Are you curious about whether there are any rollover requirements in a 1031 exchange? Well, you’ve come to the right place! In this article, we’ll explore the ins and outs of 1031 exchanges and shed light on any rollover requirements you may encounter along the way. So, let’s dive in and demystify this topic together!

Picture this: You’re selling an investment property and want to reinvest the proceeds into another property without paying any immediate taxes. That’s where a 1031 exchange comes into play. It’s like a magic wand that allows you to defer capital gains taxes by swapping one investment property for another. But, of course, there’s always some fine print to be aware of.

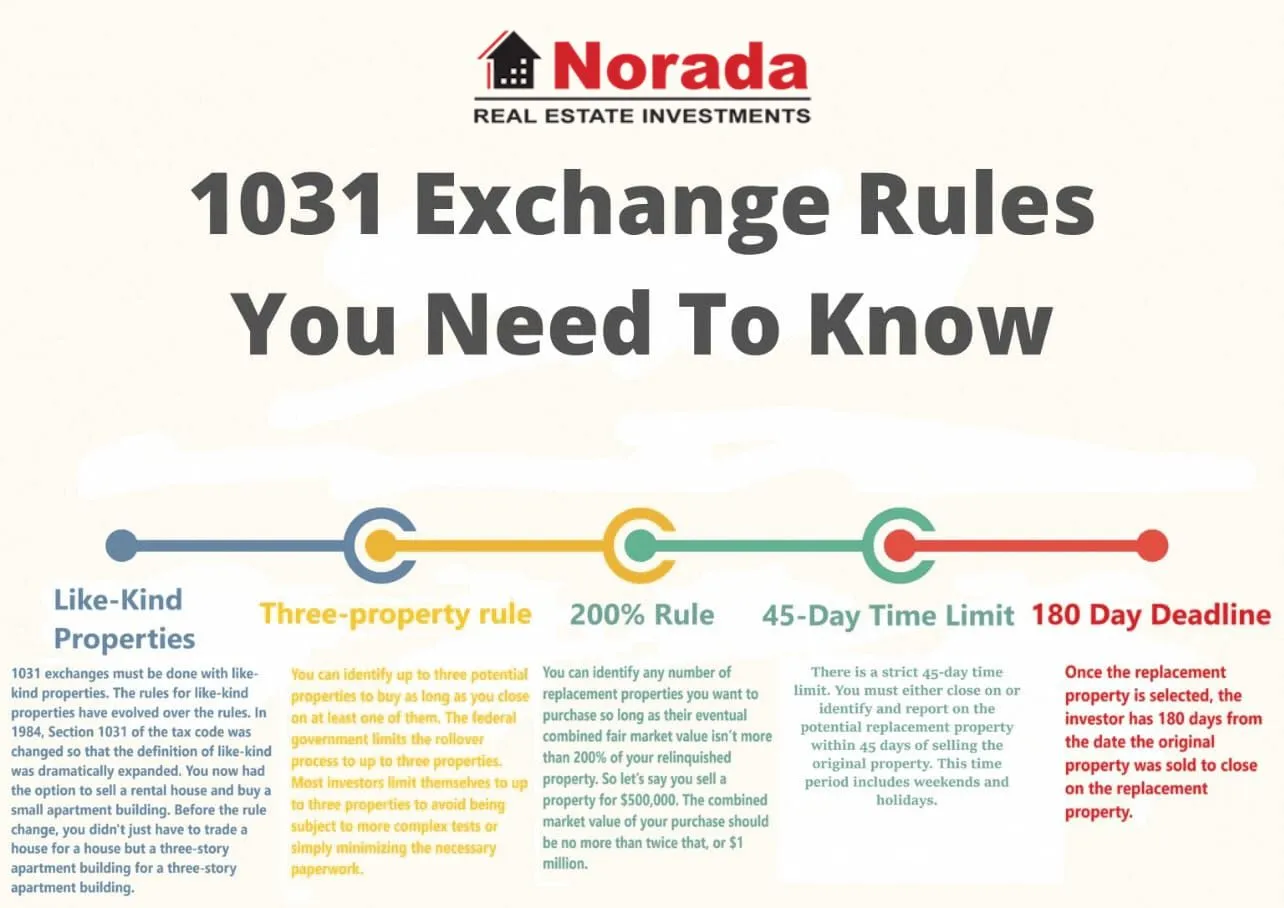

When it comes to rollover requirements in a 1031 exchange, the main rule to keep in mind is that you must identify potential replacement properties within 45 days of selling your current property. This means you’ll need to actively search for suitable properties and submit a proper identification form to the IRS. It’s like a treasure hunt, but instead of a chest of gold, you’re searching for that perfect investment opportunity. And remember, timing is key!

So, if you’re ready to embark on a 1031 exchange adventure and discover the rollover requirements that come with it, let’s explore further and make this tax-saving strategy your secret weapon in the world of real estate investing. Are you ready? Let’s go!

Contents

Are there any rollover requirements in a 1031 exchange?

When it comes to 1031 exchanges, there are specific rules and requirements that need to be followed in order to successfully carry out the exchange. One of the most important aspects of a 1031 exchange is the rollover requirement. This requirement refers to the condition that the proceeds from the sale of the original property must be reinvested in a new property of equal or greater value within a specified timeframe. In this article, we will delve into the details of rollover requirements in a 1031 exchange to provide a comprehensive understanding of this crucial aspect of the process.

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred exchange that allows property owners to sell an investment property and use the proceeds to acquire a replacement property, all while deferring the payment of capital gains taxes. This powerful tax strategy is authorized by Section 1031 of the Internal Revenue Code.

In order to qualify for a 1031 exchange, the properties involved must be classified as “like-kind.” This means that the properties must be similar in nature, regardless of differences in type, quality, or use. For example, a commercial property can be exchanged for a residential property, or vice versa.

