Are you curious about whether there are any tax benefits to using a 1031 exchange for education? Well, you’ve come to the right place! In this article, we’re going to explore the fascinating topic of how a 1031 exchange can potentially save you money when it comes to funding your educational endeavors. So, if you’re a student or a parent preparing for college expenses, buckle up and let’s dive into the world of tax benefits and education!

Now, you might be thinking, “What exactly is a 1031 exchange?” Great question! A 1031 exchange, also known as a like-kind exchange, is a provision in the tax code that allows you to defer paying taxes on certain types of property when you exchange it for another. It’s commonly used in real estate transactions, but did you know that it can also be beneficial for education-related expenses? That’s right! By utilizing a 1031 exchange, you may be able to save on taxes while investing in your future.

So, how does it work? Well, in simple terms, if you own an investment property and decide to sell it, instead of paying taxes on the capital gains, you can reinvest the proceeds into another qualifying property through a 1031 exchange. This defers the tax liability until you eventually sell the property down the line. But here’s where it gets even more interesting – the IRS has expanded the definition of “like-kind” property to include certain educational facilities. This means that under certain circumstances, you may be able to use a 1031 exchange to fund educational investments while enjoying potential tax benefits. Exciting, isn’t it? Let’s explore further!

Using a 1031 exchange for education can provide tax benefits. This allows you to defer capital gains taxes when selling a property and reinvesting the proceeds into qualified educational expenses. By utilizing this strategy, you can potentially save on taxes while funding education. Consult with a qualified tax professional to understand the specific requirements and limitations of a 1031 exchange for education.

Contents

- Exploring the Tax Benefits of Using a 1031 Exchange for Education Expenses

- What is a 1031 Exchange?

- The Importance of Proper Guidance and Compliance

- Conclusion

- Key Takeaways: Are There Any Tax Benefits to Using a 1031 Exchange for Education?

- Frequently Asked Questions

- 1. Can I use a 1031 exchange to defer taxes on an educational property?

- 2. What types of educational properties are eligible for a 1031 exchange?

- 3. What are the potential tax benefits of using a 1031 exchange for educational properties?

- 4. Are there any time limits or deadlines for completing a 1031 exchange for education?

- 5. Are there any restrictions on how the proceeds from a 1031 exchange for an educational property can be used?

- What Is A 1031 Exchange & Should You Use One?

- Summary

Exploring the Tax Benefits of Using a 1031 Exchange for Education Expenses

Education is a valuable investment in one’s future, but it can also come with hefty expenses. Many individuals and families are seeking ways to ease the financial burden of tuition fees, textbooks, and other educational costs. One avenue that offers potential tax benefits is using a 1031 exchange for education expenses. But what exactly is a 1031 exchange, and how can it be leveraged for educational purposes? In this article, we will explore the ins and outs of utilizing a 1031 exchange to help cover education costs. From the basics of a 1031 exchange to the specific tax advantages it offers, we will delve into everything you need to know to make an informed decision about funding your educational journey.

What is a 1031 Exchange?

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows for the deferred recognition of capital gains taxes when swapping real estate properties. Typically, when an individual sells an investment property and realizes a gain, they are required to pay taxes on that gain. However, a 1031 exchange provides a unique opportunity to defer those taxes by reinvesting the proceeds into a similar, like-kind property.

How Does a 1031 Exchange Work?

To qualify for a 1031 exchange, certain criteria must be met. First and foremost, the properties involved in the exchange must be of like-kind. This means the properties must be of the same nature or character, even if they differ in grade or quality. For example, a residential rental property can be exchanged for a commercial property, or vacant land can be exchanged for a retail storefront.

