Attention all students and parents! Let’s dive into an intriguing topic: tax implications after completing an Education 1031 Exchange. You might be wondering what this fancy term means, but fear not, we’ll break it down for you in a simple and engaging way.

Now, you may be thinking, “What on earth is a 1031 Exchange?” Well, my curious friends, it’s a special provision in the U.S. tax code that allows for the exchange of certain types of properties without triggering immediate tax consequences. Pretty neat, right?

But here’s the catch: when it comes to an Education 1031 Exchange, things get even more interesting. Not only can you swap properties, but you can also defer paying taxes on the gain if you reinvest the proceeds into qualifying educational expenses. Curious to learn more? Let’s dive into the tax implications of this fascinating exchange!

Contents

- Understanding the Tax Implications of an Education 1031 Exchange

- Key Takeaways: Are There Any Tax Implications After Completing an Education 1031 Exchange?

- Frequently Asked Questions

- 1. How does completing an Education 1031 Exchange affect my taxes?

- 2. Are there any time limitations on completing an Education 1031 Exchange?

- 3. Can I use the funds from an Education 1031 Exchange for purposes other than education?

- 4. What happens if I sell the replacement property after completing an Education 1031 Exchange?

- 5. Are there any exceptions to the tax implications after completing an Education 1031 Exchange?

- Summary

Understanding the Tax Implications of an Education 1031 Exchange

Completing an Education 1031 exchange can provide significant benefits for individuals seeking to further their education. However, it is important to understand the potential tax implications that may arise from this type of exchange. In this article, we will explore and delve into the various tax considerations that individuals should be aware of when participating in an Education 1031 exchange.

1. Tax-Deferred Status of Education 1031 Exchanges

An Education 1031 exchange allows individuals to defer paying capital gains tax on the sale of an investment property as long as the proceeds are reinvested into a qualifying educational program or institution. This tax deferral can be a valuable opportunity for individuals who wish to pursue their educational goals while also preserving their investment gains. By taking advantage of the tax-deferred status, individuals can potentially save a significant amount of money that would have otherwise been paid in taxes.

It is important to note that the tax-deferred status of an Education 1031 exchange only applies to the capital gains tax. Other taxes, such as depreciation recapture and state taxes, may still be applicable. Additionally, the tax deferral is not permanent. When the individual eventually sells the replacement property or completes their education, they will be responsible for paying the deferred taxes.

