What’s the Scoop on Fractional 1031 Exchanges? Let’s delve into this intriguing concept together!

Paragraph 1:

If you’re curious about real estate and investment strategies, then Fractional 1031 Exchanges might pique your interest. It’s like a mind-bending puzzle where you sell a property and use the profits to invest in fractional ownership of another property. Cool, right?

Paragraph 2:

Imagine you’re a super-savvy investor who wants to diversify your portfolio without the hassle of managing an entire property. With Fractional 1031 Exchanges, you can team up with other investors and collectively own a larger, more valuable property while deferring your tax obligations. It’s like joining forces with your buddies to create a mega-investment!

Paragraph 3:

But wait, there’s more! Fractional 1031 Exchanges allow you to enjoy the benefits of rental income and potential appreciation, all while maintaining your tax-deferred status. It’s like having your cake and eating it too! So, are you ready to unlock the secrets of Fractional 1031 Exchanges? Let’s get started on this exciting adventure!

Contents

- What’s the Scoop on Fractional 1031 Exchanges?

- Key Takeaways: What You Need to Know About Fractional 1031 Exchanges

- Frequently Asked Questions

- 1. How does a fractional 1031 exchange work?

- 2. What are the benefits of a fractional 1031 exchange?

- 3. How long do I have to identify a replacement property in a fractional 1031 exchange?

- 4. Can I do a fractional 1031 exchange with any type of property?

- 5. What are the risks associated with fractional 1031 exchanges?

- Summary

What’s the Scoop on Fractional 1031 Exchanges?

Fractional 1031 exchanges have gained significant popularity in the real estate investing world. This innovative strategy allows investors to diversify their real estate holdings while deferring capital gains taxes. In this article, we will dive deep into the concept of fractional 1031 exchanges and explore how they work, their benefits, and tips for successful implementation. So, let’s get started!

Understanding Fractional 1031 Exchanges

Fractional 1031 exchanges, also known as Delaware Statutory Trust (DST) exchanges, allow investors to sell their investment property and reinvest the proceeds into a fractional ownership of a larger, professionally managed property. This type of exchange is made possible through a trust structure, where multiple investors pool their funds to acquire a property. Each investor holds a percentage interest in the property, proportional to their investment.

To qualify for a fractional 1031 exchange, the relinquished property and the replacement property must meet the requirements set forth by Section 1031 of the Internal Revenue Code. The exchange must be like-kind, meaning both properties must be held for productive use in trade, business, or investment purposes. Additionally, certain timeframes and other rules must be followed to ensure the exchange is valid for tax deferral purposes.

Benefits of Fractional 1031 Exchanges

Fractional 1031 exchanges offer several benefits to real estate investors. Here are a few key advantages:

1. Diversification: Fractional ownership allows investors to diversify their real estate portfolio across multiple properties and markets, reducing concentration risk.

2. Professional Management: By investing in fractional ownership of larger properties, investors can benefit from professional management and the expertise of experienced asset managers.

3. Passive Income: Fractional ownership typically generates passive income for investors, as property management responsibilities are handled by the trust or third-party management company.

4. Potential Appreciation: Investing in larger, professionally managed properties may offer the potential for higher and more stable appreciation rates compared to individual properties.

5. Mitigation of Liability: Owning a fractional interest in a property can potentially shift liability away from individual investors, as the trust takes on the responsibility for legal and financial obligations.

Tips for Successful Fractional 1031 Exchanges

While fractional 1031 exchanges offer enticing benefits, it’s important to approach them with caution and careful planning. Here are a few tips to ensure a successful exchange:

1. Work with Experienced Professionals: Seek guidance from qualified tax advisors, real estate attorneys, and qualified intermediaries who specialize in 1031 exchanges. They will navigate the complex tax rules and ensure compliance with regulations.

2. Thoroughly Research Properties and Investment Opportunities: Conduct due diligence on the property and trust before committing to a fractional 1031 exchange. Evaluate the property’s location, market potential, financials, and track record of the trust or management company.

3. Understand Risks and Documentation: Familiarize yourself with the risks associated with fractional ownership and review all legal documents associated with the investment. Pay attention to the trust structure, management fees, and potential exit strategies.

4. Evaluate Cash Reserves: Consider keeping cash reserves for unexpected repairs or vacancies. Having sufficient reserves will help navigate any unexpected expenses that may arise.

5. Assess Long-Term Financial Goals: Before entering into a fractional 1031 exchange, evaluate your long-term financial goals and how this investment aligns with them. Consider factors such as investment duration, potential income, and overall investment strategy.

In conclusion, fractional 1031 exchanges offer real estate investors an opportunity to diversify their holdings, gain access to professionally managed properties, and defer capital gains taxes. However, it’s crucial to approach these exchanges with informed decision-making, thorough research, and professional guidance. By doing so, investors can take advantage of the benefits while minimizing risks and maximizing returns in their real estate investment journey.

Key Takeaways: What You Need to Know About Fractional 1031 Exchanges

- Fractional 1031 exchanges allow investors to co-own properties and exchange a partial interest in them for tax benefits.

- These exchanges are a popular strategy for deferring taxes on capital gains when selling investment properties.

- Investors form a Delaware Statutory Trust (DST) to hold the co-owned property and handle the exchange process.

- Fractional 1031 exchanges provide greater diversification and passive ownership for investors.

- It’s important to carefully analyze the investment opportunity and consult with professionals before participating in a fractional 1031 exchange.

Frequently Asked Questions

Are you curious about fractional 1031 exchanges? Here are some common questions and answers to help you understand this topic better.

1. How does a fractional 1031 exchange work?

In a fractional 1031 exchange, multiple investors pool their resources to purchase a larger property. Each investor owns a fractional interest in the property, which is managed by a professional sponsor. When a property is sold, the proceeds are reinvested into another property, allowing investors to defer capital gains taxes.

