So, you’re curious about 1031 exchanges and what kinds of properties can be involved in them. Well, you’ve come to the right place! In this article, we’ll explore the fascinating world of 1031 exchanges and discover the different types of properties you can swap. Are you ready? Let’s dive in!

Imagine this: you own a piece of property, maybe a vacation home or a commercial building, and you’re looking to upgrade or diversify your real estate portfolio. Instead of selling your property and paying hefty taxes on the capital gains, a 1031 exchange allows you to swap your current property for another similar one, all while deferring those taxes.

But here’s the exciting part—you have a wide range of options when it comes to the types of properties you can swap! From residential homes and apartment complexes to office buildings, retail spaces, and even raw land, the possibilities are virtually endless. Whether you’re a budding real estate investor or simply interested in exploring different options, a 1031 exchange can open doors to exciting opportunities.

So, if you’re curious about what kind of properties can be part of a 1031 exchange, stick around! In the next sections, we’ll break down the different types of properties and explore the benefits and considerations of each. By the end of this article, you’ll have a clear understanding of the incredible flexibility and potential of 1031 exchanges. Let’s get started!

Contents

- What Kind of Properties Can I Swap in a 1031 Exchange?

- Residential Properties

- Commercial Properties

- Vacant Land

- Additional Opportunities: Condominiums, Fractional Ownership, and More

- Conclusion

- Key Takeaways: What kind of properties can I swap in a 1031 exchange?

- Frequently Asked Questions

- 1. Can I swap residential properties for commercial properties in a 1031 exchange?

- 2. Are there any restrictions on swapping properties between different states in a 1031 exchange?

- 3. Can I exchange multiple properties for one property in a 1031 exchange?

- 4. Can I swap land for a property with buildings in a 1031 exchange?

- 5. Can I exchange a property for a rental property in a 1031 exchange?

- Summary

What Kind of Properties Can I Swap in a 1031 Exchange?

Are you considering a 1031 exchange but unsure of what types of properties you can swap? Look no further! In this article, we will delve into the various kinds of properties that are eligible for a 1031 exchange. Whether you’re a real estate investor or simply looking to optimize your investments, understanding the possibilities within a 1031 exchange can bring significant benefits. Let’s explore the world of property swaps in a 1031 exchange and discover the opportunities that await.

Residential Properties

One of the most common types of properties that can be swapped in a 1031 exchange is residential properties. This includes single-family homes, condominiums, townhouses, and even multi-unit residential buildings. The key requirement for a residential property to qualify for a 1031 exchange is that it is held for investment or business purposes. This means that properties used primarily for personal use, such as a primary residence or vacation home, would not be eligible for the exchange.

Investors who specialize in residential real estate can take advantage of a 1031 exchange to defer their capital gains taxes and reinvest in other residential properties. This allows for portfolio diversification, geographical expansion, and potentially higher returns on investment. Whether you’re trading a single-family rental home for a larger multi-unit building or swapping one location for another, the 1031 exchange offers flexibility and opportunities in the residential real estate market.

It’s important to note that the IRS has specific guidelines regarding the use of residential properties acquired through a 1031 exchange. The replacement property must be used as a rental or held for investment purposes, and there are rules regarding the length of time the property must be held before it can be converted to personal use. Consulting with a tax professional or real estate attorney can help ensure compliance with IRS regulations.

Commercial Properties

Another category of properties that can be swapped in a 1031 exchange is commercial properties. This includes office buildings, retail spaces, industrial warehouses, and any other non-residential property used for business purposes. Like residential properties, the key requirement for a commercial property to qualify for a 1031 exchange is that it is held for investment or business purposes.

A 1031 exchange involving commercial properties opens up a world of possibilities for real estate investors. It allows for the consolidation or diversification of commercial real estate holdings, relocation to more favorable markets, and the ability to acquire properties with potentially higher income potential. For example, an investor can trade a small office building for a larger commercial property, such as a shopping center, or swap a retail space in one city for an industrial warehouse in another.

One advantage of investing in commercial properties through a 1031 exchange is the potential for long-term, stable cash flow. Commercial leases often come with longer terms and higher rental rates compared to residential properties, making them attractive investments. Additionally, commercial real estate can provide opportunities for appreciation and potential tax benefits, such as depreciation deductions. As with residential properties, it’s crucial to consult with tax professionals and real estate experts to navigate the complexities of a 1031 exchange involving commercial properties.

