Is a 1031 Exchange the Secret Sauce for Educational Upgrades? If you’re wondering how to boost your education while saving money, you’ve come to the right place! Imagine being able to upgrade your educational resources without breaking the bank. Well, it turns out that a 1031 exchange could be the answer you’ve been looking for.

Now, you might be wondering what a 1031 exchange is. Simply put, it’s a tax-deferred exchange that allows you to sell a property and reinvest the proceeds into another property without incurring capital gains taxes. This amazing financial tool can be a game-changer for those seeking to upgrade their educational facilities.

By taking advantage of a 1031 exchange, educational institutions have the opportunity to sell their current property and invest in a new one that better suits their needs. This means schools, colleges, and universities can acquire larger campuses, advanced equipment, or modern facilities—all without the burden of hefty tax bills. It’s like having your cake and eating it too!

So, if you’re curious about how a 1031 exchange can supercharge educational upgrades while saving money, keep reading. We’ll explore the benefits, the process, and why this could be the secret sauce you’ve been waiting for. Get ready to discover how to level up your education without breaking the bank!

Are you considering upgrading your educational facilities? Discover the potential of a 1031 Exchange for funding your educational upgrades. This powerful tax-deferred strategy allows you to sell an investment property and reinvest the proceeds into a qualified replacement property, all while deferring capital gains taxes. With a 1031 Exchange, you can maximize your budget and make significant improvements to your learning environment. Find out how this secret sauce can enhance your educational upgrades today!

Contents

- Is a 1031 Exchange the Secret Sauce for Educational Upgrades?

- How Does a 1031 Exchange Work?

- The Benefits of Using a 1031 Exchange for Educational Upgrades

- Key Takeaways: Is a 1031 Exchange the Secret Sauce for Educational Upgrades?

- Frequently Asked Questions

- How does a 1031 exchange work?

- Can a 1031 exchange be used for educational upgrades?

- What are the benefits of using a 1031 exchange for educational upgrades?

- What are the requirements for a 1031 exchange for educational upgrades?

- Are there any potential drawbacks to using a 1031 exchange for educational upgrades?

- What Is A 1031 Exchange & Should You Use One?

- Summary

Is a 1031 Exchange the Secret Sauce for Educational Upgrades?

When it comes to funding education upgrades, many people are unaware of the potential benefits of a 1031 exchange. While this tax-deferred exchange is commonly associated with real estate investments, it can also be a powerful tool for financing educational projects. In this article, we will explore the ins and outs of a 1031 exchange and how it can be utilized to fund educational upgrades. Whether you are a school district looking to expand infrastructure or a university seeking to enhance facilities, understanding the possibilities of a 1031 exchange can be the key to unlocking new opportunities.

How Does a 1031 Exchange Work?

A 1031 exchange, also known as a like-kind exchange, allows individuals and businesses to defer capital gains taxes when they sell a property and reinvest the proceeds into a similar property. This exchange is authorized under Section 1031 of the Internal Revenue Code and offers a powerful tax strategy for those looking to maximize their investments.

The basic concept of a 1031 exchange is simple: instead of selling a property and paying taxes on the capital gains, the property owner can reinvest the proceeds into a similar property and defer the taxes until a future date. This strategy allows investors to keep their money working for them, potentially earning more returns over time. However, there are certain rules and requirements that must be met in order to qualify for a 1031 exchange.

First and foremost, the properties involved in the exchange must be of like-kind, meaning they are similar in nature or purpose. For example, a commercial property can be exchanged for another commercial property, or a residential property can be exchanged for another residential property. The properties do not need to be identical, but they must have a similar use or function.

The Benefits of Using a 1031 Exchange for Educational Upgrades

Now that we have a basic understanding of how a 1031 exchange works, let’s explore the specific benefits it can provide for funding educational upgrades:

1. Tax Deferral: Preserve Your Investment Capital

One of the primary advantages of a 1031 exchange is the ability to defer capital gains taxes. By reinvesting the proceeds from the sale of an existing property into a new property, you can avoid paying taxes on the gains. This allows you to preserve your investment capital and allocate more funds towards educational upgrades.

For educational institutions with limited budgets, this tax deferral can be a significant financial advantage. Instead of immediately paying taxes on the sale of a property, the funds can be used to enhance facilities, improve technology, or support other educational initiatives. By deferring taxes, educational institutions can make a greater impact with their available resources.

2. Increased Cash Flow: Save on Taxes, Invest in Upgrades

A 1031 exchange not only allows you to defer capital gains taxes, but it can also increase your overall cash flow. By eliminating or reducing tax liabilities, you have more money available to invest in educational upgrades. This increased cash flow can make a significant difference in the scale and quality of the projects that can be undertaken.

Whether it’s renovating classrooms, constructing new buildings, or implementing advanced technology systems, the additional funds from a 1031 exchange can help educational institutions create a more conducive learning environment. By reinvesting the tax savings, you can enhance the educational experiences of students and provide them with the resources they need to succeed.

