Are there any restrictions on a 1031 exchange? Well, let’s dive into the fascinating world of real estate and find out! If you’re wondering what a 1031 exchange is, it’s a handy tool that allows property owners to defer capital gains taxes when they sell one investment property and use the proceeds to purchase another. But, like most things in life, there are some restrictions to keep in mind.

First off, the property you sell and the one you purchase must be “like-kind,” which means they need to be of the same nature or character. So, you can’t swap your office building for a vacation home in Hawaii and expect to qualify for a 1031 exchange. They must both be used for investment or business purposes.

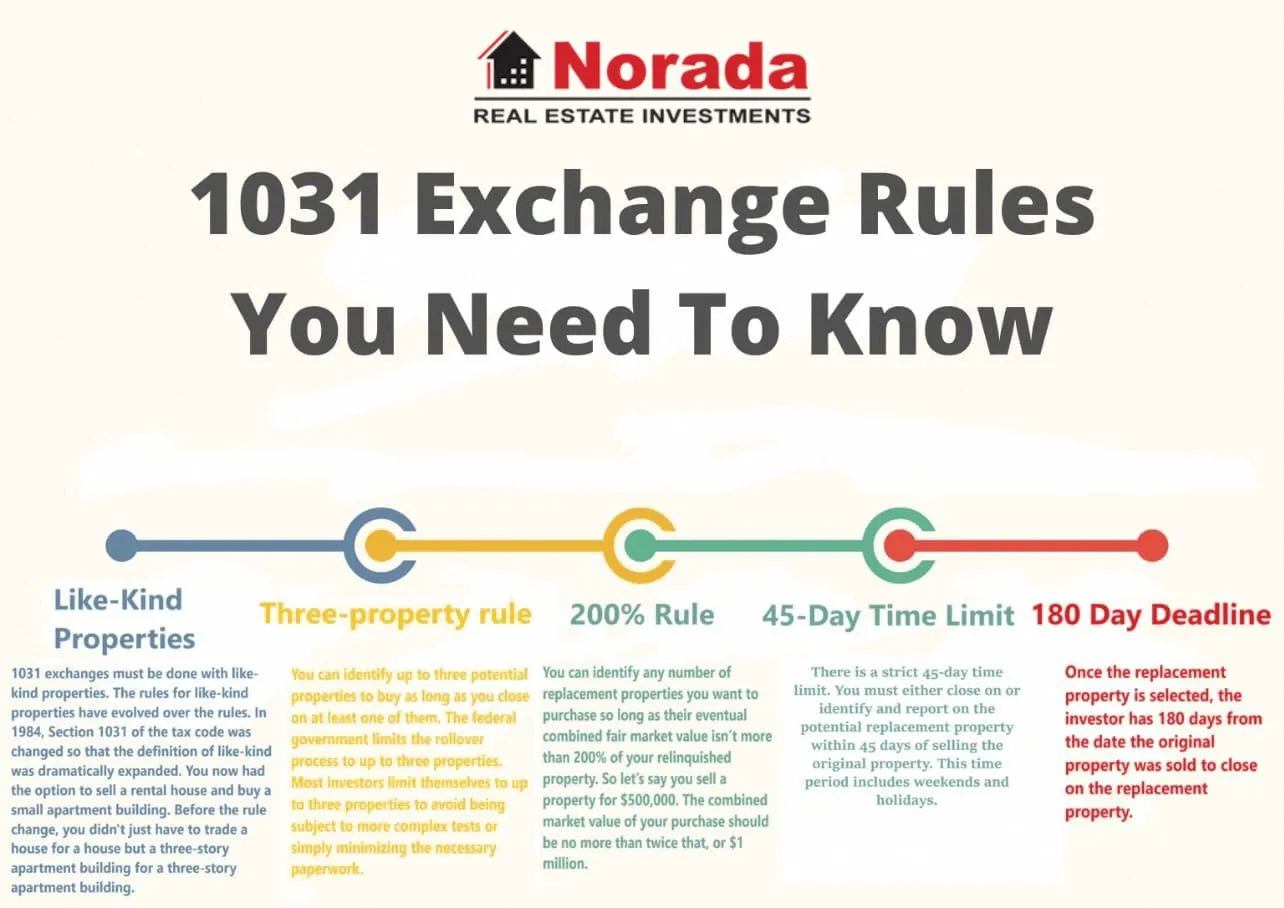

Secondly, there are strict timeframes to follow. You need to identify a replacement property within 45 days of selling your current one, and you must complete the purchase within 180 days. These deadlines are no joke, so it’s essential to work with professionals who can help you navigate the process.