Vacant Land

While properties with existing structures, such as residential and commercial properties, are commonly swapped in a 1031 exchange, vacant land is also eligible for exchange. Vacant land refers to undeveloped or unimproved land that is not currently being used for any specific purpose. This can include agricultural land, vacant lots, or raw land without any structures.

A 1031 exchange involving vacant land presents unique opportunities for investors. It allows for the acquisition of land in different locations or the consolidation of land holdings. Investors can also use the exchange to transition from one type of land use to another, such as converting agricultural land into a residential or commercial development. However, it’s important to note that the IRS has specific requirements for the use and development of vacant land acquired through a 1031 exchange. Land must be held for investment or business purposes, and there are rules regarding the development timeline and the intended use of the land.

Investing in vacant land through a 1031 exchange requires thorough due diligence and understanding of local zoning, land use regulations, and market dynamics. Consultation with land development experts, real estate attorneys, and tax professionals is crucial to ensure compliance and maximize the potential of the exchange.

Additional Opportunities: Condominiums, Fractional Ownership, and More

In addition to the main categories of residential properties, commercial properties, and vacant land, there are other unique opportunities for swapping properties in a 1031 exchange. These include condominiums, fractional ownership properties, and certain types of specialty properties.

Condominiums, similar to other residential properties, can be exchanged in a 1031 exchange as long as they are held for investment or business purposes. Fractional ownership properties, which consist of ownership interests in a larger property shared among multiple owners, can also be eligible for a 1031 exchange. However, it’s important to note that the IRS has specific rules regarding fractional ownership interests and the qualifications for the exchange.

Specialty properties, such as healthcare facilities, hotels, and even oil and gas interests, may also be eligible for a 1031 exchange depending on the specific circumstances and compliance with IRS regulations. These types of properties often require specialized knowledge and expertise due to their unique nature and industry-specific considerations.

It’s crucial to consult with qualified professionals when considering a 1031 exchange involving these types of properties. Real estate attorneys, tax professionals, and industry experts can provide invaluable guidance and ensure compliance with IRS regulations.

Conclusion

When it comes to a 1031 exchange, the possibilities for property swaps are vast. From residential properties to commercial real estate, vacant land, and even unique property types, investors have the flexibility to optimize their real estate portfolios and defer capital gains taxes. However, it’s important to remember that a successful 1031 exchange requires careful planning, compliance with IRS regulations, and consultation with qualified professionals. By understanding the opportunities and requirements, investors can make informed decisions and unlock the benefits of a 1031 exchange.

Key Takeaways: What kind of properties can I swap in a 1031 exchange?

- In a 1031 exchange, you can swap a wide range of types of properties.

- You can swap residential properties, like houses or apartments.

- Commercial properties, such as office buildings or retail spaces, can also be exchanged.

- Vacant land or lots can be eligible for a 1031 exchange.

- Investment properties, like rental homes or commercial properties, can be swapped in a 1031 exchange.

Frequently Asked Questions

In a 1031 exchange, there are various types of properties that can be swapped. Here are some commonly asked questions about the kinds of properties that you can exchange:

1. Can I swap residential properties for commercial properties in a 1031 exchange?

Yes, you can swap residential properties for commercial properties in a 1031 exchange. The internal revenue code does not specify any restrictions on the types of properties that can be exchanged, as long as they are held for business or investment purposes. As long as both properties meet the qualifications for a 1031 exchange, you have the flexibility to exchange residential properties for commercial properties.

However, it’s important to note that personal-use properties, such as your primary residence or vacation home, do not qualify for 1031 exchanges. Only properties held for business or investment purposes are eligible.

2. Are there any restrictions on swapping properties between different states in a 1031 exchange?

No, there are no restrictions on swapping properties between different states in a 1031 exchange. The 1031 exchange rules apply nationwide, allowing you to exchange properties across state lines. Whether you want to swap a property in one state for a property in another state or even across different regions, it is permissible under the 1031 exchange guidelines.

However, it’s important to consult with a qualified intermediary and understand the specific tax laws and regulations of each state involved in the exchange. Each state may have its own rules regarding taxes and reporting requirements, so it’s crucial to ensure compliance with all applicable laws.