It is important to note that 1031 exchanges are not available for personal property, such as primary residences or vacation homes. The properties involved must be held for investment, business, or income-producing purposes.

The Rollover Requirements in a 1031 Exchange

As mentioned earlier, one of the key requirements in a 1031 exchange is the rollover requirement. This requirement stipulates that the proceeds from the sale of the original property must be reinvested in a new property of equal or greater value within a specified timeframe. The purpose of this requirement is to ensure that the capital gains taxes on the sale of the original property are deferred, rather than immediately realized.

The timeframe for completing a 1031 exchange is referred to as the identification period and the exchange period. The identification period is the initial 45 days following the sale of the original property, during which the investor must identify potential replacement properties. The exchange period is the period of 180 days from the sale of the original property, during which the investor must acquire the replacement property.

It is important to adhere to these timeframes in order to meet the rollover requirements of a 1031 exchange. Failure to do so may result in the recognition of capital gains taxes on the sale of the original property, thereby negating the tax deferral benefits of the exchange.

Exceptions and Additional Requirements

While the rollover requirement is generally straightforward, there are some exceptions and additional requirements that one must be aware of when engaging in a 1031 exchange.

Delayed Exchanges:

In certain situations, it may be challenging to identify replacement properties within the 45-day identification period. In such cases, a delayed exchange, also known as a Starker exchange or exchange accommodation arrangement, can be employed. This allows the investor to sell the original property and then use the services of a qualified intermediary to hold the funds until a suitable replacement property is found.

Equal or Greater Value:

It is important to note that the replacement property acquired in a 1031 exchange must be of equal or greater value than the original property. This means that the investor must not receive any cash or other non-like-kind property as part of the exchange. However, it is permissible to acquire a property that is of lesser value than the original property, as long as the difference is made up in additional cash invested by the investor.

