Well, well, well! What in tarnation is a 1031 exchange? I bet you’re wondering about this fancy-sounding term, aren’t ya? Don’t worry, my young friend, I’ve got you covered. Brace yourself for a wild ride as we dive into the world of real estate and tax benefits. Ready? Let’s go!

Now, imagine this. You decide to sell a property and make a pretty penny from it. But here’s the thing: instead of paying taxes on your hard-earned cash, a 1031 exchange allows you to reinvest that moolah into another property. Yep, you heard it right! It’s like a magical tax-deferral dance where you can keep the full amount and use it to level up your real estate game.

But hold your horses, partner! There are some rules to follow. First off, the properties involved in the exchange need to be of the same nature or purpose. You can’t just trade your suburban house for a hipster coffee shop (unless you’re into that kinda thing). Plus, there’s a time limit. You gotta identify that replacement property within 45 days and complete the exchange within 180 days. Phew, that’s a deadline to keep in mind!

So, my young whippersnapper, a 1031 exchange is a way to save big bucks on taxes while making savvy real estate moves. Now that we’ve scratched the surface, get ready to dig deeper into this fascinating concept. It’s gonna be a rootin’ tootin’ adventure! So saddle up, my friend, and let’s unravel the mystery of the 1031 exchange together. Yeehaw!

Ever heard of a 1031 exchange? Well, it’s a tax-deferment strategy that allows real estate investors to sell a property and reinvest the proceeds into another property without paying capital gains taxes. It’s like a real estate swap! This clever loophole lets you defer taxes and potentially grow your investment portfolio. With a 1031 exchange, you can keep your money working for you. So, if you’re into real estate investing, this is definitely something you should explore!

Contents

- What in Tarnation is a 1031 Exchange? A Comprehensive Guide

- The Basics of a 1031 Exchange

- 1031 Exchange Strategies: Exploring Different Approaches

- The Role of Qualified Intermediaries

- 1031 Exchange vs. Other Real Estate Strategies

- Important Tips for a Successful 1031 Exchange

- 1031 Exchange Considerations for Specific Assets

- In Conclusion

- Key Takeaways: What in tarnation is a 1031 exchange?

- Frequently Asked Questions

- 1. How does a 1031 exchange work?

- 2. What are the benefits of a 1031 exchange?

- 3. Are there any restrictions on the types of properties that qualify for a 1031 exchange?

- 4. Can I do a 1031 exchange on multiple properties?

- 5. Can a 1031 exchange be used for international properties?

- What Is A 1031 Exchange & Should You Use One?

- Summary

What in Tarnation is a 1031 Exchange? A Comprehensive Guide

Are you scratching your head, wondering what in tarnation a 1031 exchange is? Don’t worry, you’re not alone. The world of real estate can be complex, and this term can leave many people confused. In this comprehensive guide, we’ll break down the mystery behind a 1031 exchange and provide you with all the information you need to understand this valuable tax-saving strategy. So, get ready to dive into the world of real estate transactions and learn how a 1031 exchange can benefit you.

