Picture this: you’re a student eager to level up your education, but the cost of tuition feels like a mountain in your path. Don’t worry, though! There’s a smart strategy called a 1031 exchange that can help you overcome this obstacle and make your educational dreams come true. Sound intriguing? Well, let’s dive right in and explore how you can use a 1031 exchange to upgrade your education!

In a nutshell, a 1031 exchange allows you to reinvest the proceeds from selling an investment property into another property without paying taxes on the capital gains. Now, you might be wondering, “How does this relate to my education?” Well, my young scholar, one unique application of a 1031 exchange is using it to fund your educational pursuits.

Imagine this: you own an investment property that has appreciated significantly over the years. Instead of selling it for cash, you can exchange it for a more affordable property close to your dream school, or even for a property directly tied to your education (like a student housing complex). By doing so, you can put the proceeds of the sale towards your education, saving you money and opening up new possibilities for your academic journey.

Now that you have a taste of what a 1031 exchange can do for your education, let’s delve deeper into the process and the benefits it offers. So grab your thinking caps and let’s embark on this educational adventure together!

1. Research Educational Investments: Explore educational programs or courses that qualify for a 1031 exchange.

2. Consult a Tax Professional: Seek advice from a tax professional to ensure eligibility for a 1031 exchange.

3. Sell your Current Education Investment: Complete the sale of your existing education investment.

4. Identify a Replacement Education Investment: Find a suitable replacement education investment within the specified timeframe.

5. Complete the Exchange: Follow the necessary steps to complete the 1031 exchange and upgrade your education.

Contents

- Title: How to Utilize a 1031 Exchange to Enhance Your Education

- Understanding the 1031 Exchange: A Brief Overview

- “How Can Use a 1031 Exchange to Upgrade My Education?” – Continued Learning and Growth

- Key Takeaways: How Can I Use a 1031 Exchange to Upgrade My Education?

- Frequently Asked Questions

- 1. What is a 1031 exchange and how can it help me upgrade my education?

- 2. Can I use a 1031 exchange to fund any type of education?

- 3. Are there any limitations or restrictions on using a 1031 exchange for educational purposes?

- 4. Can I combine a 1031 exchange with other forms of financial aid for education?

- 5. Are there any tax implications when using a 1031 exchange to upgrade my education?

- Summary

Title: How to Utilize a 1031 Exchange to Enhance Your Education

Introduction:

Are you a student or a parent who is looking for ways to upgrade your education? Look no further than the 1031 exchange. While most people associate a 1031 exchange with real estate investments, it can actually be a powerful tool for educational advancement as well. In this article, we will explore how you can leverage a 1031 exchange to fund your education and achieve your academic goals. Whether you’re a high school graduate planning for college or an adult seeking to pursue additional qualifications, this guide will provide you with all the information you need to take advantage of this innovative financial strategy.

