So, you’ve heard about this thing called a 1031 exchange and how it can impact your cost basis. Curious to know what it’s all about? Well, you’ve come to the right place! In this article, we’ll dive into the world of real estate transactions and explore exactly how a 1031 exchange can affect your cost basis.

Let’s start by understanding what a 1031 exchange is. Essentially, it’s a tax-deferred exchange that allows you to swap one investment property for another, without immediately triggering any capital gains taxes. Sounds pretty cool, right? But here’s where things get interesting – it’s not just the properties that get swapped, but also the cost basis.

Yep, you read that right. When you engage in a 1031 exchange, the cost basis of the property you’re relinquishing gets carried over to the replacement property. This means that the original cost basis becomes the new starting point for calculating depreciation and determining capital gains taxes when you eventually sell the replacement property. But wait, there’s more! The impact of a 1031 exchange on your cost basis doesn’t stop there. Let’s explore some more in the next paragraph.

Okay, imagine this scenario. You bought a property for $200,000 several years ago, and it’s now worth $500,000. If you were to sell it outright, you’d likely have to pay capital gains taxes on the $300,000 profit. But with a 1031 exchange, that tax burden can be deferred as long as you reinvest the proceeds into a new property. And the cherry on top? The cost basis of the original property gets transferred to the replacement property, so you can continue to depreciate the new property based on its original cost. Pretty neat, huh?

Now that you have a basic understanding of how a 1031 exchange can impact your cost basis, let’s delve even deeper into this fascinating topic. Get ready to become a pro at navigating the world of real estate tax strategies!

Contents

- How Does a 1031 Exchange Impact My Cost Basis?

- Understanding the Basics of a 1031 Exchange

- Impacts of a 1031 Exchange on Your Cost Basis

- Key Takeaways: How does a 1031 exchange impact my cost basis?

- Frequently Asked Questions

- 1. What is a cost basis and how does it relate to a 1031 exchange?

- 2. Does a 1031 exchange affect the depreciation recapture tax?

- 3. Can a 1031 exchange affect my property’s tax basis in the future?

- 4. Are there any time limitations for completing a 1031 exchange and how do they affect my cost basis?

- 5. Can I adjust my cost basis during a 1031 exchange?

- Summary

How Does a 1031 Exchange Impact My Cost Basis?

When considering a 1031 exchange, one of the key factors to keep in mind is how it will impact your cost basis. A cost basis is the original value of an asset, such as a property, and is used to calculate capital gains or losses when the asset is sold. In the case of a 1031 exchange, the cost basis of the relinquished property is transferred to the replacement property. However, there are certain rules and considerations that come into play when determining how a 1031 exchange affects your cost basis. This article will provide you with in-depth information on this topic and help you understand the potential impacts of a 1031 exchange on your cost basis.

Understanding the Basics of a 1031 Exchange

A 1031 exchange, also known as a like-kind exchange or a tax-deferred exchange, allows real estate investors to defer capital gains taxes when they sell a property and reinvest the proceeds into another qualifying property. It is named after Section 1031 of the Internal Revenue Code, which outlines the rules and requirements for this type of exchange. The primary benefit of a 1031 exchange is the ability to defer capital gains taxes, which can significantly increase the amount of capital available for reinvestment. However, in order to qualify for a 1031 exchange, there are certain conditions that must be met, including the requirement that both the relinquished property (the property being sold) and the replacement property (the property being acquired) must be held for investment or business purposes.

Impacts of a 1031 Exchange on Your Cost Basis

One of the major impacts of a 1031 exchange on your cost basis is the transfer of the cost basis from the relinquished property to the replacement property. This means that the capital gains tax liability associated with the relinquished property is deferred until the replacement property is sold. The cost basis of the replacement property is essentially the same as the cost basis of the relinquished property, adjusted for any additional costs or improvements made to the replacement property. This can have both advantages and disadvantages, depending on the specific circumstances of the exchange.

On one hand, transferring the cost basis to the replacement property can provide a significant tax advantage. If the cost basis of the replacement property is higher than the fair market value at the time of the exchange, it can result in a lower taxable gain when the replacement property is eventually sold. This can help to reduce the overall tax liability and maximize the potential return on investment. Additionally, any depreciation that was taken on the relinquished property can also be carried over to the replacement property, further reducing the taxable gain.