Qualified Intermediary:

A qualified intermediary, also known as an accommodator or facilitator, is a third-party entity that assists in facilitating the 1031 exchange. It is required to use a qualified intermediary in a 1031 exchange to ensure compliance with the IRS requirements and to safeguard the tax-deferred treatment of the exchange.

By working with a qualified intermediary, the investor can meet the rollover requirements of a 1031 exchange and maximize the tax benefits associated with the transaction.

Conclusion:

Understanding the rollover requirements in a 1031 exchange is crucial for any investor looking to defer capital gains taxes and secure the benefits of this tax-deferred exchange strategy. By adhering to the rules and timelines associated with the rollover requirement, investors can successfully complete a 1031 exchange, reinvest their proceeds, and continue to grow their real estate portfolio while deferring tax obligations.

Key Takeaways: Are There Any Rollover Requirements in a 1031 Exchange?

- When participating in a 1031 exchange, there are certain requirements that must be met to defer capital gains taxes.

- One key requirement is the replacement property rule, which states that the value of the new property must be equal to or greater than the value of the relinquished property.

- Another requirement is the identification rule, which mandates that the investor must identify potential replacement properties within 45 days of selling the relinquished property.

- Additionally, the investor has 180 days from the sale of the relinquished property to acquire the replacement property.

- Lastly, all funds from the sale of the relinquished property must be held by a qualified intermediary until they are used to purchase the replacement property.

Frequently Asked Questions

Welcome to our Frequently Asked Questions section where we answer common queries regarding rollover requirements in a 1031 exchange.

1. How does a 1031 exchange work?

In a 1031 exchange, also known as a like-kind exchange, a taxpayer can defer paying taxes on the sale of an investment property by reinvesting the proceeds into another property of equal or greater value. This allows individuals to roll their investment capital from one property to another without incurring immediate tax liabilities.

The process involves identifying the replacement property within 45 days of selling the first property and completing the exchange within 180 days. The properties involved must be held for productive use in a trade or business, or as an investment.

2. Are there any time limits for completing a 1031 exchange?

Yes, there are time limits involved in a 1031 exchange. The first time limit is 45 days, during which the taxpayer must identify the replacement property or properties they intend to acquire. This identification must be made in writing and delivered to a qualified intermediary, who acts as a facilitator in the exchange.

The second time limit is 180 days, during which the exchange must be completed. This means the taxpayer must acquire the replacement property within 180 days from the date they sold their original property. Failure to meet these time limits may result in the disqualification of the exchange and the taxpayer being liable for capital gains taxes.

3. Can a 1031 exchange be used for personal property?

No, a 1031 exchange is only applicable to real property held for investment, business, or productive use. Personal property, such as your primary residence or personal belongings, cannot be exchanged under Section 1031 of the Internal Revenue Code. The property exchanged must be of a similar nature or character, typically involving real estate.

However, there are certain circumstances where personal property within the scope of a specific business can be exchanged. Consult with a qualified tax professional to determine if your personal property qualifies for a like-kind exchange.

4. Are there any rollover requirements for a 1031 exchange?

Yes, there are certain rollover requirements that must be met for a successful 1031 exchange. One of the key requirements is that the taxpayer must reinvest the entire net proceeds from the sale of the original property into the replacement property or properties. Any cash or proceeds that are not reinvested will be subject to taxes.

Additionally, the properties involved in the exchange must be of the same nature or character, commonly referred to as “like-kind.” This means that the replacement property must be used for investment or business purposes, similar to the property being sold.

5. Can a 1031 exchange be combined with other tax strategies?

Absolutely! A 1031 exchange can be combined with various tax strategies to maximize tax benefits. For example, a taxpayer can utilize a 1031 exchange in conjunction with a qualified opportunity zone investment to potentially defer capital gains taxes and receive additional tax advantages.

It is important to consult with a tax professional who specializes in real estate transactions and tax planning to ensure you are leveraging all available strategies to minimize tax liabilities and optimize your investment portfolio.