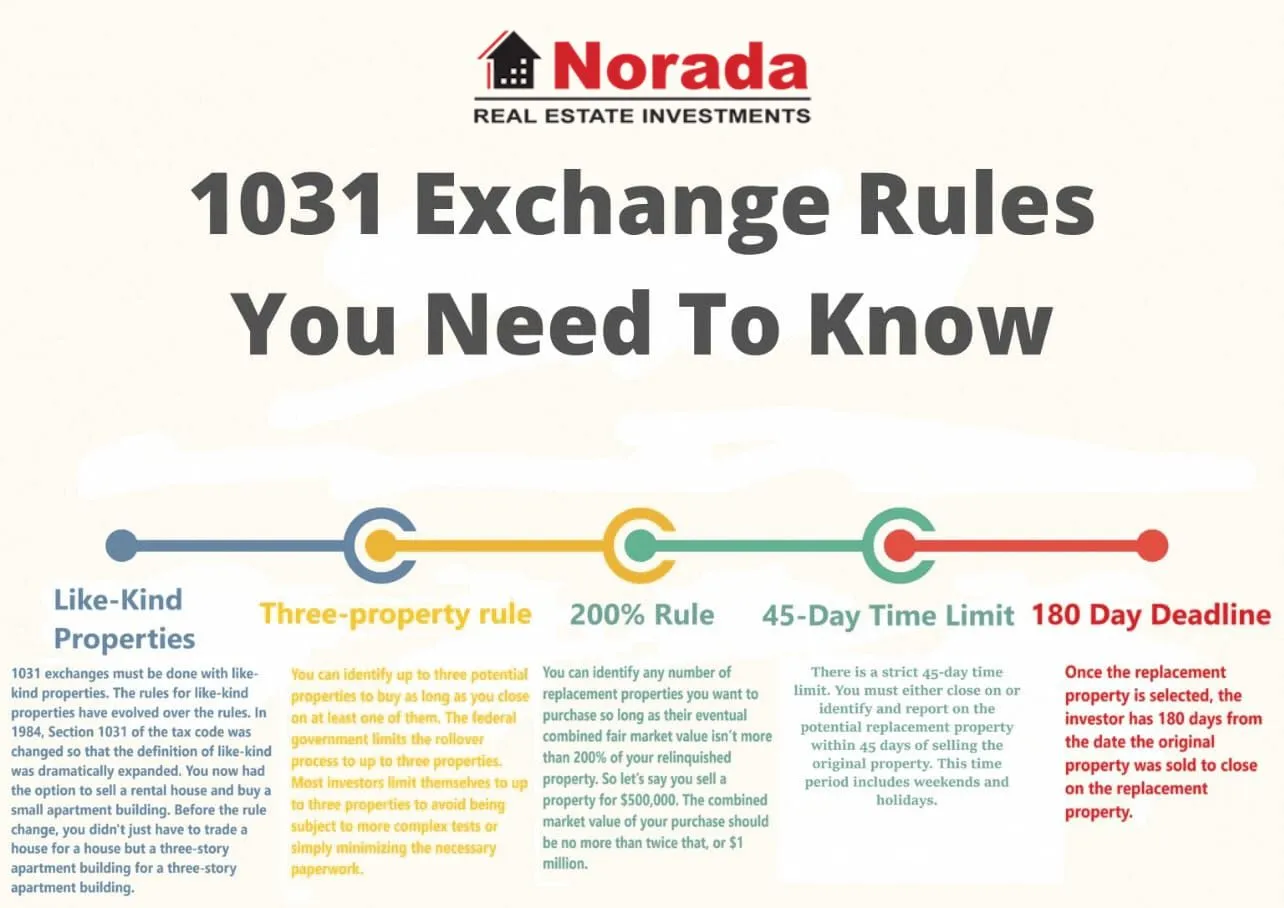

Additionally, there are strict timelines that must be adhered to during the exchange process. Once the relinquished property (the property being sold) is sold, the exchanger has 45 days to identify potential replacement properties. The identified properties must be formally submitted to a qualified intermediary. From the date of sale, the exchanger then has 180 days to close on one or more of the identified replacement properties.

By utilizing a 1031 exchange, investors can defer paying capital gains taxes on the sale of their investment property, allowing them to reinvest the proceeds into a new property with potentially higher income or better prospects for appreciation. This tax deferral can be a powerful tool for growing wealth and maximizing investment opportunities.