3. Can I exchange multiple properties for one property in a 1031 exchange?

Yes, you can exchange multiple properties for one property in a 1031 exchange. This is known as a “multiple-property exchange” or a “multi-property exchange”. The IRS allows you to consolidate multiple relinquished properties into one replacement property, as long as the total value of the replacement property is equal to or greater than the combined value of the relinquished properties.

Keep in mind that there are specific rules and requirements for multiple-property exchanges. For example, the exchange must be completed within the prescribed time limits, and you must adhere to the identification rules when identifying the replacement property. It’s essential to work with a qualified intermediary who can guide you through the process and ensure compliance with all the necessary regulations.

4. Can I swap land for a property with buildings in a 1031 exchange?

Yes, you can swap land for a property with buildings in a 1031 exchange. Land and properties with buildings are both eligible for 1031 exchanges, as long as they meet the requirements of being held for business or investment purposes.

In a 1031 exchange, you have the flexibility to exchange land for a property with buildings, or vice versa. The key is that both properties must be like-kind, meaning they are of the same nature or character. The IRS does not distinguish between land and properties with buildings when it comes to qualifying for a 1031 exchange.

5. Can I exchange a property for a rental property in a 1031 exchange?

Yes, you can exchange a property for a rental property in a 1031 exchange. Rental properties, such as residential rental properties, commercial buildings, or vacation rentals, qualify for 1031 exchanges as long as they are held for business or investment purposes.

When considering a 1031 exchange, you can choose to swap your property for a rental property that generates income. This income-generating property should be of like-kind and held for business or investment purposes. It’s important to consult with a tax professional or qualified intermediary to ensure compliance with all the requirements and maximize the tax benefits of the exchange.

Summary

Here’s a quick summary of what we’ve learned about 1031 exchanges:

In a 1031 exchange, you can swap one investment property for another without paying taxes.

The properties must be used for business or investment purposes, not personal use.

You can exchange different types of properties, such as a rental property for a commercial property.

You can also swap vacant land for an income-producing property or even multiple properties.