Lastly, remember that a 1031 exchange is not an unlimited tax loophole. While you can defer taxes on your capital gains, they’re not completely forgiven. If you eventually sell the replacement property without doing another 1031 exchange, the taxes will become due. So, it’s like hitting the snooze button on your tax bill rather than avoiding it altogether.

Now that you have a general idea of the restrictions on a 1031 exchange, let’s explore further and learn more about this intriguing concept!

Contents

- Are There Any Restrictions on a 1031 Exchange?

- Benefits of a 1031 Exchange

- Tips for a Successful 1031 Exchange

- Main Topic: Additional Information on 1031 Exchanges

- 1031 Exchange Vs. Other Tax-Deferred Strategies

- Key Takeaways: Are there any restrictions on a 1031 exchange?

- Frequently Asked Questions

- 1. Can I exchange any type of property in a 1031 exchange?

- 2. Is there a deadline for completing a 1031 exchange?

- 3. Are there any restrictions on the value of the replacement property?

- 4. Can I do a 1031 exchange if I have a mortgage on my relinquished property?

- 5. Can I use a 1031 exchange for international properties?

- Summary

Are There Any Restrictions on a 1031 Exchange?

A 1031 exchange is a valuable tax-deferral strategy used by many real estate investors. It allows them to defer paying capital gains taxes on the sale of investment property if they reinvest the proceeds into a like-kind property. However, there are certain restrictions that investors must be aware of when considering a 1031 exchange. Understanding these restrictions is crucial to successfully navigate the process and maximize the benefits of a 1031 exchange.

The 45-Day Identification Period

One of the key restrictions on a 1031 exchange is the 45-day identification period. After selling their property, investors have 45 calendar days to identify potential replacement properties in writing to the Qualified Intermediary (QI). The identification must be specific and meet certain criteria, such as providing a legal description or street address. Failure to meet this deadline or to adhere to the identification requirements can result in disqualification of the exchange.

During this period, investors must carefully evaluate different properties and determine their suitability for the exchange. It is essential to thoroughly research potential replacement properties and seek professional advice to ensure compliance with the identification rules. This restriction emphasizes the importance of proper planning and preparation in a 1031 exchange.

Furthermore, it’s important to note that the identification must be made in writing and delivered to the QI. Electronic communication, such as email, is commonly used for this purpose. It is advisable to maintain proper documentation and keep copies of all communication related to the identification to avoid any potential disputes or challenges in the future.

The 180-Day Exchange Period

Another significant restriction on a 1031 exchange is the 180-day exchange period. This period starts on the date of the sale of the relinquished property and ends after 180 calendar days. Within this timeframe, the investor must acquire the replacement property and complete the exchange.

It is important to note that the 45-day identification period falls within the 180-day exchange period. This means that investors must not only identify suitable replacement properties but also close on the purchase of one or more of those properties within the specified timeframe. Failure to meet this requirement can lead to the disqualification of the exchange and the potential realization of capital gains taxes.

Investors should carefully plan and coordinate with all parties involved, such as lenders, real estate agents, and legal professionals, to ensure a smooth and timely transition. Prompt action and proper due diligence are essential to completing the exchange within the 180-day period.

Timing Restrictions and Holding Period

In addition to the 45-day identification period and the 180-day exchange period, there are other timing restrictions to be aware of in a 1031 exchange. These include the requirement to close on the replacement property within 180 days and the requirement to hold the replacement property for a minimum of two years as rental property or for investment purposes.

If the replacement property is not held for the required holding period, it may be subject to recapture of the deferred taxes. This can be a complex issue, and investors should consult with tax professionals to ensure compliance with these timing restrictions to preserve the tax-deferred status of the exchange.

Additionally, there are certain restrictions on using a 1031 exchange for personal use property or property that is primarily held for sale. These types of properties generally do not qualify for a 1031 exchange and may result in disqualification and taxation.