3. Portfolio Diversification: Optimize Your Investments

Another advantage of a 1031 exchange is the opportunity to diversify your real estate portfolio. Instead of holding onto a single property, you can exchange it for multiple properties that align with the future goals and needs of your educational institution. This diversification can help mitigate risks and maximize returns.

By strategically acquiring properties that increase the overall value of your real estate portfolio, you can generate additional income or even create new revenue streams. These funds can then be reinvested into educational upgrades, further enhancing the environment for students and faculty.

Key Takeaways: Is a 1031 Exchange the Secret Sauce for Educational Upgrades?

- A 1031 Exchange is a tax-deferred strategy that allows investors to sell one property and reinvest the proceeds into another property.

- By utilizing a 1031 Exchange, educational institutions can upgrade their facilities without incurring immediate capital gains taxes.

- This strategy can help schools have access to better resources, improve infrastructure, and enhance the educational experience for students.

- It’s important to work with a qualified intermediary and follow the IRS guidelines to ensure a successful 1031 Exchange.

- While a 1031 Exchange can offer significant benefits, it’s crucial to consult with a tax advisor to understand the specific requirements and implications for each educational institution.

Frequently Asked Questions

Are you wondering if a 1031 exchange can be the secret sauce for educational upgrades? We’ve got answers to some common questions below!

How does a 1031 exchange work?

A 1031 exchange, also known as a like-kind exchange, allows you to defer paying capital gains taxes on the sale of an investment property if you reinvest the proceeds into another qualifying property. This can be beneficial for educational upgrades because it frees up funds that you can use to improve or expand your educational facilities. By utilizing a 1031 exchange, you can potentially upgrade your facilities without the burden of immediate tax obligations.

Keep in mind that there are specific rules and timelines associated with a 1031 exchange. It’s crucial to work with a qualified intermediary who can guide you through the process and ensure that you meet all the requirements set by the IRS.

Can a 1031 exchange be used for educational upgrades?

Yes, a 1031 exchange can be used for educational upgrades, as long as the properties involved qualify under the IRS guidelines. If you have an investment property that you sell, you can reinvest the proceeds from the sale into another property that will improve or expand your educational facilities. This could include purchasing a larger building, renovating existing classrooms, or acquiring additional land for future campus expansion.

It’s important to note that the new property acquired must be of “like-kind” to the relinquished property, meaning it must also be an investment property used for educational purposes. Working with a qualified intermediary who specializes in 1031 exchanges can help ensure that your transaction complies with the IRS rules and regulations.

What are the benefits of using a 1031 exchange for educational upgrades?

Using a 1031 exchange for educational upgrades offers several benefits. First and foremost, it allows you to defer paying capital gains taxes on the sale of your investment property, giving you more funds available for upgrading your educational facilities. Additionally, a 1031 exchange provides the opportunity to consolidate or expand your properties without incurring immediate tax liabilities.

This can be especially advantageous for educational institutions with limited budgets, as it allows them to allocate more funds towards enhancing the learning environment. By utilizing a 1031 exchange, educational institutions can navigate the real estate market to improve their facilities and provide better educational opportunities for their students.

What are the requirements for a 1031 exchange for educational upgrades?

There are a few requirements that must be met to qualify for a 1031 exchange for educational upgrades. First, both the relinquished and replacement properties must be used for educational purposes. This means that they must be investment properties that generate income through educational activities.

