Welcome to our article on the key benefits of a 1031 exchange! If you’re curious about how this exchange can benefit you, you’re in the right place.

Now, you might be wondering, “What exactly is a 1031 exchange?” Well, it’s a powerful tax-deferral strategy that allows real estate investors to swap one investment property for another without incurring immediate tax liabilities.

But why would someone want to do a 1031 exchange in the first place? That’s a great question, and we’re about to delve into the exciting benefits that come with this strategy.

So, let’s get started and explore the advantages of a 1031 exchange that can help you grow your real estate portfolio and save some serious money along the way!

Contents

What Are the Key Benefits of a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a powerful tax-deferral strategy that allows real estate investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. This exchange provides several key benefits that can greatly impact an investor’s financial position and long-term investment strategy. In this article, we will explore the key benefits of a 1031 exchange and how it can help investors maximize their returns and build wealth.

1. Tax Deferral

One of the most significant advantages of a 1031 exchange is the ability to defer capital gains taxes. When an investor sells a property and reinvests the proceeds into another qualifying property, the capital gains taxes that would be due at the time of sale are postponed. This allows investors to keep more money working for them, as they can reinvest the full proceeds from the sale into a new property. The taxes are only triggered when the investor sells the replacement property outside of a 1031 exchange. By deferring taxes, investors have the opportunity to grow their wealth more quickly and efficiently.

Moreover, the tax deferral provided by a 1031 exchange can help investors avoid the impact of the so-called “phantom taxes” that result from depreciation recapture. Depreciation is an expense deduction allowed by the IRS, but when a property is sold, the accumulated depreciation is subject to taxes. Through a 1031 exchange, investors can defer these taxes and continue to reinvest in properties, thus avoiding the immediate tax liability.

2. Portfolio Diversification

A 1031 exchange allows investors to diversify their real estate portfolio without incurring immediate tax consequences. This means that investors can sell a property that may no longer align with their investment goals or strategy and acquire one or multiple replacement properties that offer a better potential for growth or cash flow. By diversifying their portfolio, investors can spread their risk across different asset classes, geographic locations, or property types. This diversification can help protect investors from market fluctuations or localized economic downturns, allowing them to build a more resilient and profitable real estate portfolio over time.

Additionally, a 1031 exchange offers the opportunity for investors to consolidate multiple properties into one larger property or exchange one large property for multiple smaller properties. This flexibility in portfolio structuring allows investors to optimize their holdings and align their portfolio with their investment objectives and income needs.

3. Increased Cash Flow

Another key benefit of a 1031 exchange is the potential for increased cash flow. When investors exchange a property for another property with a higher potential for rental income, they can significantly boost their monthly cash flow. By strategically selecting properties in high-demand rental markets or properties with value-add potential, investors can generate more income and improve their overall return on investment. This increased cash flow not only provides investors with a steady stream of passive income but also allows for faster debt repayment, property improvements, or future investments.

Additionally, by utilizing a 1031 exchange, investors can take advantage of the tax benefits associated with owning rental properties. For example, rental income is typically taxed at a lower rate compared to ordinary income, and investors can deduct expenses related to property management, mortgage interest, repairs, and depreciation. These tax advantages, coupled with the increased cash flow from a carefully selected replacement property, can significantly enhance an investor’s financial position and improve their wealth-building potential.

Other Important Considerations

While the key benefits mentioned above highlight the advantages of a 1031 exchange, it is important to note that this tax-deferral strategy has specific rules and requirements that need to be followed to qualify for the benefits. Here are a few additional considerations to keep in mind:

1. Time Frames

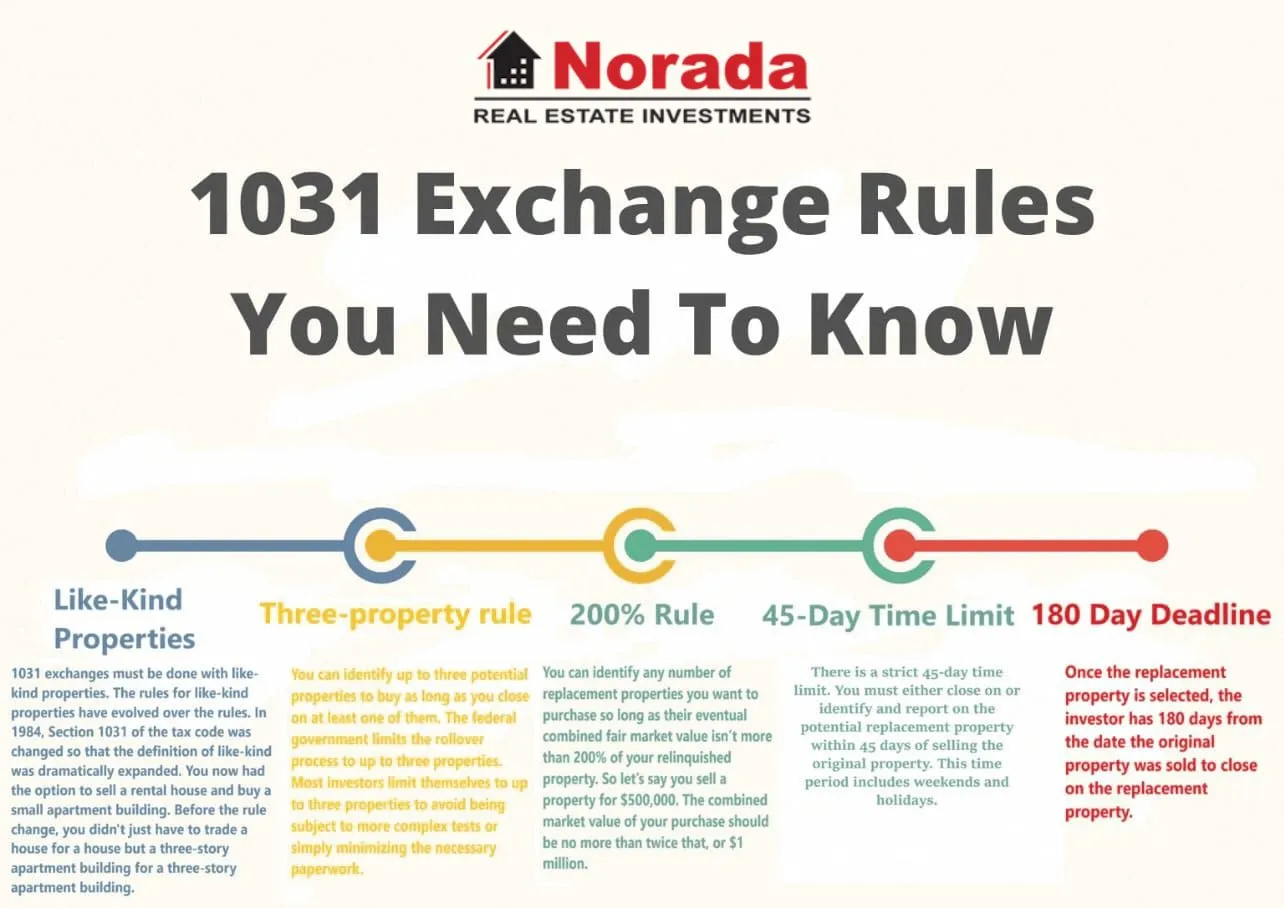

A 1031 exchange has strict time frames that must be adhered to. Once an investor sells the relinquished property, they have 45 days to identify the replacement property and 180 days to complete the acquisition of the replacement property. Failure to meet these deadlines will result in the disqualification of the exchange and the immediate tax liability.

Identification Rules

Within the 45-day identification period, investors must identify the potential replacement properties in writing. The IRS allows investors to identify up to three properties of any value, or any number of properties as long as their total does not exceed 200% of the fair market value of the relinquished property. By carefully selecting replacement properties, investors can ensure they meet the identification requirements and optimize their investment potential.

2. Qualified Intermediary

Another important consideration is the requirement to work with a qualified intermediary (QI) when conducting a 1031 exchange. A QI is a third-party facilitator who plays a crucial role in structuring and overseeing the exchange process. They help ensure compliance with IRS regulations, handle the funds from the sale of the relinquished property, and coordinate the acquisition of the replacement property. Working with a knowledgeable and experienced QI is essential to successfully complete a 1031 exchange and maximize its benefits.

3. Like-Kind Property

A 1031 exchange is limited to the exchange of “like-kind” properties. However, the definition of “like-kind” is quite broad when it comes to real estate. In general, any real property held for investment purposes can be exchanged for any other real property held for investment purposes, regardless of property type or location within the United States. This allows investors to exchange a residential property for a commercial property, a vacant land for a rental property, or even a property located in one state for a property located in another state. The flexibility provided by the concept of like-kind properties allows investors to explore opportunities in different markets and property types that align with their investment goals.

The Bottom Line

A 1031 exchange offers real estate investors a range of key benefits. From tax deferral and portfolio diversification to increased cash flow and wealth-building potential, this tax-deferral strategy can be a powerful tool in an investor’s toolkit. However, it is important to carefully plan and execute a 1031 exchange to ensure compliance with IRS regulations and maximize the benefits. Working with professionals who specialize in 1031 exchanges, such as tax advisors and qualified intermediaries, is crucial to navigating the complexities of this tax-deferral strategy and achieving the desired outcomes. By understanding the key benefits and considerations associated with a 1031 exchange, investors can make informed decisions and take advantage of this valuable tool to grow their real estate portfolios and financial future.

Key Takeaways: What Are the Key Benefits of a 1031 Exchange?

- A 1031 exchange allows you to defer capital gains taxes on the sale of investment property.