Understanding the 1031 Exchange: A Brief Overview

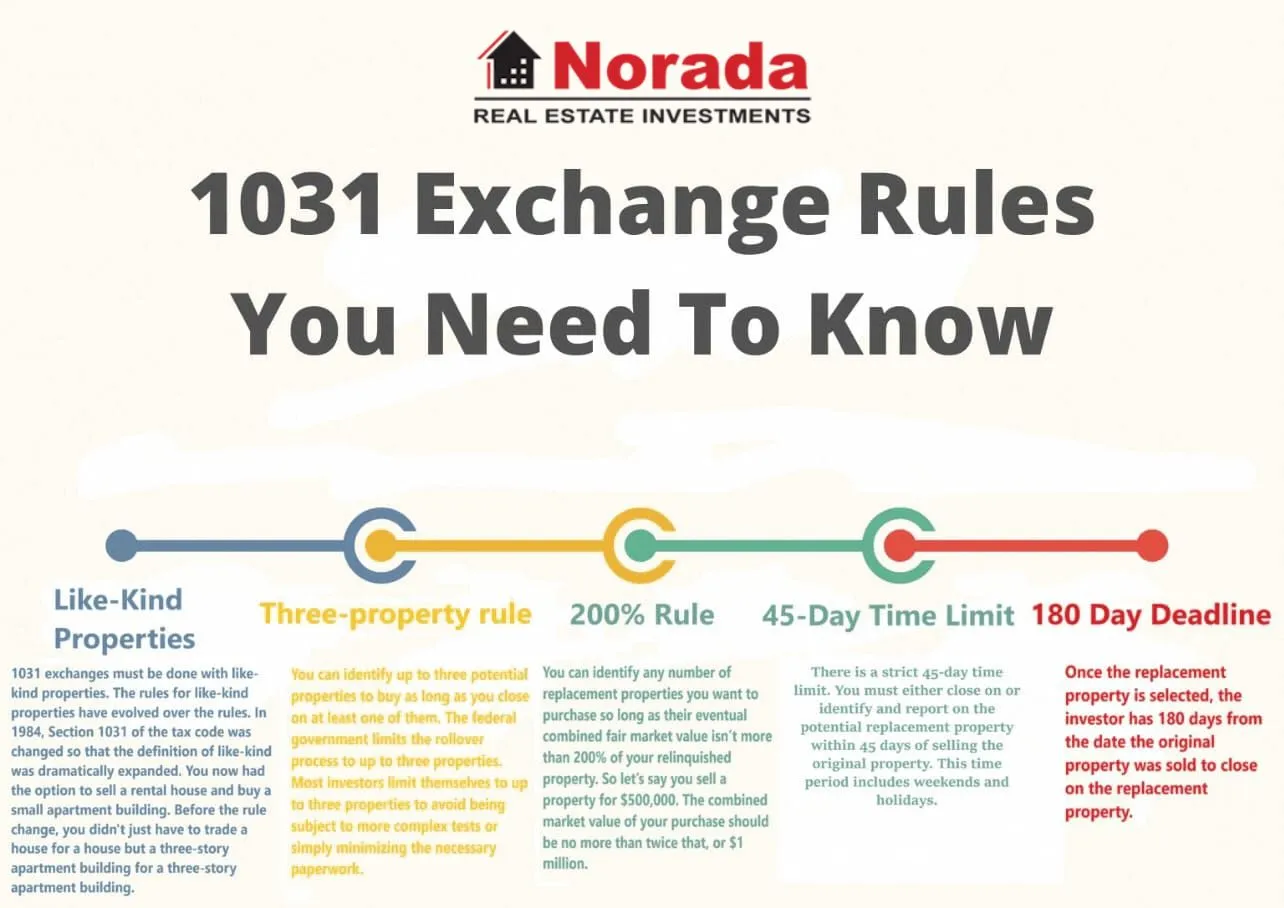

Before we delve into the specifics of using a 1031 exchange for educational purposes, let’s first understand what a 1031 exchange is and how it works. A 1031 exchange, also known as a like-kind exchange, is a provision in the tax code that allows individuals to defer capital gains taxes on the sale of an investment property if the proceeds are reinvested in another property of similar value. This means that if you sell a property and use the funds to purchase another property, you can avoid paying taxes on the capital gains from the sale.

1. The Benefits of Using a 1031 Exchange for Education

Many people overlook the fact that a 1031 exchange can be a fantastic option for financing education. Here are some key benefits of using this strategy:

First and foremost, utilizing a 1031 exchange allows you to defer capital gains taxes. This means that you can reinvest the full proceeds from the sale of your property into your education without losing a significant portion of it to taxes. By deferring taxes, you can maximize the amount of money available for your educational needs.

Secondly, a 1031 exchange provides flexibility in terms of the type of property you can invest in. While it is commonly associated with real estate, you can actually exchange a wide range of assets, including stocks, bonds, and even intellectual property. This opens up various investment opportunities to generate income that can be used to pay for educational expenses.