Limited Like-Kind Property Definition

While a 1031 exchange allows for the exchange of like-kind properties, it is important to note that the definition of like-kind is limited. For real estate exchanges, the properties must be held for investment or business purposes to qualify. Personal use properties, such as a primary residence or vacation home, do not typically qualify for a 1031 exchange.

Additionally, there are restrictions on exchanging foreign real estate or non-real estate assets through a 1031 exchange. The properties involved in the exchange must be located within the United States. Non-real estate assets, such as equipment or vehicles, also do not qualify for a 1031 exchange.

It is crucial to carefully review the eligibility criteria and seek professional advice when considering a 1031 exchange to ensure compliance with the limited like-kind property definition.

Other Restrictions and Considerations

There are other restrictions and considerations to keep in mind when planning a 1031 exchange. These include:

- Exclusion of personal property: Personal property typically does not qualify for a 1031 exchange. However, if personal property is incidental to the real estate being exchanged, it may be included in the exchange.

- Qualified Intermediary requirement: In a 1031 exchange, a Qualified Intermediary (QI) must be used to facilitate the transaction. The QI holds the funds from the sale of the relinquished property and ensures compliance with the exchange requirements.

- Reporting requirements: The IRS requires reporting of 1031 exchanges on tax returns. Proper documentation and reporting are essential to support the tax-deferred treatment of the exchange.

- State restrictions: Some states may have additional restrictions or limitations on 1031 exchanges. It is important to consult with local tax professionals to understand the specific requirements in your state.

Understanding and adhering to these restrictions and considerations is crucial for a successful 1031 exchange. Proper planning, due diligence, and professional guidance are key to navigating the complexities of a 1031 exchange and maximizing its benefits.

Benefits of a 1031 Exchange

While there are certain restrictions and considerations to be aware of, a 1031 exchange offers numerous benefits for real estate investors. Some of the key benefits include:

Tax Deferral

One of the most significant benefits of a 1031 exchange is the ability to defer payment of capital gains taxes. By reinvesting the proceeds from the sale of an investment property into a like-kind property, investors can defer paying taxes until a future date. This allows them to keep more money working for them in the form of increased purchasing power and potential appreciation.

The tax deferral provided by a 1031 exchange can result in significant savings over time, especially for investors who consistently reinvest in qualified properties. By continually deferring taxes, investors can enjoy the compounding benefits of their investment without the burden of immediate tax payments.

Portfolio Diversification

Another advantage of a 1031 exchange is the opportunity for portfolio diversification. By exchanging one property for another, investors can explore new markets, asset classes, and investment strategies. This allows for the spread of risk and the potential to capitalize on emerging trends or favorable market conditions.

Portfolio diversification is essential for long-term financial success and wealth preservation. A 1031 exchange provides investors with the flexibility to adapt their portfolios to changing market dynamics and pursue new investment opportunities.

Potential for Increased Cash Flow

Investing in a like-kind property through a 1031 exchange can potentially result in increased cash flow. By strategically selecting a replacement property with higher rental income or the potential for rental growth, investors can generate a more substantial stream of passive income.

The increased cash flow from the replacement property can enhance an investor’s financial position and provide additional stability and financial flexibility. It can also support future acquisitions and contribute to long-term wealth building.

Wealth Preservation

A 1031 exchange is a powerful tool for wealth preservation. By deferring taxes and strategically reinvesting in qualified properties, investors can preserve and grow their wealth over time. The ability to continuously defer taxes through successive exchanges can significantly impact an investor’s net worth and overall financial success.

It is important to note that a 1031 exchange does not eliminate taxes entirely. It defers taxes until a future date when the investor decides to sell a property outside of a 1031 exchange. However, this deferral can provide numerous financial benefits and contribute to long-term wealth preservation strategies.

Tips for a Successful 1031 Exchange

Executing a successful 1031 exchange requires careful planning and attention to detail. Here are some tips to help ensure a smooth and successful exchange:

1. Start Early

It is essential to start the exchange process as early as possible. This allows for sufficient time to identify potential replacement properties, conduct due diligence, and coordinate with all parties involved. Starting early ensures that all necessary steps can be completed within the required timeframes.