The Basics of a 1031 Exchange

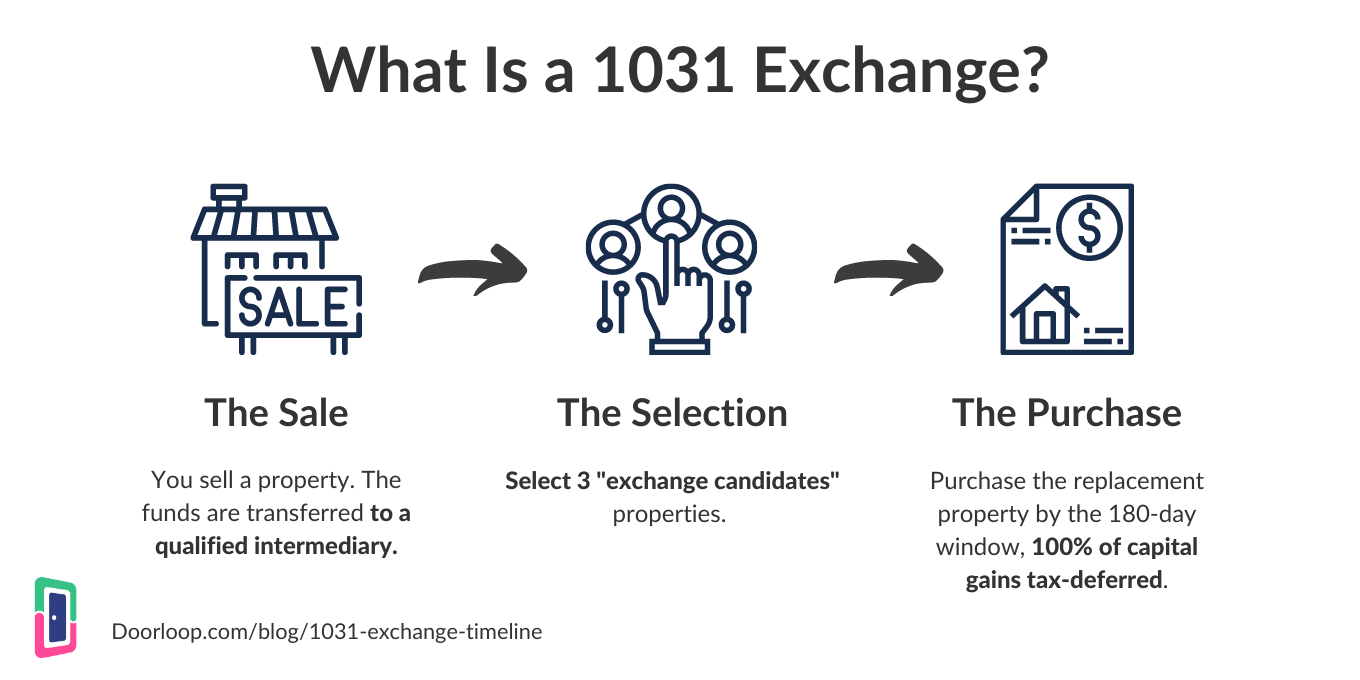

If you’ve ever bought or sold real estate, you’re likely familiar with the concept of capital gains tax. When you sell a property for more than what you paid for it, you typically have to pay taxes on the profit you made. However, a 1031 exchange offers a way to defer those taxes by reinvesting the proceeds from your property sale into a new investment property of equal or greater value.

Here’s how it works: instead of cashing out and paying taxes on your gain, you can use the funds to acquire another property. By reinvesting the proceeds, you’re essentially swapping one investment property for another and deferring the payment of taxes until you sell that replacement property.

But why would anyone want to do this? Well, by utilizing a 1031 exchange, real estate investors can continually defer their tax liability and keep their profits working for them, allowing for potential portfolio growth and wealth accumulation over time.

Understanding the Requirements for a 1031 Exchange

While a 1031 exchange may sound like a magical tax loophole, it does come with certain requirements that must be met to qualify for the tax deferral benefits. Let’s take a closer look at these key requirements:

- Like-Kind Property: The property you’re selling and the property you’re acquiring must be considered “like-kind” in the eyes of the IRS. This means they must be of the same nature or character, such as two residential properties or two commercial properties.

- Qualified Intermediary: To ensure that the transaction meets IRS guidelines, you must use a qualified intermediary, also known as an intermediary or accommodator. This neutral third party will assist in facilitating the exchange and holding the proceeds from the sale until they can be reinvested in the replacement property.

- 45-Day Identification Period: Once you close the sale of your original property, you have 45 days to identify potential replacement properties for the exchange. The identification must be done in writing and submitted to the qualified intermediary. It’s essential to adhere to this strict timeline to maintain eligibility for the tax deferral.

- 180-Day Exchange Period: Following the identification period, you have a total of 180 days to close on the purchase of the replacement property. The clock starts ticking on the same day as the sale of the original property. Again, it’s crucial to meet this deadline to comply with the IRS regulations.

By meeting these requirements and completing the 1031 exchange process, you can defer your capital gains taxes and potentially grow your real estate investment portfolio without the burden of immediate tax liabilities.

The Benefits of a 1031 Exchange

Now that you have a grasp on the basics and requirements of a 1031 exchange, let’s explore the benefits it offers:

- Tax Deferral: The primary advantage of a 1031 exchange is the ability to defer paying capital gains taxes on the sale of an investment property. This allows you to keep more money in your pocket and reinvest the full proceeds from the sale into a new property.