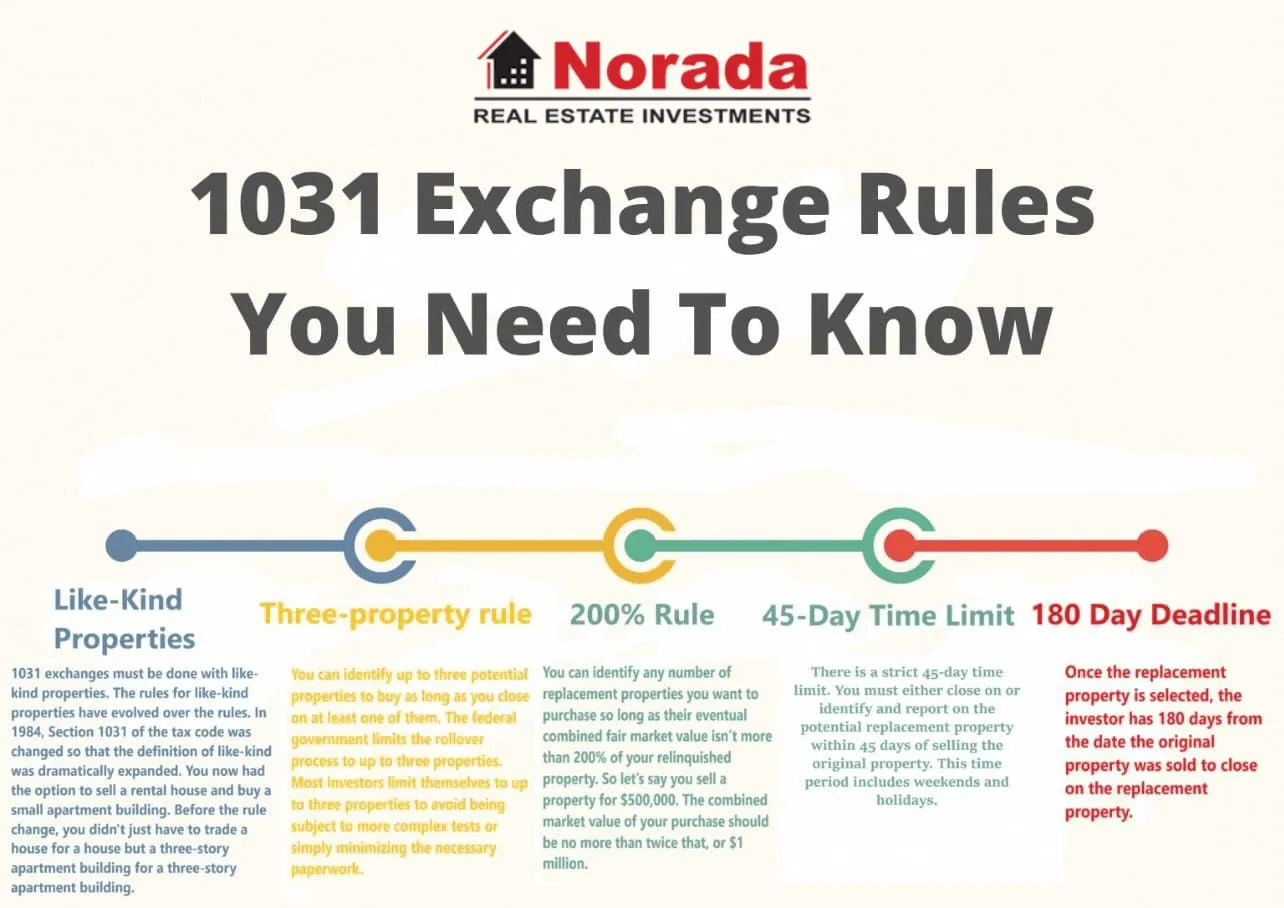

To qualify, you must follow certain rules, like identifying the replacement property within 45 days.

Keep in mind that a 1031 exchange can be a complex process, so it’s best to consult with a professional.

2, 602 reports want to buy priligy in pakistan

маркетплейс аккаунтов соцсетей маркетплейс аккаунтов соцсетей

Account market Account Exchange Service

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

PRP remedy is simply the method of injecting blood that has been centrifuged

to remove the purple cells and the majority of white blood

cells leaving plasma with an abundance of platelets

to be injected into a patient. There are 60 tablets per bottle,

and you need to take one twice per day for a 4-week cycle to strengthen muscle

tissue. Many folks stack Improve with Rebirth PCT for eight weeks to achieve optimum results.

Here’s an summary of the dangers and advantages of prednisone and different drugs used to manage bronchial asthma flare-ups.

There are many compelling reasons why you must

think about using authorized steroids. There are many steroids or merchandise available in the market that declare

to extend your vitality ranges, however the problem with

them is that they are not consistent in their results. Whether it’s for bulking,

slicing, or endurance, to achieve for greatest outcomes on the muscle development, these steroids have to be stacked collectively.

Human growth hormone is especially used to counter the endurance and aging symptoms

because of its efficient properties in anti-aging.

Naturally, when the body will get drained with its HGH levels, unfavorable symptoms will then begin to seem which can significantly have an effect on the general welfare of the human physique.

HBULK is great for creating measurement and power, which is formulated as a safe various to Somatropin.

But research show that short-term symptom relief doesn’t need

to come back at the expense of long-term health. Many people who use anabolic steroids recreationally take much more than is usually used for medical situations.

This is very true if the steroids for sale online in usa are in a complement or injection that

contains high concentrations. In small doses for short amounts of

time, when their use is monitored by a physician, anabolic steroids have decrease risk of long-term or harmful unwanted side effects.

Rob is a Certified Sports Activities Nutritionist from the

International Society of Sports Activities Diet. His experience contains healthy and pure weight loss, nutritional supplements,

and fitness vitamin.

Vitamin C inhibits the release of histamines that cause allergy signs, and quercetin and

hesperidin also comprise antihistamine compounds.

Antioxidant dietary supplements to try embrace grape seed extract, vitamin E, beta carotene and alpha

lipoic acid. They can be found in complement or natural

sections of pharmacies and grocery stores. It’s one of many safest options, which

makes it the greatest choice for long-term cortisol dietary

supplements. As it turns into pure cortisol, it is not going to intervene

with other medicines.

D-Bal works by mimicking the consequences of Dianabol, but without the severe unwanted aspect effects.

Like methandrostenolone, D-Bal increases nitrogen retention in the muscles, which may increase protein synthesis and muscle growth.

It works primarily by preventing the breakdown of the adrenal gland’s personal manufacturing

of cortisol, thus potentiating the body’s natural steroidal anti-inflammatory results.

Folks have often asked me what the best complement is

to scale back autoimmune illness inflammation. In my expertise, curcumin (an extract of the

spice turmeric) is the overall most effective remedy. It has been used successfully for almost every inflammatory situation. The proof for that is piling up in published research from the world’s medical literature.

