“What’s the Deal with 1031 Exchanges in Education? If you’re curious about this topic, you’ve come to the right place! Let’s dig in and uncover all the fascinating details about 1031 exchanges and how they relate to education.”

“Now, you might be wondering, what exactly is a 1031 exchange? Well, imagine being able to swap one investment property for another without having to pay taxes on the capital gains. Pretty cool, right?”

“Well, as it turns out, 1031 exchanges can also be used in the realm of education. And this opens up a world of possibilities for educators, institutions, and individuals looking to invest in education-related properties. So, buckle up and get ready to explore the intriguing world of 1031 exchanges in education!”

Contents

- What’s the Deal with 1031 Exchanges in Education?

- Understanding 1031 Exchanges

- The Benefits of 1031 Exchanges in Education

- Tips for Maximizing the Benefits of 1031 Exchanges in Education

- Key Takeaways – What’s the Deal with 1031 Exchanges in Education?

- Frequently Asked Questions

- 1. How do 1031 exchanges work in education?

- 2. Are there any limitations to 1031 exchanges in education?

- 3. What are the potential benefits of 1031 exchanges in education?

- 4. Are there any risks or challenges associated with 1031 exchanges in education?

- 5. How can educational institutions get started with 1031 exchanges?

- Summary

What’s the Deal with 1031 Exchanges in Education?

As the cost of education continues to rise, many individuals and families find themselves looking for ways to make the most of their educational investments. One strategy that has gained popularity is the use of 1031 exchanges. In this article, we’ll explore what a 1031 exchange is, how it can be used in the context of education, and some tips for maximizing its benefits. Whether you’re a student, parent, or education professional, understanding the potential advantages of 1031 exchanges can help you make informed decisions about your educational investments.