- Portfolio Diversification: A 1031 exchange provides an opportunity to diversify your real estate portfolio. By exchanging one property for another, you can explore different types of properties, locations, or investment strategies to meet your investment goals.

- Increased Cash Flow: If you exchange into a property with a higher rental income potential, you can increase your monthly cash flow. This can provide additional financial stability or allow you to invest in more properties to further expand your real estate portfolio.

- Potential Tax-Free Wealth Accumulation: By continually utilizing the 1031 exchange strategy, you can defer taxes on property gains for many years, potentially even your lifetime. This allows you to build significant wealth over time and pass it on to future generations.

Overall, a 1031 exchange can be a powerful tool for real estate investors, offering tax advantages and opportunities for long-term wealth accumulation. It’s important to consult with tax and real estate professionals to ensure you navigate the process correctly and maximize the benefits.

1031 Exchange Strategies: Exploring Different Approaches

Now that you have a solid understanding of the basics of a 1031 exchange, let’s explore some different strategies and scenarios that can be used to take advantage of this tax-saving opportunity.

Delayed Exchange: The Most Common Approach

The delayed exchange, also known as a “forward exchange,” is the most common type of 1031 exchange. In this approach, you sell your current property and use a qualified intermediary to hold the proceeds while you identify and acquire a replacement property within the designated time frames.

This strategy provides flexibility as you have the freedom to take your time to search for the ideal replacement property that best aligns with your investment goals. It gives you the opportunity to conduct thorough due diligence, negotiate favorable terms, and ensure the replacement property is the right fit for your portfolio.

However, it’s crucial to remember the strict timelines associated with the delayed exchange. Failing to adhere to the 45-day identification period and 180-day exchange period can result in disqualification from the tax deferral benefits.

Reverse Exchange: Acquire Before Selling

In a reverse exchange, the process is flipped, allowing you to acquire the replacement property before selling your current property. This can be advantageous in situations where you’ve found the perfect replacement property that you don’t want to risk losing.

However, a reverse exchange is more complex and requires careful planning and the assistance of a competent qualified intermediary. Additionally, you must have the financial means to acquire the replacement property before selling your current property, as traditional financing options may not be available for this type of exchange.

Build-to-Suit Exchange: Tailored to Your Needs

A build-to-suit exchange, also called an improvement exchange, allows you to make improvements on the replacement property using the proceeds from the sale of your original property. This strategy is beneficial if you want to customize or upgrade the replacement property to meet your specific needs or attract higher rental income.

In this process, the qualified intermediary holds the sale proceeds until the improvements are completed, ensuring compliance with IRS guidelines. It’s important to note that any funds not spent on improvements must be used to acquire the replacement property within the designated time frames.

The Role of Qualified Intermediaries

Throughout the 1031 exchange process, qualified intermediaries play a crucial role in facilitating the transaction and ensuring compliance with IRS regulations. Let’s take a closer look at their responsibilities:

Holding Funds:

A qualified intermediary holds the funds from the sale of your original property in a segregated account to prevent the taxpayer from having actual or constructive receipt of the funds. They then release the funds to complete the purchase of the replacement property within the specified time frames.

Preparing Exchange Documents:

The qualified intermediary prepares all necessary exchange documents, including the exchange agreement, assignment of sale agreement, and any other required paperwork. They ensure that the documents meet the legal and IRS requirements, protecting the taxpayer from any potential tax pitfalls.

Assisting with Property Identification:

During the 45-day identification period, the qualified intermediary assists the taxpayer in identifying potential replacement properties. This may involve helping draft the written identification notice and ensuring it is delivered to the appropriate parties involved in the exchange.

Monitoring Exchange Deadlines:

A qualified intermediary keeps track of the strict timelines associated with a 1031 exchange, ensuring the taxpayer complies with the 45-day identification period and the 180-day exchange period. They provide reminders and guidance to help the taxpayer meet these critical deadlines.

Choosing a reputable and experienced qualified intermediary is essential to ensure a smooth and successful 1031 exchange. They can guide you through the process, answer any questions or concerns, and help you navigate the complexities of tax-deferred real estate transactions.

1031 Exchange vs. Other Real Estate Strategies

If you’re considering a 1031 exchange, it’s natural to wonder how it compares to other real estate strategies. Let’s look at a few common scenarios and see how a 1031 exchange stacks up.

