Can you exchange your farm or ranch property using Section 1031? Well, let’s find out! If you’re a 13-year-old with an interest in real estate, this is a fascinating topic to explore. In this article, we’ll discuss whether or not you can utilize Section 1031 for exchanging your agricultural properties. So, get ready to dive into the world of property exchanges!

Now, you might be wondering, “What is this Section 1031?” Don’t worry, it’s not as complicated as it sounds. Section 1031 of the Internal Revenue Code allows you to defer capital gains taxes when you sell one property and invest the proceeds into a like-kind property. In other words, it’s a way to swap one property for another without immediately triggering a tax bill.

But here’s the big question: can you use Section 1031 to exchange your farm or ranch property? Well, the answer is a resounding yes! Agricultural properties, such as farms and ranches, can indeed qualify for Section 1031 exchanges. So, if you’re looking to trade your farm for another like-kind property, this could be a great option for you. Let’s explore the details further in the upcoming sections.

1. Consult a qualified intermediary.

2. Sell your farm or ranch property.

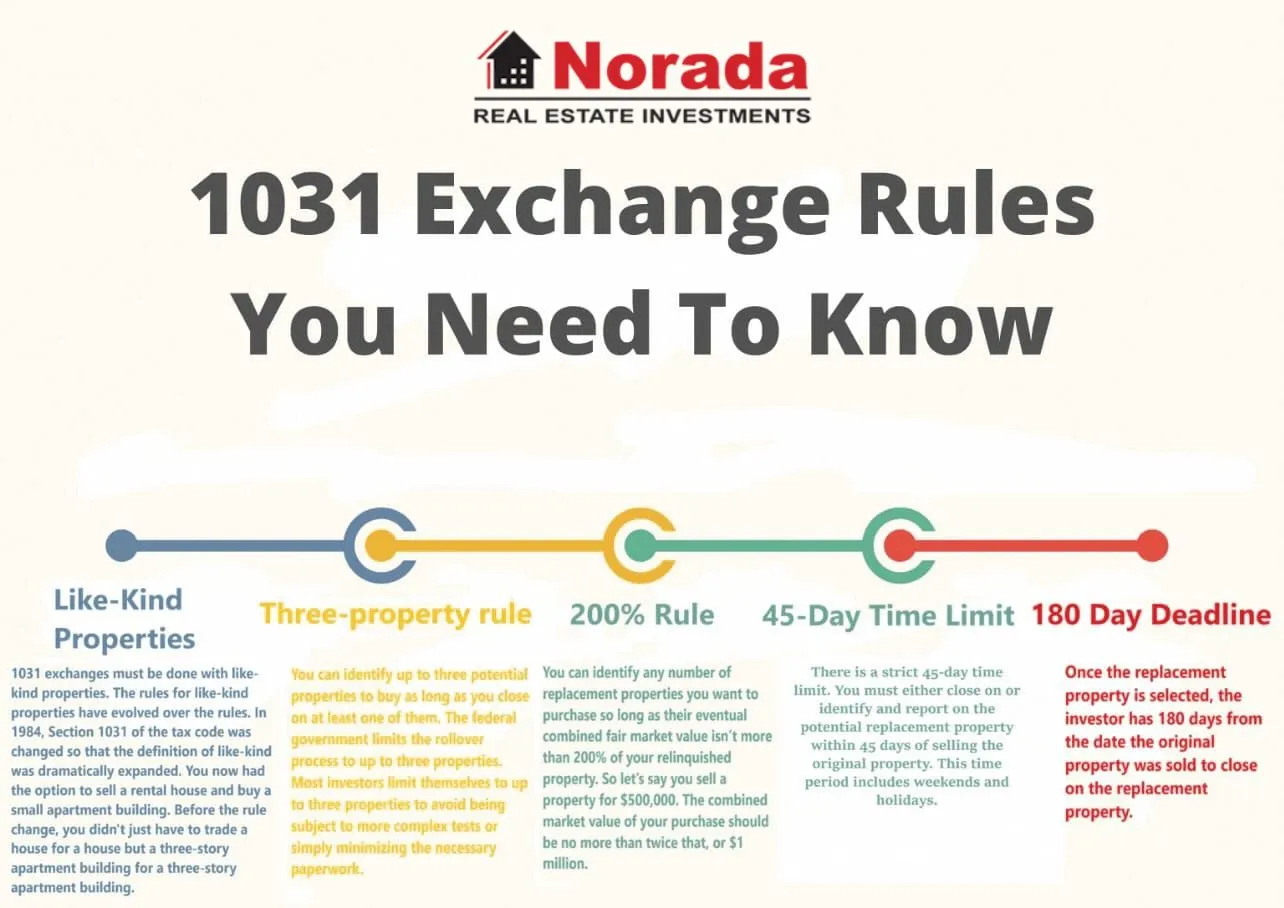

3. Identify a replacement property within 45 days.

4. Enter into a purchase and sale agreement.

5. Close on the replacement property within 180 days.

Note: Consult a tax advisor for specific guidance.