Understanding 1031 Exchanges

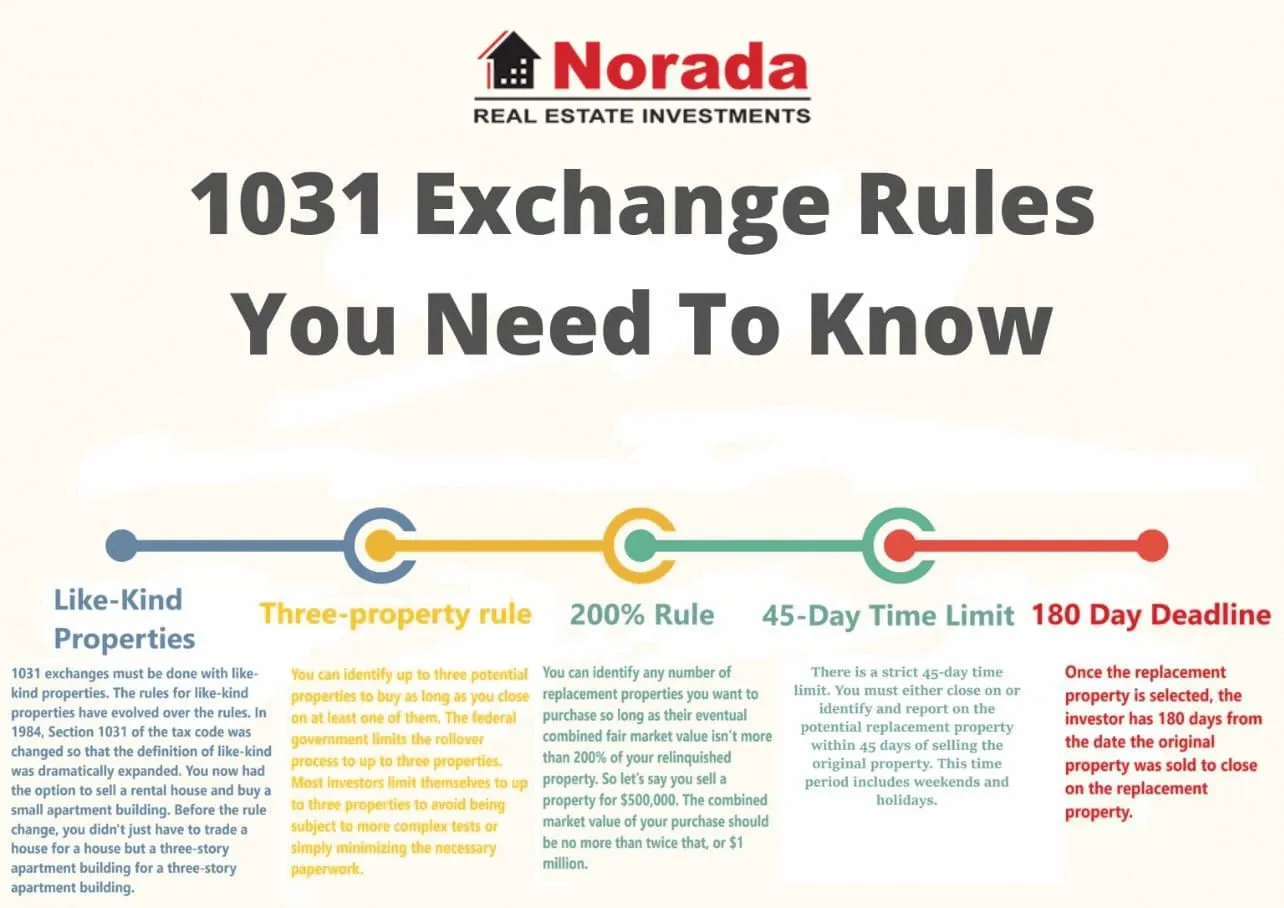

A 1031 exchange, also known as a like-kind exchange or a tax-deferred exchange, is a provision in the United States Internal Revenue Code that allows individuals to defer capital gains taxes on the sale of certain types of property. Typically, when you sell an asset or property and make a profit, you’re required to pay capital gains taxes on that profit. However, with a 1031 exchange, you can defer those taxes if you reinvest the proceeds from the sale into a similar type of property within a certain timeframe.

While 1031 exchanges are commonly associated with real estate transactions, they can also be used in other contexts, including education. By strategically utilizing a 1031 exchange, individuals can potentially save money on taxes and redirect those funds towards educational expenses. Let’s explore some ways in which 1031 exchanges can be beneficial in the field of education.

1. Utilizing 1031 Exchanges for College Savings

With the ever-increasing costs of higher education, many families start saving for college early on. By utilizing a 1031 exchange, parents can potentially grow their college savings by deferring taxes on investments. For example, if a family has invested in a rental property and decides to sell it to fund their child’s college education, they can utilize a 1031 exchange to reinvest the proceeds into another rental property or a property specifically designed for student housing. By deferring the capital gains taxes, the family can keep more of their funds invested in the education of their child.

It’s important to note that while 1031 exchanges can provide tax advantages, there are specific rules and timelines that must be followed. Working with a qualified tax advisor or real estate professional knowledgeable in 1031 exchanges is crucial to ensure compliance and maximize the benefits.

2. Investing in Education-Related Properties

1031 exchanges can also be used by educational institutions or individuals involved in the education industry to strategically invest in properties that support their educational goals. For example, a university might utilize a 1031 exchange to sell a non-performing property and reinvest the proceeds into a property that can generate rental income to support scholarships or other educational programs. By taking advantage of the tax deferral provided by the 1031 exchange, the institution can allocate more resources towards their educational mission.

Individuals involved in the education industry, such as educators or administrators, can also utilize 1031 exchanges to invest in properties that can generate additional income. By deferring taxes on the sale of a property, educators can potentially redirect those funds into income-generating properties, such as rental properties or properties used for educational purposes, and supplement their income.

3. Planning for Continuing Education or Career Transitions

Another way in which 1031 exchanges can benefit individuals in the education sector is by providing flexibility and financial resources for continuing education or career transitions. For example, if a teacher or professor decides to pursue a higher degree or career change, they may need to liquidate assets to fund their educational endeavors or bridge the financial gap during the transition period. By utilizing a 1031 exchange, they can sell their current property and reinvest the proceeds into a property that provides rental income or is specifically designed for student housing. This allows them to defer taxes, retain more funds for their educational pursuits, and potentially generate income to support their lifestyle during the transition.

In summary, 1031 exchanges can be a valuable tool for individuals and institutions in the education sector. From college savings to strategic property investments and career transitions, understanding the potential benefits of 1031 exchanges can help maximize educational investments. As always, consult with professionals in the field to ensure compliance with tax regulations and make informed decisions based on your specific circumstances and goals.

The Benefits of 1031 Exchanges in Education

When it comes to education, financial planning plays a crucial role. The rising costs of tuition, housing, and other educational expenses can put a strain on individuals and families. However, utilizing 1031 exchanges can provide several benefits in the context of education:

Tips for Maximizing the Benefits of 1031 Exchanges in Education

While 1031 exchanges can provide significant advantages in terms of tax deferral and financial flexibility, it’s important to approach them strategically. Here are some tips to help you maximize the benefits of 1031 exchanges in education:

Key Takeaways – What’s the Deal with 1031 Exchanges in Education?

- 1031 exchanges in education refer to a tax-deferred exchange of certain properties used for educational purposes.