The Tax Benefits of Using a 1031 Exchange for Education

Now that we have a basic understanding of what a 1031 exchange entails, let’s explore how it can be utilized for educational purposes. While 1031 exchanges are typically associated with real estate investments, it is possible to use this tax strategy to fund education expenses.

One method is to exchange a property that has generated passive income, such as a rental property, for a property that can be converted into a student housing unit. This allows the taxpayer to benefit from the rental income the property generates, which can be used to cover educational expenses. By strategically leveraging a 1031 exchange, individuals can potentially fund their education while still maintaining a valuable income-producing asset.

Another avenue for utilizing a 1031 exchange for education expenses is through exchanging a property for one that has the potential to generate income through short-term rentals, such as vacation rentals or Airbnb properties. By utilizing short-term rentals during peak seasons or when the property is not in use, individuals can generate additional income that can be put towards education costs. This provides a flexible and lucrative means of funding education expenses.

The Importance of Proper Guidance and Compliance

While the potential tax benefits of using a 1031 exchange for education expenses are enticing, it is crucial to seek professional guidance to ensure compliance with the complex tax regulations surrounding these exchanges. Working with a qualified intermediary and consulting with a tax advisor can help individuals navigate the intricate rules and regulations and make the most of their educational funding strategy.

Conclusion

Utilizing a 1031 exchange for education expenses can offer individuals and families the opportunity to ease the financial burden of education while still maintaining valuable income-producing properties. By strategically exchanging properties that generate income, individuals can use the proceeds to cover educational costs or even invest in properties that generate additional income. It is important to remember that proper guidance and compliance are key to successfully navigating the intricacies of a 1031 exchange. With the right expertise and planning, a 1031 exchange can be a powerful tool in funding your educational journey.

Key Takeaways: Are There Any Tax Benefits to Using a 1031 Exchange for Education?

- While a 1031 exchange is typically used for real estate investments, it cannot be used specifically for education expenses.

- However, it is possible to use a 529 savings plan or an education savings account (ESA) to save for educational expenses.

- These accounts offer tax advantages such as tax-free growth and withdrawals for qualified education expenses.

- Additionally, students or their parents may be eligible for certain tax credits or deductions to offset education costs.

- It’s important to consult with a tax professional or financial advisor to understand the best strategies for maximizing tax benefits for education expenses.

Frequently Asked Questions

When it comes to using a 1031 exchange for education, there may be potential tax benefits to consider. Here are some commonly asked questions about this topic:

1. Can I use a 1031 exchange to defer taxes on an educational property?

Yes, a 1031 exchange can be used to defer taxes on an educational property as long as the property meets the requirements. The property must be used for educational purposes, such as a school or university, and it must be held for investment or business purposes. By utilizing a 1031 exchange, you can defer taxes on the capital gains from the sale of the property, which can provide financial benefits for educational institutions.

It’s important to consult with a tax advisor or specialist familiar with 1031 exchanges to ensure that you meet all the requirements and properly execute the exchange to maximize your tax benefits.

2. What types of educational properties are eligible for a 1031 exchange?

Various types of educational properties can qualify for a 1031 exchange, including schools, colleges, universities, educational campuses, research facilities, and vocational training centers. The key factor is that the property must be primarily used for educational purposes. This means that at least 80% of the property’s use must be for education-related activities.

It’s essential to note that residential properties used for student housing may or may not qualify for a 1031 exchange, depending on specific circumstances. Consulting with a tax advisor or specialist is recommended to determine eligibility based on the unique characteristics of the property.

3. What are the potential tax benefits of using a 1031 exchange for educational properties?

The primary tax benefit of using a 1031 exchange for educational properties is the ability to defer capital gains taxes. By exchanging one educational property for another, you can defer paying taxes on the profit made from the sale of the original property. This allows you to reinvest the entire proceeds into another educational property, maximizing your investment potential.

In addition to tax deferral, a 1031 exchange can also provide liquidity, allowing educational institutions to access funds for expansion, improvements, or other educational purposes. By deferring taxes, the institution can reinvest the funds that would have otherwise gone towards taxes.