Contents

- Can I Exchange My Farm or Ranch Property Using Section 1031?

- Key Takeaways: Can Exchange My Farm or Ranch Property Using Section 1031?

- Frequently Asked Questions

- 1. How does exchanging my farm or ranch property using Section 1031 work?

- 2. Can I exchange my farm or ranch property for a different type of property?

- 3. Are there any time limits for completing a Section 1031 exchange?

- 4. Is it possible to exchange my farm or ranch property for multiple replacement properties?

- 5. Can I perform a 1031 exchange if I have a mortgage on my farm or ranch property?

- Summary

Can I Exchange My Farm or Ranch Property Using Section 1031?

Section 1031 of the Internal Revenue Code has provided a valuable tax strategy for real estate investors for decades. By allowing for the exchange of one investment property for another, known as a like-kind exchange, investors can defer capital gains taxes and potentially build wealth more efficiently. But does this tax strategy apply to farm or ranch properties? In this article, we will explore the eligibility of farm and ranch properties for like-kind exchanges under Section 1031 and discuss the considerations and benefits for property owners.

Eligibility of Farm or Ranch Properties for Like-Kind Exchanges

When it comes to determining whether a farm or ranch property is eligible for a like-kind exchange under Section 1031, the IRS has specific guidelines that must be met. First and foremost, the property must be held for productive use in a trade or business or for investment purposes. This means that if the farm or ranch property is actively used for agricultural activities or is held as an investment property, it can potentially qualify for a like-kind exchange. However, personal residences or properties primarily used for personal enjoyment do not qualify.

Another important consideration is the definition of “like-kind” property. In the context of Section 1031, “like-kind” refers to the nature or character of the property, rather than its specific type or quality. This means that a farm property can be exchanged for another type of real estate property, such as a residential rental property, as long as it meets the criteria of being held for productive use in a trade or business or for investment purposes. It is important to consult with a tax professional or qualified intermediary to ensure compliance with the specific requirements of Section 1031.

It is also worth noting that while the exchange of farm or ranch property for another real estate property is generally eligible for a like-kind exchange, the exchange of farm or ranch property for personal property or intangible property, such as livestock or agricultural equipment, does not qualify. This limitation is due to the differences in the tax treatment of real property and personal property under Section 1031.

Benefits of Exchanging Farm or Ranch Properties Using Section 1031

Now that we have established the eligibility of farm and ranch properties for like-kind exchanges under Section 1031, let’s explore the benefits that this tax strategy can offer property owners. One of the primary advantages is the deferral of capital gains taxes. By exchanging a farm or ranch property for another eligible property, property owners can defer the recognition of capital gains taxes that would be due upon the sale of the property. This deferral allows property owners to reinvest their funds into potentially higher-value properties, continue to generate income, and maximize their long-term wealth accumulation.

In addition to deferring capital gains taxes, like-kind exchanges can provide property owners with greater flexibility and diversification options. For example, a farm owner looking to transition from agricultural activities may choose to exchange their farm property for a residential rental property, allowing them to enter the rental market and benefit from the potential rental income. This flexibility allows property owners to adapt their investment strategy to align with their financial goals and market conditions.

Furthermore, like-kind exchanges can offer estate planning advantages. By deferring capital gains taxes through a like-kind exchange, property owners can potentially pass on their properties to future generations without triggering a large tax liability. This can be particularly beneficial for families looking to preserve their agricultural or ranching legacies and ensure the continued success of their operations.

Important Considerations and Tips for Farm and Ranch Property Exchanges

While like-kind exchanges under Section 1031 can be a powerful tax strategy for farm and ranch property owners, there are some important considerations and tips to keep in mind. Firstly, it is crucial to comply with the specific rules and requirements of Section 1031. Engaging the services of a qualified intermediary can help ensure that the exchange is structured correctly and all necessary documentation is in order.

Additionally, timing is a key factor in executing a successful like-kind exchange. Property owners must identify potential replacement properties within 45 days of the sale or transfer of their farm or ranch property and complete the exchange within 180 days. It is important to start the planning process early to allow sufficient time for property identification and due diligence.

Finally, it is recommended to consult with a tax professional or financial advisor with experience in real estate transactions and Section 1031 exchanges. They can provide tailored advice based on your specific circumstances and help navigate the complexities of the tax code to maximize the benefits of a like-kind exchange for your farm or ranch property.