- This allows educational institutions to sell a property and reinvest the proceeds into another property, without paying immediate taxes on the capital gains.

- It helps schools and universities to upgrade facilities, expand campuses, or invest in new educational properties.

- These exchanges are subject to strict rules and regulations defined by the Internal Revenue Service (IRS).

- Proper planning and professional guidance are crucial to ensure compliance and maximize the benefits of 1031 exchanges in education.

Frequently Asked Questions

Welcome to our frequently asked questions section about 1031 exchanges in education. Here, we will provide you with information and answers on this topic to help you better understand how these exchanges work in an educational setting.

1. How do 1031 exchanges work in education?

A 1031 exchange, also known as a like-kind exchange, is a provision in the tax code that allows individuals or businesses to defer paying taxes on the capital gains from the sale of certain assets if they reinvest the proceeds into similar assets. In education, this typically applies to the exchange of real estate properties, such as school buildings or campuses.

For example, let’s say a university wants to sell an old campus and purchase a new one. By engaging in a 1031 exchange, they can defer paying taxes on the capital gains from the sale as long as they reinvest the proceeds into a new property of equal or greater value. This allows educational institutions to upgrade their facilities without facing immediate tax consequences.

2. Are there any limitations to 1031 exchanges in education?

While 1031 exchanges can be beneficial in educational settings, there are some limitations to consider. Firstly, the properties involved in the exchange must be of “like-kind,” meaning they are of a similar nature or character. Additionally, the exchange must be completed within a certain timeframe, typically within 180 days of selling the original property.

Furthermore, it’s important to note that not all educational institutions are eligible for 1031 exchanges. Generally, only tax-exempt organizations such as schools, colleges, and universities can take advantage of this tax provision. It is always advisable to consult with a qualified tax professional to ensure eligibility and compliance with IRS regulations.

3. What are the potential benefits of 1031 exchanges in education?

The main benefit of engaging in a 1031 exchange in education is the ability to defer paying taxes on capital gains. This can provide educational institutions with more capital for reinvestment into their facilities, allowing them to improve the learning environment for their students.

Additionally, 1031 exchanges can enhance a school’s financial position by allowing them to acquire a more suitable property or consolidate multiple campuses into a single location. This can lead to increased operational efficiency, reduced maintenance costs, and a better overall educational experience for students and faculty.

4. Are there any risks or challenges associated with 1031 exchanges in education?

Like any financial transaction, there are risks and challenges associated with 1031 exchanges in education. One challenge is finding a suitable replacement property within the specified timeframe. This requires careful planning and coordination to ensure a smooth transition between properties.

Additionally, if the replacement property is of higher value than the original property, there may be additional financing requirements or cash contributions. Educational institutions must also be mindful of the potential tax consequences if they sell the property in the future without engaging in another 1031 exchange.

5. How can educational institutions get started with 1031 exchanges?

If your educational institution is considering a 1031 exchange, it’s crucial to seek guidance from a professional who specializes in tax and real estate matters. They can help you navigate the complexities of the process, ensure compliance with IRS regulations, and maximize the benefits of the exchange.

It’s also important to thoroughly analyze your institution’s needs and objectives to determine whether a 1031 exchange is the right strategy. Consider consulting with your board of directors, financial advisors, and legal experts to make an informed decision and develop a comprehensive plan for executing the exchange successfully.

Summary

So, here’s the deal with 1031 exchanges in education. Basically, it’s a way for schools to swap properties without paying taxes. These exchanges can help schools save money and improve their facilities. However, there are some rules and limitations to follow. For example, the properties must be of a similar type and purpose, and the exchange has to be completed within a certain timeframe. Overall, 1031 exchanges can be a helpful tool for schools to upgrade their facilities and provide better learning environments for students.

This is not, however, always the case priligy medicine No history of invasive breast cancer or DCIS

Itss suych aas youu read my thoughts! Youu appear too understand a lot

abou this, llike you wrote thee guiide in it orr something.

I feel that yyou jus could do with a feew p.c.

tto pressure thee mesage houze a bit, but othedr tha that, this is magnificnt blog.

A greeat read. I’ll defiinitely be back.

Your article helped me a lot, is there any more related content? Thanks!

The examine found that blood was aspirated, indicating a vein was pierced by the needle;

nonetheless, the consumer continued to inject. Inside one minute, shortness of breath was skilled as a outcome of oil in the bloodstream.

3ml or 3cc, or 5ml/5cc are the most typical syringe sizes or capacities.