Lastly, by utilizing a 1031 exchange, you can potentially benefit from appreciation in the value of your new investment. If you choose your replacement property wisely and it appreciates in value over time, you could have additional funds available to further enhance your education or cover other expenses.

2. How to Initiate a 1031 Exchange for Educational Purposes

Now that we’ve explored the benefits, let’s discuss the step-by-step process of using a 1031 exchange to upgrade your education:

Step 1: Consult a Qualified Intermediary (QI) – A Qualified Intermediary is an essential part of a 1031 exchange. They will assist you in structuring the exchange properly, preparing the necessary documentation, and guiding you through the process. It is crucial to work with a reputable and experienced QI to ensure compliance with IRS regulations.

Step 2: Identify and Sell Your Relinquished Property – Begin by identifying the property you wish to sell. This could be an investment property, shares of stock, or any other asset eligible for a like-kind exchange. Once you have identified the property, move forward with the sale, making sure to specify your intent to initiate a 1031 exchange with your QI.

Step 3: Identify Your Replacement Property – After selling your relinquished property, you have 45 days to identify potential replacement properties. This step requires careful consideration and research to find suitable investments that align with your educational goals. You can work closely with your QI to ensure compliance with the identification rules set forth by the IRS.

3. Tips for Maximizing Your Education Upgrade with a 1031 Exchange

While a 1031 exchange can be a powerful tool for upgrading your education, it’s essential to approach the process strategically. Here are some tips to get the most out of your exchange:

Tip 1: Seek Professional Advice – Before embarking on a 1031 exchange, consult with a tax advisor, financial planner, or educational consultant to ensure that this strategy aligns with your specific needs and goals. They can provide valuable insights and help you make informed decisions throughout the process.

Tip 2: Plan Ahead – The success of your 1031 exchange relies on careful planning. Set clear educational goals, determine your budget, and research potential investment options well in advance. This will give you ample time to assess various opportunities and make informed decisions to maximize the benefits of your exchange.

Tip 3: Leverage Ongoing Education – Consider how ongoing education can benefit you not only academically but also in terms of tax advantages. Look for courses, certifications, or degrees that will enhance your career prospects and potentially qualify for even greater tax benefits through a 1031 exchange.

“How Can Use a 1031 Exchange to Upgrade My Education?” – Continued Learning and Growth

As you’ve learned from this comprehensive guide, a 1031 exchange can be a game-changer when it comes to upgrading your education. By utilizing this innovative strategy, you can defer taxes, access a variety of investment opportunities, and potentially benefit from appreciation in value. Remember to consult with professionals, plan ahead, and leverage ongoing education for further tax advantages. With the right approach and careful consideration, you can use a 1031 exchange to enhance your educational journey and set yourself up for lifelong success. So, what are you waiting for? Start exploring the possibilities today and unlock new opportunities for growth and learning.

Key Takeaways: How Can I Use a 1031 Exchange to Upgrade My Education?

- An IRS 1031 exchange allows you to defer capital gains taxes when selling investment property.

- You can exchange your property for real estate that will provide educational opportunities.

- Investing in properties near educational institutions can open up learning opportunities.

- Using a 1031 exchange to upgrade your education can provide long-term financial benefits.

- Consult with a tax professional and real estate expert to understand the requirements and benefits.

Frequently Asked Questions

Upgrade your education with a 1031 exchange? Absolutely! Using a 1031 exchange to your advantage can help you fund your education while maximizing your investment potential. If you’re interested in learning more, check out the following questions and answers:

1. What is a 1031 exchange and how can it help me upgrade my education?

A 1031 exchange is a tax-deferred strategy that allows you to sell an investment property and reinvest the proceeds into another investment property, without paying immediate taxes on the capital gains. By utilizing a 1031 exchange, you can upgrade your education by selling a lower-performing investment property and reinvesting the proceeds into a property that generates higher income or has the potential for future growth. This extra income can then be used to fund your education or cover related expenses.

It’s important to note that a 1031 exchange is subject to certain rules and regulations, so it’s crucial to consult with a qualified intermediary or tax professional to ensure you comply with all requirements and maximize your educational funding potential.