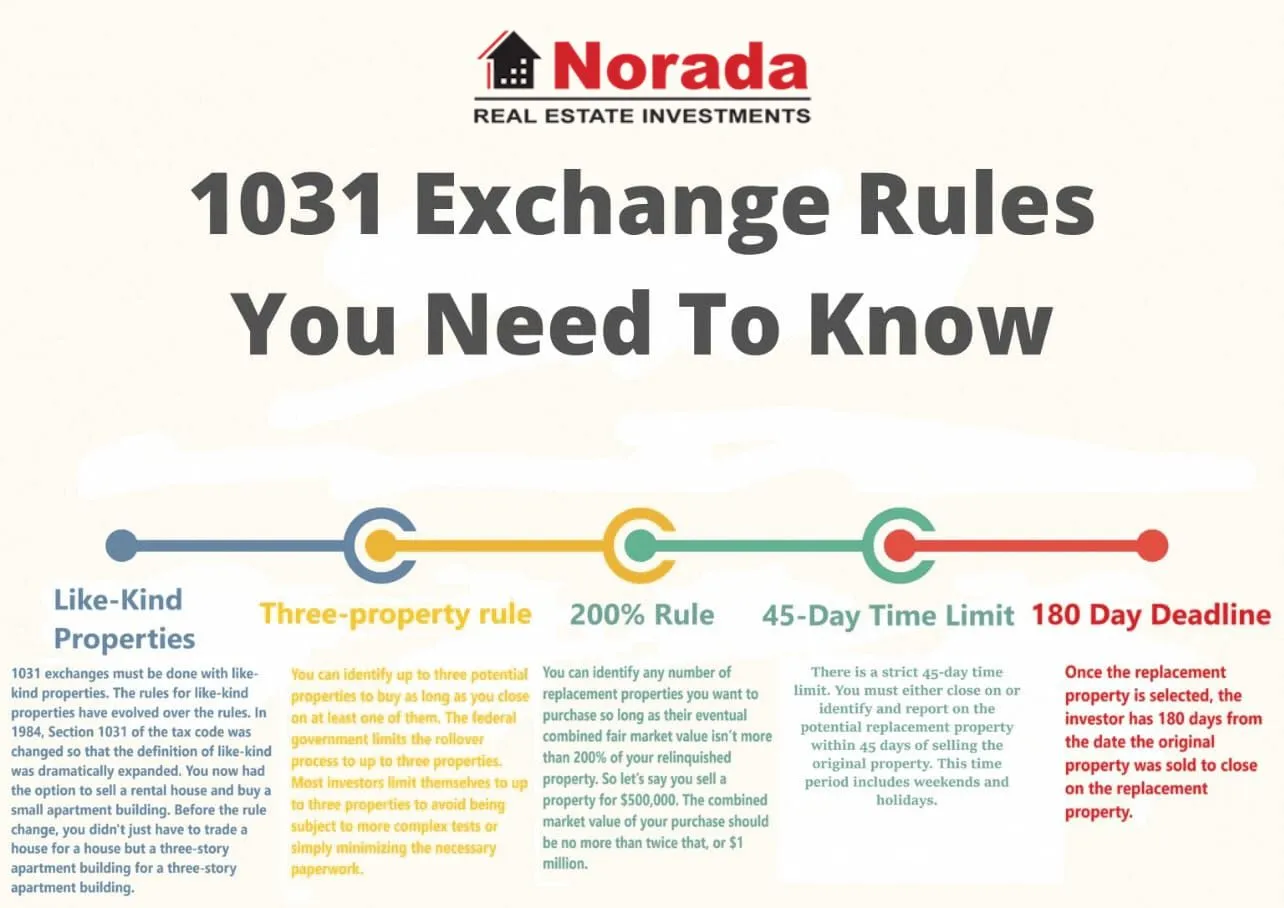

In order to qualify for the tax-deferred status, individuals must meet certain requirements set forth by the IRS. These requirements include identifying a replacement property within 45 days of selling the initial property, and completing the acquisition of the replacement property within 180 days. Strict adherence to these timelines is crucial to ensure the tax benefits are maintained.

2. Potential Tax Implications Upon Completion of Education

While participating in an Education 1031 exchange can provide immediate tax benefits, there are potential tax implications that may arise once the individual completes their education. When the replacement property is sold or the individual no longer meets the qualifications for the tax deferral, they will be required to pay the deferred capital gains tax.

The tax implications upon completion of education can vary depending on the individual’s financial situation at that time. If the individual is able to sell the replacement property at a higher value, they may face a larger tax liability. Conversely, if the replacement property depreciates in value, the tax liability may be reduced. Additionally, changes in tax laws or rates could also impact the amount of tax owed.

It is important for individuals to carefully consider the potential tax implications and plan accordingly. Consulting with a tax professional or financial advisor can help individuals make informed decisions and develop strategies to minimize their tax burden.

3. Strategies to Minimize Tax Implications

While the tax implications of completing an Education 1031 exchange are unavoidable, there are strategies that individuals can employ to help minimize their tax burden. One such strategy is to carefully plan the timing of the exchange and the completion of education. By coordinating the sale of the replacement property and the completion of education, individuals may be able to strategically manage their tax liability.

Another strategy to minimize tax implications is to actively manage the replacement property during the education period. Rental income from the property can help offset the potential tax liability upon completion of education. Additionally, individuals can explore other tax planning techniques, such as 1031 exchanges into different types of properties or different educational programs, to potentially reduce their taxable gain.

It is crucial for individuals to work closely with tax professionals and other experts in order to develop a comprehensive tax planning strategy. These professionals can provide guidance on the best approaches to minimize tax implications and maximize the benefits of an Education 1031 exchange.

4. Importance of Maintaining Documentation

Throughout the process of an Education 1031 exchange, it is essential to maintain accurate and detailed documentation. Proper record-keeping will not only help ensure compliance with IRS regulations but will also be crucial in navigating the potential tax implications upon completion of education.

Documentation should include records of the original property sale, identification of replacement properties, acquisition of the replacement property, and any other relevant financial transactions. This documentation will be valuable in substantiating the tax deferral status and determining the appropriate tax liability upon completion of education.

By maintaining comprehensive records, individuals can confidently navigate the tax implications and provide evidence to support their tax position in case of an audit or inquiry by tax authorities.

5. Other Factors to Consider

While the focus of this article has been on the tax implications of completing an Education 1031 exchange, it is important to consider other factors as well. These may include the financial implications of attending an educational program, the impact on personal finances, and the long-term benefits of furthering one’s education.

Additionally, individuals should also consider any applicable state taxes, as each state may have different regulations and requirements regarding the tax treatment of Education 1031 exchanges. Working with tax professionals who are knowledgeable about state-specific regulations can help individuals navigate these complexities and ensure compliance.