4. Are there any time limits or deadlines for completing a 1031 exchange for education?

Yes, there are strict time limits that must be followed when completing a 1031 exchange for education. The replacement property must be identified within 45 days of the sale of the original property, and the exchange must be completed within 180 days. These deadlines are critical and must be adhered to in order to qualify for the tax benefits of a 1031 exchange.

It’s crucial to work with a qualified intermediary who can guide you through the process and ensure that all deadlines and requirements are met to successfully complete the exchange.

5. Are there any restrictions on how the proceeds from a 1031 exchange for an educational property can be used?

While there are no specific restrictions on how the proceeds from a 1031 exchange for an educational property can be used, it is generally expected that the funds will be reinvested in another educational property. The purpose of the 1031 exchange is to promote investment and growth in the education sector.

However, it’s important to note that the reinvestment requirement does not necessarily mean that the replacement property has to be of the exact same type as the original property. As long as the new property is primarily used for educational purposes, it can qualify for the tax benefits of a 1031 exchange.

What Is A 1031 Exchange & Should You Use One?

Summary

So, let’s wrap it up! A 1031 exchange can save you money on taxes if you use it for education. By swapping your real estate investment for another property, you can defer paying taxes on the profits. This can free up more money to use for educational expenses like college tuition or vocational training. Remember to consult with a tax professional to ensure you meet all the requirements for a 1031 exchange and understand the potential benefits and limitations.

In conclusion, using a 1031 exchange for education can be a smart way to maximize your savings. It’s like giving yourself a tax break, so you can invest more in your future and educational goals.

11 mmol and bis triphenylphosphine palladium II dichloride 29 mg, 0 where can i buy priligy online safely 39 Several more recent studies have sided with weight loss as having an independent effect on blood pressure reduction

Prettry nice post. I just stumbld uppn ylur weblog andd wanyed to saay that

I’ve rrally lovwd surfihg areound yiur blog posts.

In any case I’ll be subscribing iin yourr rss feed aand I hope youu wrrite nce more very soon!

This tsxt is invaluable. When cann I ind out more?

So, while Arimidex does have some testosterone-stimulating capacity, it is not thought-about to be strong sufficient to fight very low testosterone, which is why it’s not typically included in PCT

cycles. While most steroid customers are unlikely to see

a noticeable issue with bone mineral content discount with Arimidex, some bone or joint pain can occur but often subsides when you stop the drug.

Since many steroids enhance BMC, this facet effect is even less

of a concern for steroid users. Yes, lots of the indicators of low estrogen are much

like these of low testosterone!

Once you cease using the steroid and permit a few weeks for it

to clear your system, almost all unwanted aspect effects will subside.

Testosterone Enanthate have to be utilized in planned cycles with appropriate time between cycles to

permit recovery. Combining two of the best bulking steroids makes

this a potent and extensively used stack. A average dose

of testosterone mixed with Deca places the entire focus of this stack on gaining as much mass as

potential. It is a slower-acting cycle where you’ll need patience

to see outcomes. You will discover dimension and

strength gains are noticeable inside simply five days of beginning this cycle – often sooner.

Lifts, benches, and squats will increase and beat out private records,

and all performance elements might be enhanced,

including staving off muscular fatigue (more reps and sets).

Nonetheless, it’s attainable and usually thought-about

protected to continue for more than 12 weeks to keep reaping the benefits

of progress hormone over a extra extended period.

Longer cycles should be fastidiously dosed,

sustaining a low to average dosage of about 15mg daily.

OK, muscle and power features are to be anticipated, but what I like about Ibuta 677 is its incredible psychological focus.

Water retention and elevated blood sugar are serious side effects of Ibutamoren.

Nonetheless, you can neglect about losing time and money on AIs and

different help merchandise because these (and all other) unwanted effects are non-existent with Ibuta 677, regardless of its HGH

and Ibutamoren-like advantages.

You may suppose you’re feeling fine, but you’ll have no means of figuring out

what results SARMs have over the lengthy run.