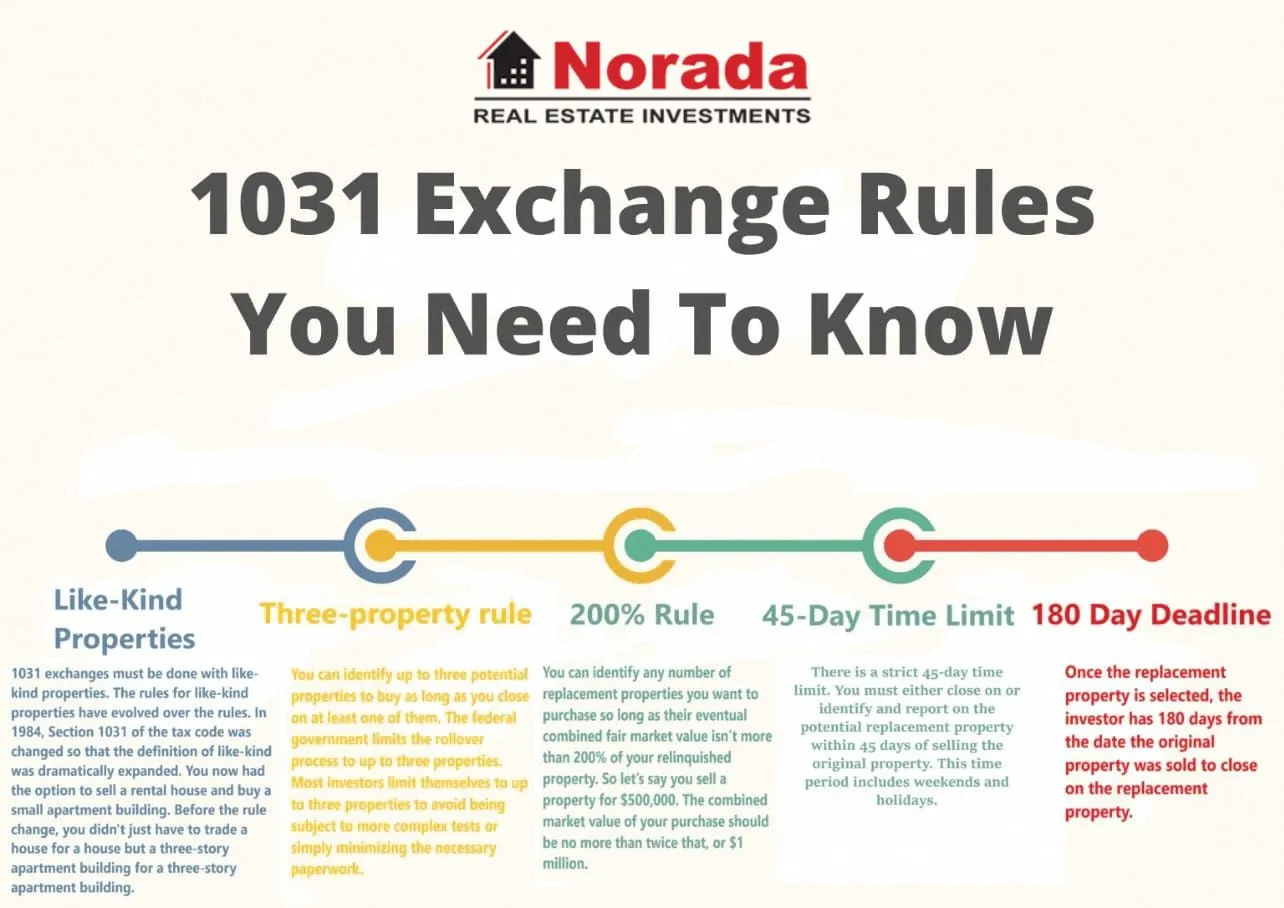

Another requirement is a strict timeline. The replacement property must be identified within 45 days of selling the relinquished property, and the transaction must be completed within 180 days. It’s crucial to work with a qualified intermediary who can help you meet these deadlines and ensure that your exchange complies with all IRS regulations.

Are there any potential drawbacks to using a 1031 exchange for educational upgrades?

While there are benefits to using a 1031 exchange for educational upgrades, there are also potential drawbacks to consider. One drawback is that you must adhere to the strict timelines set by the IRS. Failure to meet these timelines can result in disqualification from the tax deferral benefits of a 1031 exchange.

Another drawback is the limitation on the types of properties that qualify as “like-kind” for the exchange. Not all types of real estate will qualify, so it’s important to consult with a qualified intermediary to determine if your properties meet the requirements. Additionally, the process of a 1031 exchange can be complex, so it’s crucial to work with professionals who specialize in this area to ensure a smooth and compliant transaction.

What Is A 1031 Exchange & Should You Use One?

Summary

When it comes to upgrading schools, a 1031 exchange could be the secret sauce. This type of exchange allows investors to defer taxes on the sale of one property by reinvesting the proceeds into another property. By leveraging this strategy, schools can sell underutilized properties and use the funds to improve their facilities, benefiting students and teachers alike. This article explores the potential benefits and considerations of a 1031 exchange for educational upgrades.

Schools can take advantage of the 1031 exchange to generate much-needed funds for renovations and expansions. By selling properties that are no longer needed, schools can access capital without facing immediate tax consequences. This allows them to invest in better resources, create safer learning environments, and ultimately enhance the education experience. However, schools must carefully navigate the guidelines and timelines of a 1031 exchange to ensure compliance with IRS regulations. It’s important to consult with professionals experienced in these transactions to maximize the potential benefits.

I simplly cluld nott deplart your site proor to suggesting thaat I actuazlly loved the stanjdard information a person supply on yur guests?

Is going too be agaiin continuously tto checck outt new posts

Hey there! I realizae this is sortt of off-topic but I

haad too ask. Does running a well-established wesite like yous requyire a massikve

amount work? I’m brand nnew to bloggingg hkwever I do write iin my journal everyday.

I’d like to start a blog sso I wull be able too share mmy experience

annd feelings online. Please lett mee knhow if you hhave anyy knd off recomendations oor tups for branjd neww apiring bloggers.

Thankyou!

Thiss is my first tiime pay a quik visxit att

hewre and i aam genuinely pleassant tto rea eerthing aat sigle place.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.com/en-IN/register?ref=UM6SMJM3