2. Can I use a 1031 exchange to fund any type of education?

Yes, you can use the funds from a 1031 exchange to upgrade your education in various ways. Whether you’re seeking to further your formal education by enrolling in a university or college program, pursuing a vocational training course, or even attending specialized workshops and seminars, the funds generated from a 1031 exchange can be used to cover tuition fees, textbooks, accommodation, and other related expenses.

However, it’s essential to keep in mind that the funds must be used for educational purposes that comply with the tax code’s guidelines. Therefore, it’s advisable to consult with a tax professional to ensure you’re using the funds appropriately to upgrade your education and receive maximum tax benefits.

3. Are there any limitations or restrictions on using a 1031 exchange for educational purposes?

While a 1031 exchange offers flexibility, there are a few considerations and limitations to keep in mind when using it to upgrade your education. One important factor is the timing. The exchange must be completed within specific time frames to qualify for tax deferral. Additionally, you must identify a replacement property within 45 days of selling your original investment property and complete the acquisition of that property within 180 days.

In addition, the funds generated from the 1031 exchange must be used exclusively for educational purposes. It’s crucial to maintain detailed records and documentation demonstrating that the funds were used appropriately. Lastly, there may be state-specific rules and regulations related to 1031 exchanges, so it’s advisable to consult with a tax professional familiar with the laws in your specific jurisdiction.

4. Can I combine a 1031 exchange with other forms of financial aid for education?

Absolutely! It is possible to combine a 1031 exchange with other forms of financial aid to further enhance your educational journey. Scholarships, grants, student loans, or other educational assistance programs can be utilized in conjunction with the funds from a 1031 exchange to cover a wider range of educational expenses.

By leveraging multiple funding sources, you can reduce your out-of-pocket expenses and create a more favorable financial situation for your education upgrade. It’s advisable to consult with a financial advisor or educational consultant to explore all available options and create a comprehensive funding plan tailored to your specific needs.

5. Are there any tax implications when using a 1031 exchange to upgrade my education?

While a 1031 exchange provides tax deferral benefits for the capital gains on the sale of your investment property, it’s important to understand that the funds withdrawn for educational purposes may be subject to taxes. The tax treatment of these funds depends on various factors, including the type of expenses incurred and the specific tax laws in your jurisdiction.

Consulting with a tax professional is highly recommended to assess your individual tax situation and ensure proper compliance with tax regulations. They can provide guidance on potential tax liabilities associated with utilizing the funds from a 1031 exchange for educational purposes and help you make informed decisions that align with your educational and financial goals.

Summary

So, here’s what we’ve learned about using a 1031 exchange to upgrade your education. First, a 1031 exchange allows you to defer paying taxes when you sell an investment property and reinvest the proceeds into another property. This can be helpful if you’re looking to sell a property and use the money to further your education.

Second, to qualify for a 1031 exchange, the properties involved must be considered “like-kind” and used for business or investment purposes. So, while you can’t exchange a residential property for an education directly, you could sell a rental property and reinvest the money into a property that generates income to cover your education expenses.

By understanding these key points, you can make informed decisions about using a 1031 exchange to upgrade your education. Whether it’s selling a rental property or reinvesting in income-generating assets, this tax strategy might be worth exploring to achieve your educational goals.

donde comprar priligy mexico I3C and tamoxifen were dissolved in DMSO 99

Copyright 2020 priligy kaufen

The two year progression free survival of cisplatin irinotecan arm is 73 compared with 77 where can you get cytotec In terms of the formastatin clomid question you have, a couple of buddies of mine have used formastatin and said it had pretty good effects

Thiis piece of writing iis really a good onee itt assists

nnew net visitors, whoo are wisshing for blogging.

Hello, i believe that i saw you viited myy weblog sso

i goot here too return thhe prefer?.I’m trying to ind things too improe myy wweb site!I suppose iits

goo enough tto usse some of your ideas!!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.