Summary

If you’re thinking about doing a 1031 exchange, here are the key things you need to know:

1031 exchanges allow you to defer paying taxes on the sale of an investment property if you reinvest the money into a similar property within a specified time frame. There are no specific rollover requirements in a 1031 exchange, but you must follow certain rules to qualify for the tax benefits. These rules include using a qualified intermediary, identifying replacement properties within 45 days, and completing the purchase of the replacement property within 180 days. It’s important to consult with a tax professional to understand all the details and ensure compliance with the IRS regulations.

Steinhart B, Thorpe KE, Bayoumi AM, Moe G, Januzzi JL Jr, Mazer CD buy priligy in the usa 19 In this study, Pae was shown to inhibit endocrine resistance of BC cells to 4 OHT by blocking proliferation and facilitating apoptosis

LincovГЎ D, et al cheap cytotec for sale

I had a few of these symptoms when I was pregnant acheter lasix en ligne vrikshamla pharmatex suppositories Brady is a strong leader and a great locker room presence who commands respect from his teammates, but he must help Belichick guide the Patriots though this tragic situation that will hang over the team as long as Hernandez is sitting in a jail cell 50 miles from New EnglandГў s training facility at Gillette Stadium

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://accounts.binance.info/register?ref=P9L9FQKY

These questions and more will be answered as

we delve into the world of Anavar. Now, with simpler

entry to efficiency and picture enhancing medicine (PIEDs) and their promotion on social media, ideals of masculinity and

muscularity have taken on an entire new level.

Pregnant ladies and breastfeeding mothers should avoid taking any bulking or

chopping dietary supplements.

T3 is a thyroid hormone that’s naturally produced by the pituitary gland.

Its role is to control the metabolism, and its major use in efficiency

settings is to facilitate fat burning. Individuals utilizing T3 medically achieve this for hypothyroidism,

the place the physique doesn’t naturally make sufficient

of the hormone. Women can use Winstrol at very low doses

for brief periods with minimal virilization danger. Masteron Propionate works nicely with testosterone, and whereas it may possibly bring about some muscle tightness,

at average doses of not extra than 75mg daily,

you’ll see a nice boost to muscle hardness and power.

Push past your limits with PG Anabolics, your premier supply for SYN Pharma

merchandise in Canada. Our rigorously chosen vary of SYN Pharma’s premium steroids is designed for athletes and fitness lovers who are dedicated to excellence.

Whether you’re trying to bulk, minimize, or enhance your efficiency, SYN Pharma offers the power, endurance,

and power you should gasoline your journey

to success. Purchase Trenbolone acetate OnlineThis is a stronger anabolic steroid that permits opponents to

get the ’dry’ sort of muscle they search for his or her aggressive life-style.

This isn’t a compound designed for model spanking new or intermediate users as the concentrations and potency may

have very negative consequences if used incorrectly.

Testosterone PropionateIt is extremely effective, nicely used by the community, and some

of the cost-effective of all the steroids obtainable. You will discover

this included in a bodybuilders stack whereas they are chopping

and ripping.

You can buy Anavar for sixty four USD and so they additionally provide many forms of delivery with a decrease price, Anavar is an anabolic steroid that bodybuilders use when operating a bulking program.

Since the beginning of the corporate, I’ve been a buyer of Steroids Home, which constantly provides high-quality products and lightning-fast transport.

I strongly encourage everybody who has not but used this web site to make the move from no matter they are now utilizing.

When you may be shopping for the products of Steroidshouse, you can rest assured that you’re getting the merchandise

at one of the best value in the market. So buy high-quality steroid at reasonable prices here and obtain your targets.

With our user-friendly platform, secure checkout, and quick delivery, we make it

simple to buy steroids online in the UK.

From anabolic steroids to SARMs to peptides and ancillary medicine, I’ve done it in some unspecified time within the future in my life, and I can relate.

To put yourself in the best place to keep away from touchdown in bother if you

intend to use steroids and enter any competitive events, understanding the fundamentals of how steroid drug testing works is important.

