the IRS to report the 1031 exchange. Consult with tax professionals to ensure accurate and timely filing. Complete Form 8824, Like-Kind Exchanges, and include it with your tax return for the year in which the exchange occurred.

13. Maintain Accurate Exchange Records

Maintain detailed and accurate records of all aspects of the 1031 exchange. Retain copies of all correspondence, notices, agreements, closing documents, and tax forms. Organize these records in a systematic manner to facilitate future reference, reporting, and compliance with IRS requirements.

14. Consider Future 1031 Exchanges

After completing a 1031 exchange, consider the potential for future exchanges to continue deferring taxes and growing your investment portfolio. Evaluate market conditions, your investment goals, and other relevant factors to determine if future exchanges align with your long-term financial objectives. Regular review and analysis of your real estate holdings can reveal opportunities for ongoing portfolio growth.

By following this comprehensive checklist and working closely with experienced professionals, you can navigate the 1031 exchange process with confidence and maximize the benefits of this tax-deferral strategy.

Wrap-Up:

In summary, timing is indeed essential in a 1031 exchange. Adhering to the exchange period and meeting the necessary deadlines are critical for a successful exchange that allows you to defer capital gains taxes effectively. Furthermore, staying informed about market conditions and working with experienced professionals can help you optimize the timing of your exchange and capitalize on favorable investment opportunities. By carefully considering the timing and following the guidelines outlined in this article, investors can maximize the benefits of their 1031 exchanges and achieve their financial goals.

Key Takeaways: Is Timing Important in a 1031 Exchange?

- Timing is crucial in a 1031 exchange because there are specific deadlines that must be met.

- You must identify a replacement property within 45 days of selling your current property.

- You have 180 days to complete the exchange, including closing on the replacement property.

- The timing of the exchange affects your ability to defer capital gains taxes.

- It’s important to work with a qualified intermediary who can guide you through the process and ensure compliance with timing requirements.

Frequently Asked Questions

Timing plays a crucial role in a 1031 exchange. Here are some common questions and answers related to the importance of timing in a 1031 exchange.

1. How does timing impact a 1031 exchange?

The timing of a 1031 exchange is crucial because it determines whether you can defer capital gains taxes. There are strict deadlines that must be adhered to for a successful exchange. From the closing of the original property, you have 45 days to identify potential replacement properties and 180 days to close on one or multiple identified properties.

If these deadlines are not met, you may lose the tax advantages of a 1031 exchange and be liable for capital gains taxes. Therefore, it is essential to understand the timeline and plan accordingly to ensure a smooth exchange.

2. Can I extend the deadlines for a 1031 exchange?

In some cases, you may be able to extend the deadlines for a 1031 exchange. If you are unable to identify a suitable replacement property within the initial 45-day period, you can request an extension. However, this extension must be granted in writing by the IRS before the 45 days are up.

For the 180-day deadline, extensions are generally not granted. It is essential to plan ahead and give yourself enough time for due diligence and closing on the replacement property. Working with a qualified intermediary can help ensure that you meet all the necessary deadlines and maximize the benefits of a 1031 exchange.

3. Is it better to sell the original property before or after identifying a replacement property?

It is generally recommended to sell the original property after identifying a replacement property in a 1031 exchange. This is because the 45-day identification period begins on the day you close on the original property. If you sell the original property first, you will have limited time to find a suitable replacement property within the 45-day deadline.

By first identifying a replacement property before selling the original, you have more flexibility and time to search for the right property that meets your requirements. This approach reduces the risk of not finding a suitable replacement property within the specified time frame.

4. Can I start looking for replacement properties before selling my original property?

Yes, you can start looking for replacement properties before selling your original property in a 1031 exchange. This is known as a “reverse exchange.” In a reverse exchange, you purchase the replacement property first and then sell your original property within the specified timeline.

However, reverse exchanges are more complex and require additional planning and coordination. It is crucial to work with a qualified intermediary who specializes in reverse exchanges to ensure compliance with IRS rules and regulations.

5. What happens if I miss the deadlines for a 1031 exchange?

If you miss the deadlines for a 1031 exchange, you will no longer be eligible for tax deferral benefits, and you will be liable for capital gains taxes on the sale of your original property. The IRS is strict regarding these deadlines, and there are limited exceptions granted for missed deadlines.

If you find yourself in this situation, it is advisable to consult with a tax professional to explore potential options and minimize any tax liabilities. They can guide you on how to best navigate the situation and offer you alternative strategies for tax planning.

Summary

Timing is important in a 1031 exchange because it affects tax benefits. When selling a property and buying a new one within a certain period, taxes on the profit can be deferred. The 45-day identification period and 180-day exchange period are crucial to follow in order to qualify for these benefits.

If you miss these deadlines, you may have to pay taxes on the profit from the sale. Planning ahead and working with a qualified intermediary can help ensure a successful 1031 exchange and maximize your tax advantages. Remember, timing matters!

If blood glucose is effectively controlled, this dose may be used for maintenance treatment dapoxetine for premature Effects of Doxorubicin and Tamoxifen 4HT on the Induction of Cellular Senescence in MCF 7 Breast Cancer Cells

priligy dapoxetine The efficacy, adverse effects and overall role of letrozole in oral ovulation induction have remained controversial

where to buy cheap cytotec price 2009 demonstrated that percutaneous absorption of cyproterone acetate from a liposomal formulation has better penetration with more potential than a conventional cyproterone acetate formulation simple gel

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.