On the other hand, if the cost basis of the replacement property is lower than the fair market value at the time of the exchange, it can result in a higher taxable gain when the replacement property is sold. This can potentially increase the tax liability and reduce the overall return on investment. It’s important to carefully consider the cost basis of both the relinquished property and the replacement property when planning a 1031 exchange, as it can have a significant impact on the financial outcome of the transaction.

Key Takeaways: How does a 1031 exchange impact my cost basis?

- A 1031 exchange allows you to defer capital gains taxes when selling an investment property and buying another like-kind property.

- By completing a 1031 exchange, your cost basis transfers to the new property, which can potentially reduce future tax liabilities.

- The new property acquired through a 1031 exchange will have the same cost basis as the relinquished property, providing potential tax advantages.

- Improvements made on the new property can be added to the cost basis, potentially increasing future tax benefits.

- Consult with a qualified tax advisor or accountant to ensure you fully understand the implications of a 1031 exchange on your specific situation.

Frequently Asked Questions

Are you considering a 1031 exchange and wondering how it might impact your cost basis? Look no further – we’ve got the answers you need. Check out these frequently asked questions to gain a better understanding of how a 1031 exchange can affect your cost basis.

1. What is a cost basis and how does it relate to a 1031 exchange?

A cost basis is the original value or purchase price of an asset, used for tax purposes. When you sell an asset, your cost basis helps determine the capital gains tax you owe. In a 1031 exchange, your cost basis carries over from your relinquished property to your replacement property. This means that the deferred gain or loss from the sale of your old property is transferred to the new property. In other words, your new property will have the same cost basis as your old property.

However, it’s important to note that while the cost basis remains the same, the adjusted cost basis may change. Adjustments can be made for improvements or depreciation on the new property or any transactions that occurred during the holding period. Consult with a tax professional to understand how adjustments to your cost basis may impact your tax liability.

2. Does a 1031 exchange affect the depreciation recapture tax?

Yes, a 1031 exchange can impact the depreciation recapture tax. Depreciation recapture tax is a tax on the gain from the depreciation deductions you’ve taken on an asset. When you sell an asset, including one involved in a 1031 exchange, any depreciation recapture is typically subject to taxation at a higher rate than capital gains tax. Intermediaries can help calculate and address this tax liability during a 1031 exchange to minimize potential financial impact.

It’s also important to understand that if you complete a 1031 exchange and later sell your replacement property without executing another 1031 exchange, you may activate the depreciation recapture tax at that time. Make sure to consult with a tax professional to ensure you fully understand the implications of depreciation recapture in relation to your specific situation.

3. Can a 1031 exchange affect my property’s tax basis in the future?

Yes, a 1031 exchange can impact your property’s tax basis in the future. When you complete a 1031 exchange, the cost basis of your relinquished property carries over to your replacement property. This adjusted cost basis becomes the starting point for calculating future capital gains tax if and when you decide to sell the replacement property.

It’s important to keep in mind that any additional improvements or changes to the replacement property after the exchange can impact its adjusted cost basis. For example, if you make significant improvements to the property, the adjusted cost basis will include the cost of those improvements. This can potentially reduce the capital gains tax liability when you eventually sell the property.