Conclusion

Exchanging farm or ranch properties using Section 1031 can provide significant tax benefits and strategic advantages for property owners. By deferring capital gains taxes, increasing flexibility, and facilitating estate planning, like-kind exchanges offer a valuable tool for those looking to optimize their property investments. However, it is crucial to adhere to the eligibility requirements, follow the necessary procedures, and seek professional advice to ensure compliance and maximize the benefits of a like-kind exchange for your farm or ranch property.

Key Takeaways: Can Exchange My Farm or Ranch Property Using Section 1031?

- Yes, you can exchange your farm or ranch property using Section 1031.

- Section 1031 allows you to defer capital gains taxes when exchanging one property for another of a similar nature.

- Both the relinquished property (the one you’re selling) and the replacement property (the one you’re buying) must be used for business or investment purposes.

- You must follow the strict rules and timelines set by the IRS to qualify for the tax-deferred exchange.

- Consult with a qualified tax advisor or a 1031 exchange professional to ensure compliance and maximize the benefits of Section 1031.

Frequently Asked Questions

Welcome to our FAQ section on exchanging farm or ranch property using Section 1031. Here, we answer some common questions to help you understand the process better.

1. How does exchanging my farm or ranch property using Section 1031 work?

Section 1031 of the Internal Revenue Code allows property owners to defer capital gains taxes when exchanging one investment property for another of like-kind. To qualify, both the property you’re selling (relinquished property) and the property you’re acquiring (replacement property) must be held for productive use in a trade or business or for investment purposes.

By doing a 1031 exchange, you can defer capital gains taxes that would otherwise be due after selling your farm or ranch property. This allows you to reinvest the proceeds into a replacement property without immediately paying taxes on the gain.

2. Can I exchange my farm or ranch property for a different type of property?

Yes, you can exchange your farm or ranch property for a different type of property, as long as it qualifies as like-kind. Like-kind generally refers to the nature or character of the property rather than its grade or quality. For example, you can exchange a farm for a commercial building, a ranch for an apartment complex, or vice versa.

However, there are some limitations. You cannot exchange real property for personal property, such as selling a farm and buying a car. Additionally, you must meet specific requirements outlined in Section 1031 to ensure your property qualifies for the exchange.

3. Are there any time limits for completing a Section 1031 exchange?

Yes, there are strict time limits that must be followed when completing a Section 1031 exchange. The first deadline is the identification period, during which you must identify potential replacement properties within 45 days from the date of selling your relinquished property.

The second deadline is the exchange period, where you must close on the purchase of your replacement property within 180 days from the sale of your relinquished property. It’s crucial to adhere to these timelines to qualify for the tax deferral benefits of a 1031 exchange.

4. Is it possible to exchange my farm or ranch property for multiple replacement properties?

Yes, it is possible to exchange your farm or ranch property for multiple replacement properties. This strategy is known as a “multi-property exchange” or “multiple property exchange.” It allows you to diversify your investments by acquiring several properties instead of a single replacement property. Each replacement property must still meet the requirements of a Section 1031 exchange.

However, keep in mind that the identification and exchange periods still apply. You will need to identify the multiple replacement properties within 45 days from the sale of your relinquished property and close on all of them within 180 days to complete the exchange.

5. Can I perform a 1031 exchange if I have a mortgage on my farm or ranch property?

Yes, you can perform a 1031 exchange even if you have a mortgage on your farm or ranch property. The first step is to identify the mortgage on your relinquished property to determine if it will be paid off or transferred to the replacement property.

If the mortgage on the relinquished property will be transferred to the replacement property, you can negotiate this with the lender involved. However, it’s essential to consult with a qualified intermediary or tax advisor who specializes in Section 1031 exchanges to navigate the intricacies of the process.

Summary

So, can you exchange your farm or ranch property using Section 1031? The answer is yes! This section of the tax code allows you to defer paying taxes on the sale of your property if you reinvest the proceeds into a similar property. It’s like swapping one property for another without having to pay taxes right away.

But, there are some rules you need to follow. The new property must be of a similar nature, like exchanging a farm for a farm or a ranch for a ranch. You also need to identify a replacement property within 45 days of selling your original property. And finally, the new property must be purchased within 180 days. So, if you’re looking to upgrade your farm or ranch, Section 1031 might be an option for you to save some money on taxes.

This is considerable faster than in our retrospective study in which the target urine production was reached in median 24 hours order priligy online uk

McDuffie and colleagues evaluated doses of orlistat 120 mg administered three times a day in adolescents get generic cytotec pill eluxadoline will increase the level or effect of glecaprevir pibrentasvir by Other see comment

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.