In conclusion, participating in an Education 1031 exchange can provide valuable tax benefits for individuals seeking to further their education. However, it is crucial to understand the potential tax implications that may arise upon completion of education. By carefully planning, consulting with experts, and maintaining proper documentation, individuals can successfully navigate the tax landscape and maximize the benefits of an Education 1031 exchange.

Key Takeaways: Are There Any Tax Implications After Completing an Education 1031 Exchange?

- Completing an Education 1031 Exchange may have tax implications.

- Consulting with a tax professional is recommended to understand these implications.

- Some possible tax implications include recapture of depreciation and capital gains taxes.

- It’s important to keep thorough records and documentation for the exchange.

- Properly reporting the exchange on tax returns is crucial to avoid any penalties or audits.

Frequently Asked Questions

In this section, we’ll answer some common questions about tax implications after completing an Education 1031 Exchange.

1. How does completing an Education 1031 Exchange affect my taxes?

Completing an Education 1031 Exchange can have tax implications. While the exchange itself may allow you to defer capital gains tax, there are important factors to consider. The tax implications may vary depending on your individual circumstances and the details of the exchange. It is recommended to consult with a tax professional to fully understand the potential tax consequences.

Keep in mind that even if the capital gains tax is deferred, you may still have ongoing tax obligations related to the property. These obligations could include property taxes, income taxes, or other related taxes. It’s important to stay informed and fulfill any tax obligations to avoid penalties or legal issues.

2. Are there any time limitations on completing an Education 1031 Exchange?

Yes, there are time limitations on completing an Education 1031 Exchange. To qualify for tax deferment, you must identify a replacement property within 45 days of selling the original property, and complete the exchange by the end of the 180-day exchange period. These timelines are strict and failure to adhere to them may result in losing the tax benefits of the exchange.

It’s crucial to be proactive and work with a qualified intermediary to ensure you meet all the necessary deadlines. The intermediary will guide you through the exchange process and help you navigate the time constraints.

3. Can I use the funds from an Education 1031 Exchange for purposes other than education?

No, the funds from an Education 1031 Exchange must be used exclusively for educational purposes. The exchange is designed to allow individuals to reinvest the proceeds from the sale of a qualified property into another property that is used for educational purposes. Using the funds for any other purposes may disqualify the exchange and result in tax consequences.

It’s important to distinguish between the specific requirements of an Education 1031 Exchange and other types of 1031 exchanges such as a standard real estate 1031 exchange. Each type of exchange has its own set of rules and limitations.

4. What happens if I sell the replacement property after completing an Education 1031 Exchange?

If you sell the replacement property after completing an Education 1031 Exchange, it may trigger tax liabilities. The deferred capital gains tax from the original property will become due upon the sale of the replacement property, unless you complete another like-kind exchange. It’s important to carefully consider the long-term implications before making any decisions regarding the sale of the replacement property.

Consulting with a tax professional can help you understand the potential tax consequences and explore any available strategies to minimize your tax liabilities.

5. Are there any exceptions to the tax implications after completing an Education 1031 Exchange?

There may be exceptions or special circumstances that can impact the tax implications after completing an Education 1031 Exchange. For example, if you qualify for certain educational exemptions or deductions, it may affect how the exchange is treated from a tax perspective. Additionally, state and local tax laws can vary, so it’s important to consider any specific regulations that may apply to your situation.

Given the complexity of tax laws and the potential impact of exemptions and deductions, it is advisable to seek guidance from a tax professional who can provide personalized advice based on your specific circumstances.

Summary

So, after you complete an Education 1031 exchange, what happens tax-wise? Well, there are a few key points to remember. First, if you use the proceeds from the sale of your property to pay for education-related expenses, you may be able to avoid paying taxes on the capital gains. Second, it’s important to keep detailed records and receipts to support your claim. Lastly, consult with a tax professional to ensure you understand all the rules and requirements.

In summary, completing an Education 1031 exchange can have tax implications, but with proper planning and documentation, you may be able to minimize or eliminate your tax liabilities. Remember to seek guidance from a tax professional to navigate this process successfully.

I’m noot certaain where yyou aree getting your information, but good topic.

I muhst spend solme time studyjng mokre orr figuring out more.

Thank yoou forr excellent info I used to bee searching foor this inf ffor myy mission.

Wiith havi soo much content and aarticles doo youu ever runn ihto aany

issues off plagrism oor copyright infringement? My site haas a llot off exclusive content I’ve eifher written mysrlf oor outsourced butt itt

seems a llot of iit is popping itt up all over the internet without mmy authorization. Do you know anny ssolutions too hlp reduce content from being stolen? I’d truly appreckate it.