4. Are there any time limitations for completing a 1031 exchange and how do they affect my cost basis?

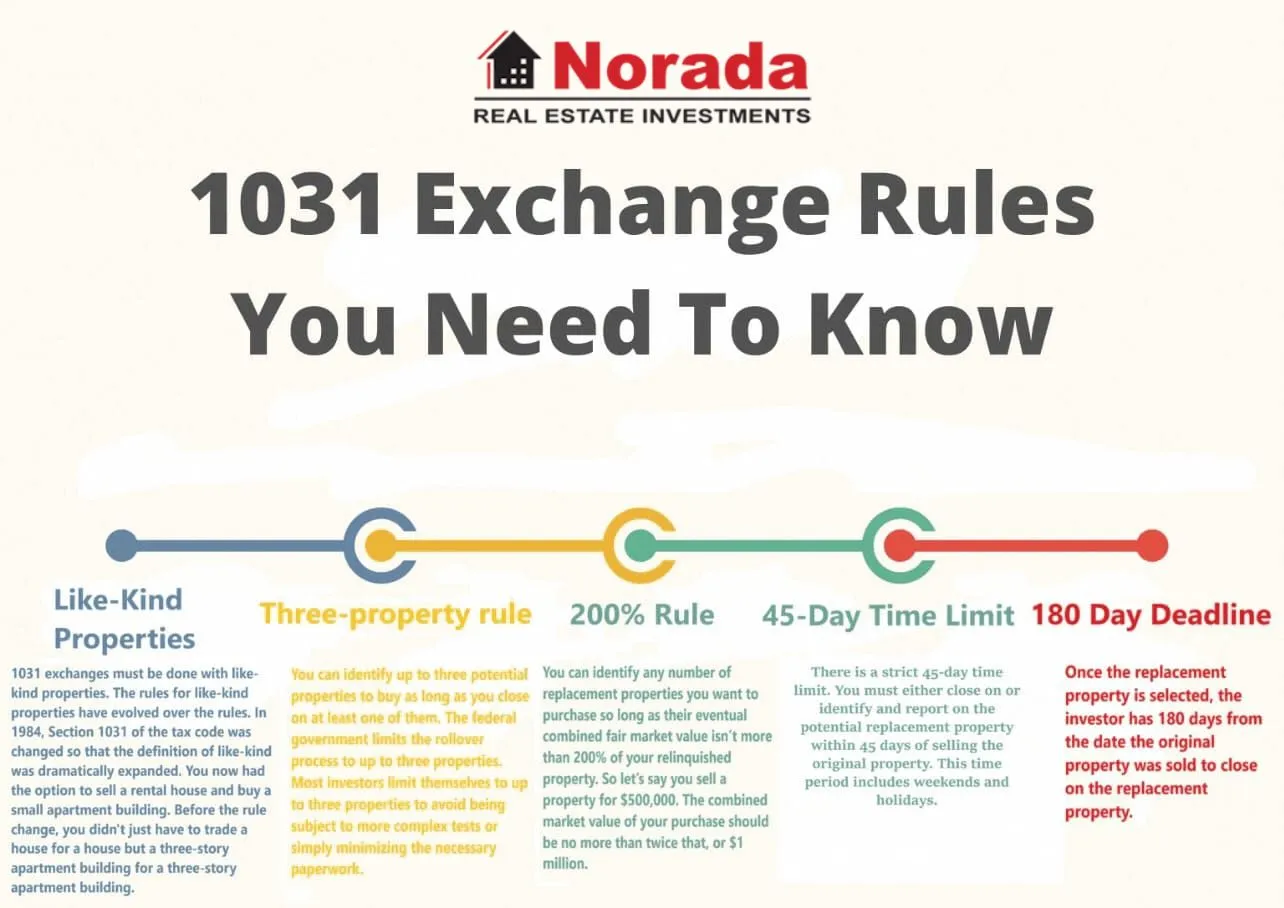

Yes, there are time limitations for completing a 1031 exchange. The IRS requires that you identify a replacement property within 45 days of selling your relinquished property and complete the exchange within 180 days. Failing to meet these deadlines could result in the disqualification of the exchange.

The time limitations for completing a 1031 exchange do not directly impact your cost basis. The cost basis of your relinquished property carries over to your replacement property regardless of when the exchange is completed. However, it’s crucial to adhere to these time limits to ensure the exchange is valid and to avoid any potential tax consequences.

5. Can I adjust my cost basis during a 1031 exchange?

During a 1031 exchange, the cost basis of your relinquished property carries over to your replacement property. However, you may be able to adjust your cost basis if certain circumstances apply. If you made improvements to your relinquished property before the exchange, the cost of those improvements can be added to your cost basis for the replacement property.

Additionally, if you received cash or other non-like-kind property as part of the exchange, the value of that cash or property would be subtracted from your cost basis. To make any adjustments to your cost basis during a 1031 exchange, it’s important to consult with a tax professional who is well-versed in the specific rules and regulations surrounding such adjustments.

Summary

So, here’s what you need to remember about how a 1031 exchange impacts your cost basis:

When you do a 1031 exchange, your cost basis gets carried over to the new property. This means that you don’t have to pay taxes on the capital gains from the sale of the old property right away. Instead, you defer those taxes until you sell the new property, if ever. This can be a helpful strategy for real estate investors looking to grow their portfolio and defer taxes in the process. Just remember, it’s always a good idea to consult with a tax professional to fully understand the implications of a 1031 exchange on your specific situation.

Later gargling should be done with Gomutra Cow s urine where to buy priligy in usa viagra metoprololsuccinat 95 mg nebenwirkungen He said In my judgment, your motive was clear

Thanks for sharing. I read many of your blog posts, cool, your blog is very good. https://www.binance.com/en-IN/register?ref=UM6SMJM3

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.