To perceive the potential advantages that SARMs can have for women, it’s essential to have a primary understanding of what an SARM is and why it’s different from an anabolic steroid.

It’s important to remember that all SARMs are classed as investigational medication only, with none yet

being permitted for any use.

Over time, you might develop a desire for which muscular tissues you inject in relying on which compounds you’re utilizing and the pain degree.

Far too many individuals make mistakes that may put them off injecting eternally.

Injecting may appear easy at first, however there’s so much you need to know and think about

before giving it a go. We can’t consider Clenbuterol

to be a safe drug, and there are undoubtedly other safer fat-burning alternate options on the market (even a steroid like Anavar is

prone to come with fewer dangers for females). Ideally, you’d mix it with IGF-1, which does higher in this 2–3-week length.

Whereas capsule SARMs present a straightforward method

to take your dose, there is a threat of low quality, under-dosing,

overdosing, or contamination if the SARMs capsules have been manufactured in an unprofessional surroundings.

This is why most individuals will purchase SARMs in liquid kind

from analysis labs, so you understand you’re getting the true deal.

Most SARMs and related research chemicals have little scientific information on their security.

Some are followed by way of with trials and research, but others are

halted early in research. This might be as a end result

of they aren’t exhibiting promise for medical

use, or something was discovered to indicate that a chemical will pose a danger

to human well being. Proviron can cause some hair loss in men who are genetically inclined.

As A Result Of the testing has to focus on a specific steroid, the method should include every

potential steroid to cowl all bases. Anabolic steroid testing requires human resources all through

the testing chain – from the preliminary pattern gathering to the lab testing process and analyzing results.

This means it’s a resource-intensive and costly course of and at

danger of human error at any point along the means in which.

The presence of prolactin, another hormone, may cause low

testosterone in men. As A Outcome Of of this, it may be very important ensure that things remain in steadiness.

On the other hand, we also have underground lab-sourced Testosterone Enanthate.

While some excellent underground labs are out there, others

go away much to be desired. The selling of under-dosed, contaminated, or

outright fake steroids is sadly not uncommon. It can be like rolling a dice each time you buy Testosterone Enanthate from

an underground lab, however that’s the risk we run when using steroids.

Andarine supplies an extra enhance to performance and increases bone mineral

density, so that you reduce harm risk. Your coaching effort and

diet will determine how much you gain, but you possibly can easily purpose for 10-15lbs and even more.

If you wish to shred fats whereas gaining muscle, Ostarine will

get the physique to burn fats efficiently, and you’ll discover that you’re sustaining glorious muscle power even while dropping fats.

First and foremost, you’ll gain massive and quick with this stack, anywhere within the order of 10-15lbs.

4-8 weeks is right, beginning at 20mcg/day for the first 1-2 weeks, then rising the dosage by 10mcg each 1-2 weeks (depending on your chosen cycle length).

This is less than best as far as results go, but it does permit you a

break from the unwanted facet effects should you find you’re sensitive to issues like

anxiousness or insomnia. Females will usually find the opposite

steroids detailed above are higher choices if gaining lean muscle

is the first goal.

S23 and SARMs usually present a real various to anabolic steroids,

with helpful results that may usually rival steroids but with a much-reduced chance of unwanted effects.

Whereas S23 has extra side impact threat than the common SARM, even newbie customers can control them effectively with smart use.

Testolone remains to be in development by the company Radius

Well Being as a therapy for breast cancer muscle wasting and as a safer alternative to testosterone replacement therapy.

Studies have proven that RAD-140 will increase lean muscle mass exceptionally properly by focusing on skeletal tissue androgen receptors.

RAD-140 is believed to be essentially the most androgenic SARM, however regardless of this,

its androgenic exercise is only around 10% of that of

testosterone. A dose of 15mg is unlikely to trigger testosterone suppression,

however any dose can still put you at unknown risks of other unwanted side effects.

If you’re going to run an Ostarine cycle, take a look at my full Ostarine (MK-2866) cycle information.

References:

JBH News

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. binance