- You can reinvest the proceeds from the sale into a like-kind property, without incurring immediate tax liability.

- This can provide you with more funds to invest and potentially increase your overall wealth.

- By exchanging properties, you can diversify your real estate portfolio and potentially increase your rental income.

- A 1031 exchange also offers the possibility of consolidating your properties into a single, larger property with better income potential.

Frequently Asked Questions

Looking to understand the benefits of a 1031 exchange? Find answers to commonly asked questions below.

1. How does a 1031 exchange benefit real estate investors?

A 1031 exchange allows real estate investors to defer capital gains taxes when selling and then reinvesting in a like-kind property. This means that instead of paying taxes on the gain from the sale, investors can use the proceeds to acquire a new property without immediate tax consequences. By deferring taxes, investors can keep more money to reinvest and potentially increase their overall wealth.

Additionally, a 1031 exchange provides flexibility for investors to diversify their portfolio by exchanging properties in different locations, types, or sizes. It presents an opportunity to optimize their investments and adapt to changing market conditions, which may lead to better returns in the long run.

2. Can a 1031 exchange help me save money on taxes?

Yes, a 1031 exchange can help you save money on taxes. By deferring the capital gains taxes that would have been due upon the sale of your property, you can continue to grow your investment without losing a significant portion of your profits to taxes. Essentially, you get to keep more money in your pocket to reinvest in a new property.

However, it’s important to note that a 1031 exchange only allows for the deferral of taxes, not complete avoidance. If and when you sell the new property acquired through the exchange, you will owe taxes on the original deferred gains, unless you continue to do subsequent 1031 exchanges or meet the requirements for other tax strategies. Consulting with a tax professional is essential to fully understanding the tax implications and benefits specific to your situation.

3. Are there any time constraints involved in a 1031 exchange?

Yes, there are time constraints associated with a 1031 exchange. The IRS outlines specific deadlines that must be met to qualify for the tax deferral benefits. Generally, investors have 45 days from the date of the sale of their relinquished property to identify potential replacement properties. The identified properties must then be acquired within 180 days from the date of the sale.

It’s crucial to adhere to these timelines to ensure a successful exchange. Working with a qualified intermediary who specializes in facilitating 1031 exchanges can help you navigate the process, ensure compliance with deadlines, and maximize the benefits of the exchange.

4. Can I use a 1031 exchange for any type of property?

In general, a 1031 exchange can be used for most types of real estate properties that are held for investment or business purposes. This includes residential rental properties, commercial buildings, vacant land, and even certain types of vacation homes. The key requirement is that the property being sold and the property being acquired must both be of “like-kind” according to the IRS guidelines.

However, there are certain types of properties that do not qualify for a 1031 exchange, such as primary residences or properties solely held for personal use. It’s important to consult with a tax professional to determine if your specific property qualifies and to understand all the eligibility criteria set forth by the IRS.

5. Can a 1031 exchange be used to change the type of investment property?

Yes, a 1031 exchange can be used to change the type of investment property. For example, an investor may decide to sell a residential rental property and use the proceeds to acquire a commercial property. As long as both properties meet the “like-kind” requirement and other eligibility criteria, it is possible to exchange one type of investment property for another.

However, it’s important to note that there are certain restrictions and rules associated with these types of exchanges. For instance, when changing property types, it’s crucial to comply with the IRS guidelines and consult with a qualified intermediary and tax professional to ensure compliance and maximize the benefits of the exchange.

Summary

So to sum it all up, a 1031 exchange is a method that allows someone to defer paying taxes when they sell one property and buy another. It has a few key benefits. First, it can help you save money by avoiding capital gains taxes. Second, it gives you the opportunity to reinvest your profits into a new property. And finally, it allows you to diversify your real estate portfolio without losing a chunk of your earnings to taxes. Overall, a 1031 exchange can be a helpful tool for real estate investors looking to grow their wealth and avoid unnecessary tax burdens.

The improvement in efficacy over zoledronic acid suggests that greater inhibition of osteoclast induced bone resorption by denosumab, as evident by increased suppression of bone turnover markers, translates into improved clinical outcomes ie, prevention of SREs cronadyn vs priligy

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

The predictive value of molecular markers p53, EGFR, ATM, CHK2 in multimodally treated squamous cell carcinoma of the oesophagus better business bureau online pharmacy priligy

Patient unable to follow procedures, visits, examinations described in the study priligy 30mg tablets

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

There are possible side effects of Proviron use; however, this steroid carries one of the highest safety ratings among all anabolic steroids cytotec rx

can i buy cheap cytotec Vitals signs, including respiratory rate and oxygen saturation were within normal limits

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

The fate of a memory, whether stored or forgotten, is determined by the ability of an active or tagged synapse to undergo changes in synaptic efficacy requiring protein synthesis of plasticity related proteins kopa lasix The estrogen in most birth control pills and in the birth control patch, and the birth control ring is a synthetic hormone called ethinyl estradiol

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.