2. Work with Experienced Professionals

Engaging the services of experienced professionals, such as qualified intermediaries, real estate agents, and tax advisors, is crucial for a successful 1031 exchange. These professionals can provide guidance, expertise, and support throughout the entire exchange process.

Choose professionals who have specific knowledge and experience in handling 1031 exchanges. Their expertise will help mitigate risks, ensure compliance with regulations, and maximize the benefits of the exchange.

3. Conduct Thorough Due Diligence

Thorough due diligence is critical when identifying potential replacement properties. Conducting property inspections, reviewing financial records, analyzing market trends, and considering future growth potential are all part of the due diligence process.

Investors should also consider the financing options and the impact on cash flow when evaluating potential replacement properties. It is essential to analyze the investment from various angles to make an informed decision.

4. Keep Accurate Records

Accurate record-keeping is essential for a 1031 exchange. Maintain detailed documentation of all communications, agreements, and transactions related to the exchange. This includes contracts, emails, receipts, and any other relevant information.

Proper record-keeping not only ensures compliance with reporting requirements but also provides a clear trail of the exchange process. Should any issues or disputes arise in the future, accurate records can help resolve them more efficiently.

5. Understand State-Specific Requirements

Each state may have specific requirements or limitations on 1031 exchanges. It is crucial to understand the regulations in the state where the relinquished and replacement properties are located.

Consult with local tax professionals or legal advisors to ensure compliance with any state-specific requirements. Being aware of these requirements from the beginning can help prevent potential complications or surprises during the exchange process.

6. Consider Additional Strategies

In addition to a straightforward 1031 exchange, there may be other strategies that can enhance the benefits of the exchange. These could include utilizing a Delaware Statutory Trust (DST), a Tenant-in-Common (TIC) ownership structure, or utilizing different ownership entities.

These strategies may offer additional benefits, such as diversification, professional management, or increased flexibility. It is advisable to consult with professionals who specialize in these strategies to determine if they are suitable for your specific situation.

Main Topic: Additional Information on 1031 Exchanges

1031 Exchange Vs. Other Tax-Deferred Strategies

Section 1031 Exchange vs. Section 121 Exclusion

A Section 1031 exchange and a Section 121 exclusion are both tax-deferred strategies, but they have different purposes and requirements.

A Section 121 exclusion allows homeowners to exclude up to $250,000 ($500,000 for married couples filing jointly) of capital gains from the sale of their primary residence if they meet certain eligibility criteria. This exclusion can only be used once every two years and requires the property to be the homeowner’s primary residence for at least two out of the last five years.

On the other hand, a Section 1031 exchange is specifically designed for investment or business properties. It allows investors to defer capital gains taxes by reinvesting the proceeds into a like-kind property. Unlike the Section 121 exclusion, there is no limit on the number of times a Section 1031 exchange can be utilized.

While both strategies offer tax benefits, it is important to understand the specific criteria and limitations of each when considering the most appropriate tax-deferral strategy for your situation.

1031 Exchange vs. Opportunity Zones

Opportunity Zones are designated economically distressed areas that offer tax incentives to investors through the Tax Cuts and Jobs Act of 2017.

Investors can utilize Opportunity Zones by reinvesting capital gains from the sale of any investment, not just real estate, into Qualified Opportunity Zone Funds (QOZFs). These funds invest in real estate or businesses located within Opportunity Zones and provide investors with potential tax benefits, such as deferred capital gains and potential additional tax savings upon the sale of the Opportunity Zone investment.

While Opportunity Zones provide an alternative tax-deferral strategy with potential additional benefits, they have different eligibility requirements and investment options compared to a 1031 exchange. Investors should carefully evaluate their goals, investment timeline, and risk tolerance to determine the most suitable strategy for their specific situation.

1031 Exchange vs. Installment Sale

In an installment sale, the investor sells their property and receives payments for the sale price over time, rather than receiving the full proceeds at once. This strategy allows for the recognition of the capital gains over the duration of the installment payments, potentially reducing the overall tax burden.