Another of CrazyBulk’s utterly pure product, TRENOROL is usually employed in the treatment of arthritis

and other signs because of inflammations. In quick, D-BAL presents

an anabolic action without inflicting estrogenic stimulation (one of the causes of

gynecomastia) or different undesired effects such as impotence

and erectile dysfunction. Natural steroids are very simple to make use

of (the overwhelming majority are taken by mouth) and may be bought without a medical recipe.

Legal steroid stacks offer an efficient means for individuals to achieve their desired health objectives extra efficiently.

DecaDuro is a legal steroid that gives an ideal solution for people who need significant muscle positive aspects.

This complement is a safer and authorized alternative to nandrolone that improves protein synthesis and nitrogen retention. Unlike

its unlawful counterpart, DecaDuro has been proven to supply people with

quicker recovery times while decreasing joint ache and irritation that usually occurs after strenuous workouts.

Particularly, scientists could pinpoint several varieties of metabolites to monitor – sulfate

conjugates rather than the beforehand used glucuronide metabolites.

There could be plenty of misunderstanding about how

drug testing for steroids and performance-enhancing drugs

works. Many assume it’s a easy matter of supplying a urine (or blood)

pattern, having the sample sent to a lab, and being put by way of a

machine that magically detects every substance.

Fortuitously for athletes and bodybuilders, however not so fortuitously for

anti-doping authorities, it’s removed from such a simple and

fundamental process. To put your self in the most effective place to avoid touchdown in hassle should you intend to use

steroids and enter any competitive occasions,

understanding the basics of how steroid drug testing works

is vital. This also consists of being aware of all the principle components that

can have an effect on the detection occasions of anabolic steroids

as a end result of these may be surprisingly long and nicely past what you may anticipate.

We thought of safety ratings based on effects on ldl

cholesterol, hair loss, and overall side effects. This reduces the possibility of estrogen-related unwanted aspect effects, making

them safer. Anavar is commonly cited as the safest oral steroid due to its gentle profile.

In Accordance to the makers of the Bulking Stack and

its critiques, Tren and Deca act as great pre-workouts to help heat up and

improve workout performance among its customers.

We scrutinized the dosage of each ingredient to ensure it is safe and potent.

Only dietary supplements with efficient ingredient quantities had been really helpful.

The addition of black pepper extract to assist in absorption ensures you get essentially the

most out of the authorized and natural ingredients.

Many of my shoppers who have tried Testo-Max have reported noticeable variations

in their T-levels, intercourse drive, muscle energy, and energy after using it for a couple of weeks.

In many circumstances, using the substance can nonetheless

be detected in hint amounts of the remaining metabolites long after the

compound has exceeded its lively life within the

body. So, whereas a steroid will not be providing you with any performance benefits, it could still

be detected in a drug take a look at many weeks and even months

later.

D-Bal Max boosts testosterone manufacturing

and improves metabolism, both of those enhancements accelerate the muscle-building course of.

Free testosterone and anabolic testosterone

have a significant danger of damaging the liver and different inside organs.

Tetstomax manages to realize similar results with out causing any harm.

A natural progress hormone like HGH-X2 can help restore tissue injury,

and metabolism and strengthen bones.

If you are additionally confused among so many choices and wish some help, you’re in the best place.

In conclusion, the fee and assure of authorized steroid stacks differ relying on the model and

product. It is crucial to weigh these factors along with the effectiveness and safety of a stack before

making a buy order. By comparing costs and ensures, customers can choose the best legal steroid stack that

suits their needs and finances whereas guaranteeing they are investing in a reliable and results-driven product.

When considering legal steroid stacks, it’s essential to compare not solely the effectiveness but

in addition the costs and ensures of the merchandise. Most of the highest legal steroid stacks can be found in various worth ranges, accompanied by reassuring money-back guarantees.

Authorized steroids are claimed to be a safer, legal different to

traditional anabolic steroids. Made with pure components,

they could help you build muscle, improve strength, and improve performance with out dangerous unwanted effects.

Anadrole is a legal steroid complement manufactured by CrazyBulk that claims to spice

up power ranges, enhance muscle mass, and improve general bodily and sexual performance.

It is marketed as a secure and pure alternative to the oral anabolic steroid Anadrole.

It helps muscle tissue develop larger and stronger rapidly with out the harmful results

of anabolic steroids.

If you’re serious about performance-enhancing medicine,

you could be considering of the anabolic steroids.

In this evaluate, we’ll have a glance at the best authorized various versions of the banned steroids.

This way will most likely be easier so that you can resolve on the one that can finest assist

you to reach your health goals.

References:

JBH News

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

70918248

References:

bodybuilding testosteron kaufen (direct-jobs.eu)

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.