This type of exchange provides an opportunity for individual investors to diversify their real estate holdings without the need for a substantial amount of capital. It also allows investors to access higher-value properties that may not be affordable on their own.

2. What are the benefits of a fractional 1031 exchange?

The main benefit of a fractional 1031 exchange is the ability to defer capital gains taxes. By reinvesting the proceeds from the sale of a property into another property, investors can defer their tax liability until they sell their fractional interest or the entire property down the line.

Additionally, a fractional 1031 exchange provides investors with the opportunity to diversify their real estate holdings without the burden of sole ownership. By pooling resources with other investors, individuals can access higher-value properties and potentially generate greater returns on investment.

3. How long do I have to identify a replacement property in a fractional 1031 exchange?

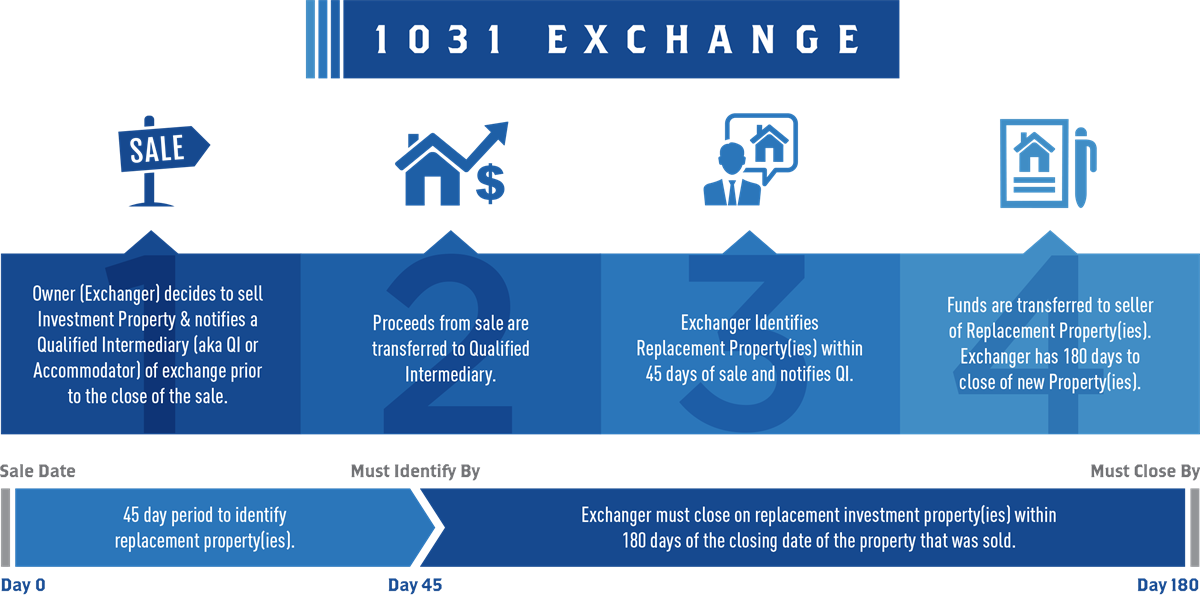

The “identification period” in a fractional 1031 exchange is typically 45 calendar days, starting from the day the original property is sold. During this time, investors must identify potential replacement properties and comply with the IRS guidelines, which require identifying up to three properties or 200% of the value of the original property.

It is crucial to work with a qualified intermediary or 1031 exchange professional to navigate the identification process correctly, ensuring compliance with IRS regulations and maximizing the benefits of the exchange.

4. Can I do a fractional 1031 exchange with any type of property?

Yes, fractional 1031 exchanges can be done with various types of investment properties, including residential, commercial, or even vacation properties. However, there are restrictions on certain types of properties, such as primary residences and personal use properties, which do not qualify for 1031 exchanges.

It is essential to consult with a tax advisor or a 1031 exchange professional to determine whether your specific property qualifies for a fractional 1031 exchange and to ensure compliance with IRS regulations.

5. What are the risks associated with fractional 1031 exchanges?

While fractional 1031 exchanges offer several advantages, they also come with certain risks that investors should be aware of. One risk is the potential illiquidity of the fractional interest. Selling a fractional interest in a property might be more challenging than selling a whole property, as buyers may be limited.

Another risk is the reliance on the professional sponsor managing the property. It is crucial to thoroughly research and select a reputable sponsor with a track record of successfully managing fractional properties. Additionally, investors should carefully review the partnership agreements and legal documents before participating in a fractional 1031 exchange.

Summary

Fractional 1031 exchanges can help you save money on taxes when buying and selling properties.

Instead of selling a property and paying taxes on the entire profit, you can exchange a portion of the property for shares in a larger property. This allows you to defer paying taxes and potentially earn more money in the long run.

However, fractional 1031 exchanges can be complicated, so it’s important to work with a qualified professional who can guide you through the process. They can help you understand the rules and regulations, determine the best properties to invest in, and ensure you meet all the requirements for a successful exchange.

By taking advantage of fractional 1031 exchanges, you can make the most of your real estate investments and keep more of your hard-earned money.

can you buy ventolin over the counter in nz: Buy Ventolin inhaler online – ventolin price uk

ventolin 4mg uk

neurontin cost in singapore: neurontin tablets 300mg – neurontin gel

ventolin prescription cost: Ventolin inhaler – ventolin canadian pharmacy

best online pharmacies in mexico: medication from mexico – purple pharmacy mexico price list

pharmacies in mexico that ship to usa: pharmacies in mexico that ship to usa – reputable mexican pharmacies online

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/en-IN/register?ref=UM6SMJM3

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.