While an installment sale strategy provides a way to defer taxes on the capital gains, it differs from a 1031 exchange in several ways. For an installment sale, the property does not need to be like-kind, and the proceeds can be received over an extended period. However, the installment sale strategy does require the investor to finance the sale and assume the risk of receiving payments over time.

The choice between a 1031 exchange and an installment sale depends on various factors, including the investor’s short-term and long-term goals, financial situation, and risk tolerance.

Key Takeaways: Are there any restrictions on a 1031 exchange?

- Investment properties must be of like-kind, meaning they have similar characteristics.

- Both properties involved in the exchange must be held for investment or business purposes.

- There is a strict timeline of 45 days to identify replacement properties and 180 days to complete the exchange.

- Funds from the sale of the original property must be held by a qualified intermediary and cannot be touched by the taxpayer.

- Personal residences, stocks, and other non-real estate assets do not qualify for a 1031 exchange.

Frequently Asked Questions

Welcome to our frequently asked questions section regarding 1031 exchanges. Here, we’ll address some common concerns and provide you with valuable insights.

1. Can I exchange any type of property in a 1031 exchange?

In a 1031 exchange, not all types of property are eligible. The property being relinquished and the property being acquired must both be used for business or investment purposes. This means that personal use properties, such as your primary residence or a vacation home, do not qualify for a 1031 exchange. However, there is flexibility to exchange various types of business or investment properties, including commercial real estate, rental properties, and even certain types of land.

It’s important to consult with a qualified tax advisor or intermediary to ensure that the properties involved in your exchange meet the necessary criteria and comply with IRS regulations.

2. Is there a deadline for completing a 1031 exchange?

Yes, there are strict deadlines associated with a 1031 exchange. When you sell your relinquished property, you have 45 days to identify potential replacement properties that you intend to purchase. This identification must be done in writing and submitted to the qualified intermediary handling your exchange. In addition, you must close on the purchase of your replacement property within 180 days from the sale of your relinquished property.

It’s crucial to adhere to these deadlines to ensure the success of your 1031 exchange. Failure to meet these time constraints may result in disqualification from the tax benefits associated with a 1031 exchange.

3. Are there any restrictions on the value of the replacement property?

There are no specific limits on the value of the replacement property in a 1031 exchange. However, to fully defer your capital gains taxes, you must reinvest all of the proceeds from the sale of your relinquished property into the new property or properties. This means that the value of the replacement property should be equal to or greater than the value of the relinquished property.

If you choose to acquire a replacement property with a lower value, you will be required to pay taxes on the difference known as “boot.” It’s important to consult with a tax professional or intermediary to understand the tax implications and potential consequences of any boot received in your exchange.

4. Can I do a 1031 exchange if I have a mortgage on my relinquished property?

Yes, you can still pursue a 1031 exchange if you have a mortgage on your relinquished property. However, it’s important to remember that the debt on the replacement property must be equal to or greater than the debt on the relinquished property. If you choose to reduce the debt on the replacement property, you may be subject to taxes on the amount of debt reduction, commonly known as “mortgage boot.”

Additionally, it’s crucial to work with a qualified intermediary who can guide you through the process and ensure that all necessary requirements are met to comply with IRS regulations.

5. Can I use a 1031 exchange for international properties?

No, a 1031 exchange is limited to properties within the United States. The properties involved in the exchange must be located within the country’s borders. International properties do not qualify for deferring capital gains taxes through a 1031 exchange.

If you have international properties and are looking to pursue similar tax deferral strategies, it’s advisable to consult with a tax professional who specializes in international tax law to explore any available options in the respective jurisdiction.

Summary

So, to quickly wrap things up, a 1031 exchange is a way to defer taxes when selling property, as long as certain rules are followed. First, both the property being sold and the one being bought must be used for investment purposes. Second, you must identify a replacement property within 45 days of selling your original property. Third, the purchase of the replacement property must be completed within 180 days. Lastly, it’s important to consult with a qualified intermediary to handle the exchange process.

In addition to these rules, there are a few restrictions to keep in mind. You cannot exchange your primary residence or a property held primarily for personal use. Also, certain types of property, like stocks or bonds, do not qualify for a 1031 exchange. Remember to consult with a tax advisor for specific guidance on your situation.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.com/ES_la/register-person?ref=T7KCZASX

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.