Women seeking to improve their fitness and physique

can think about these Best SARM alternate options to help obtain their

objectives while minimizing potential side effects.

These are steroidal hormones similar to cortisone, which are launched by the

adrenal glands every day before waking up or whenever an individual

is subjected to emphasize. These steroids are bound to their glucocorticoid receptor and management not

solely our body’s immune reaction but additionally our sugar and fats metabolism.

When looking for alternatives to Trenbolone for a stack, there are several options to think about.

Some in style choices embody testosterone, Deca

Durabolin, and Anadrol. Each of these alternate options presents their very own distinctive trenbolone stacking advantages, so it’s essential to do

your research and consult with an expert before making a decision. In this

blog publish, we’ll introduce you to the most effective Trenbolone options obtainable available on the market right now.

Nevertheless, this prescription drug has serious unwanted side effects, and long-term prednisone users are susceptible to a weakened immune function, osteoporosis, high blood pressure,

and significant weight gain. It is free of side effects, but mimics Trenbolone

in its slicing and bulking talents. It aids in nitrogen retention, which is

essential for packing on muscle mass. It additionally raises pink

blood cell counts similarly to Trenbolone, and does not trigger water retention. When used as part of a weight coaching program, most users expertise features in muscle mass as

properly as elevated stamina, without the harmful side effects of Dianabol.

The bottom line is that the majority males want to see prompt outcomes, and most usually are not prepared to do

what it takes to gain real muscle development. The final cycle

or stack accommodates six merchandise and is perfect for accelerating muscle progress.

This protected anabolic product guarantees turbocharged metabolism, which in easy words imply super-quick muscle growth.

Anadrole is available in many dosages, but the standard

for no antagonistic unwanted effects is 50mg per tablet, a minimal of, to build

muscle mass effectively. Lastly, bone density is definitely increased

too, making HBULK as the most effective Somatropin alternative for energy athletes such as powerlifters, along with

bodybuilders. The androgen receptors are situated in both the muscle and fats cells,

with androgens reacting right on the receptors in fat cells to affect the physique fat burning course of.

The localized inflammation causes healing cells to reach

at the injured space and lay down new tissue, creating stronger ligaments and rebuilding delicate tissue.

As the ligaments tighten and the soft tissues heal, the knee constructions

function usually somewhat than subluxing and moving misplaced.

At Caring Medical, our option is to repair the joint or spine

by rebuilding and repairing broken tissue with regenerative injections.

As such, testosterone is often the foundation of any steroid cycle.

Bodybuilders and athletes will typically stack different anabolic steroids,

most of which don’t naturally happen in the physique, with testosterone for even higher effects.

While these medical interventions should contain some stage of invasiveness, they will offer an various to the repeated use of cortisone injections

for individuals in search of long-term pain reduction. Topical remedies, or “topicals,”

for eczema are medications, together with creams, gels and foams, that are applied to the skin to handle signs and scale back irritation. Prescription topicals require a prescription from a

physician (as opposed to over-the-counter products you should buy and not using a prescription).

Now, I all the time stress to my clients that

no supplement is without risks, and Testol 140

is no exception. Nonetheless, in comparability with conventional anabolic steroids, the aspect impact profile is way milder.

Most users report minimal to no testosterone suppression, which means

easier post-cycle restoration. What sets Testo Prime apart

is its clinically-backed ingredient profile.

We’re talking about heavy hitters like D-Aspartic Acid, which may boost luteinizing hormone

production by as a lot as 45%, resulting in increased testosterone ranges.

guaranteed accounts https://social-accounts-marketplace.org

buy account account buying service

secure account purchasing platform https://buy-accounts.live/

buy facebook accounts for ads https://ad-account-buy.top

buy aged facebook ads accounts buy fb ads account

buy google ads verified account buy verified google ads account

facebook business manager buy buy business manager account

unlimited bm facebook facebook business manager buy

tiktok ads account buy https://tiktok-ads-account-buy.org

70918248

References:

what’s a steroid – Son –

tiktok ad accounts https://buy-tiktok-business-account.org

buy tiktok business account https://buy-tiktok-ads.org

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Reading your article helped me a lot and I agree with you. But I still have some doubts, can you clarify for me? I’ll keep an eye out for your answers.