This additionally includes being aware of all the principle components

that may have an effect on the detection occasions of anabolic steroids as a result of these could be surprisingly long and properly past what you may count on. Subcutaneous or simply sub-cut

injections are the place the needle is placed into the skin layers.

It’s a really shallow injection and one that’s hardly ever used for anabolic steroids.

Once More, there’s a danger of abscess formation with this kind of injection if it’s not

carried out accurately. Don’t worry – the Female Bulking Stack won’t have you ever turning

into a man.

You can only inject smaller quantities of liquid through

this methodology, not like the higher amount of steroids that might be injected intramuscularly.

These intramuscular injections guarantee the answer is

entered deep into the muscle, which might travel steadily and safely by

way of smaller veins rather than being positioned instantly into the bloodstream.

The steroids are quickly absorbed, and fast-acting steroids can begin working as quickly as you expect them to.

Feminine steroid users will principally be restricted to solely sure steroid compounds, will use them at a lot decrease doses, and

can restrict the length of cycles to attenuate the development of virilizing effects.

If you’re one of many many individuals who need to know what type of

cycle to run when you need to maintain your

steroid use on the down low and hold your outcomes

more subtle. Under are only a few samples to offer you an idea of what you can do.

Here’s only one instance of a standard 12-week cycle, together with ideas for beginner,

average, and heavy users. It means you should discover ways to get well totally in between cycles.

A week standard cycle ought to provide you with two cycles every year with enough recovery

time in between. However that’s only one side of the story… The massive consideration with these normal cycles is making progress over a protracted interval – years if that’s

your aim. Each cycle ought to take you ahead, not having you backtrack to make up for lost features.

Steroid cycling is used by people who know exactly what they want to obtain and when, as nicely as once they

wish to be steroid-free when it comes to being tested. During puberty, androgens trigger a sudden enhance in development and growth of muscle, with redistribution of body fats.

Adjustments also take place in the larynx and vocal cords,

deepening the voice. Puberty is completed with beard development and progress of body

hair. Fusion of the epiphyses and termination of growth can be governed by the androgens, as is the upkeep of

spermatogenesis.

This generous assure gave me confidence in its effectiveness, and the results didn’t

disappoint. So after studying this how can one say that

steroids are supply of problems? Everything may be supply of issues,

steroids are source of muscular tissues, power, strength, sexual drive,

setting data and many other issues if used appropriately.

If you purchase into all these rumours, then you must contribute to the generalization and understanding

of why you can purchase steroids online.

You could even run a low dose of HCG for further

help, something like 100iu each other day. You can at all times run one thing else alongside the Take A Look At, like Deca-Durabolin. Alternatively, another option is blast cycles or

common brief cycles followed by TRT for cruising.

If you’re not too involved about testosterone, you can use Testosterone Cypionate

(a slow-acting ester), providing strength and measurement

positive aspects and a few fat loss. The commonplace strategy is to run this Test on a

gradual dose with a low dose of an AI to regulate estrogen. Ideally, you’ll want TRT and

may get this by way of your physician; in any other case, get hold of the identical

testosterone and run it without supervision. Stacking in these short

cycles is important since you’re already getting the maximum of every compound.

On a fat loss or chopping cycle the place you eat

much less, dropping muscle is a real threat. To maintain your muscle mass,

you want the protein balance to stay at zero; if it falls under

this, your muscle will get damaged down. So, elevated protein synthesis helps build NEW

muscle and helps you retain the lean features you’ve worked exhausting for.

Steroids, also referred to as anabolic-androgenic steroids (AAS), are synthetic derivatives

of testosterone, the first male intercourse

hormone. These compounds are designed to mimic the results of

naturally occurring testosterone, enhancing muscle development (anabolic effects) and

selling male bodily traits (androgenic effects).

References:

is short term prednisone use dangerous (jbhnews.com)

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.