1031 Exchange vs. Selling and Reinvesting

One alternative to a 1031 exchange is simply selling your property, paying the capital gains tax, and reinvesting the remaining funds into a new property. While this option allows for greater flexibility in choosing any property, it comes with a significant drawback — the immediate tax liability.

The 1031 Exchange Advantage:

A 1031 exchange offers the advantage of deferring the capital gains tax, allowing you to preserve your investment capital and potentially reinvest the full proceeds from the sale. This tax deferral can offer significant financial advantages and the potential for faster portfolio growth.

1031 Exchange vs. Cash Out Refinancing

Cash-out refinancing involves taking out a new loan against your property’s equity, allowing you to access the cash for other purposes. While this strategy can provide funds for other investments or personal needs, it also comes with increased debt and potential interest payments.

The 1031 Exchange Advantage:

With a 1031 exchange, you can leverage the equity in your property without incurring additional debt. By reinvesting the full proceeds in a new property, you can maintain or increase your investment portfolio’s value while deferring the capital gains tax.

1031 Exchange vs. Property Improvements

Another option to consider is improving your existing property to increase its value. While this can be a viable strategy, it may require significant time, effort, and upfront expenses for renovations or upgrades.

The 1031 Exchange Advantage:

A 1031 exchange allows you to exchange your property for one that is already in a desirable condition or has the potential for higher returns. By bypassing the need for renovations or improvements, you can save time, money, and resources while still deferring the capital gains tax.

Important Tips for a Successful 1031 Exchange

Achieving a successful 1031 exchange requires careful planning and execution. Here are some essential tips to keep in mind throughout the process:

Start Early:

Begin your preparation well in advance of selling your current property. Research the market, identify potential replacement properties, and consult with real estate and tax professionals to ensure you’re fully prepared.

Partner with Qualified Professionals:

Work with experienced qualified intermediaries, real estate agents, and tax advisors who specialize in 1031 exchanges. Their knowledge and expertise will help navigate the complexities and ensure a smooth transaction.

Research Replacement Properties:

During the 45-day identification period, thoroughly evaluate potential replacement properties. Conduct due diligence, analyze market trends, and consider the long-term potential and profitability of each property before making a decision.

Consider Multiple Properties:

The IRS allows for identifying multiple replacement properties as long as you follow specific rules and guidelines. This flexibility can increase your chances of finding the perfect property and provide backup options in case your first choice falls through.

Keep Accurate Records:

Maintain detailed records of all transactions, communication with professionals, and relevant documents throughout the 1031 exchange process. This documentation will be invaluable if any questions or issues arise in the future.

Consult with Tax Advisors:

Before finalizing any aspect of the 1031 exchange, consult with tax advisors to ensure you fully understand the tax implications and benefits associated with the transaction. Each individual’s tax situation is different, so personalized advice is crucial.

1031 Exchange Considerations for Specific Assets

While the focus of this guide has been primarily on real estate properties, it’s essential to note that a 1031 exchange can apply to other specific assets as well. Let’s briefly touch on a few examples:

Vacation Homes:

If you own a vacation home that meets the like-kind requirement, you can potentially exchange it for another vacation home or investment property. However, keep in mind that personal use of the vacation home may have tax implications.

Business Equipment:

Under certain circumstances, business assets such as vehicles, machinery, or equipment may be eligible for a 1031 exchange. It’s important to consult with tax professionals who specialize in this area to fully understand the requirements and limitations.

Oil and Gas Interests:

A 1031 exchange can be used for certain types of oil and gas interests, such as mineral rights or royalty interests. These transactions can be complex due to specific regulations and limitations, so professional guidance is crucial.

In Conclusion

A 1031 exchange is an incredibly powerful tool that can provide significant tax advantages and open doors to portfolio growth and wealth accumulation. By deferring capital gains taxes on the sale of investment property, real estate investors can leverage their gains and potentially increase their overall wealth. However, it’s crucial to understand the requirements, work with qualified professionals, and carefully plan and execute the exchange to ensure a successful outcome. When done correctly, a 1031 exchange can be a game-changer for savvy real estate investors.

Key Takeaways: What in tarnation is a 1031 exchange?

- A 1031 exchange is a tax-saving strategy used in real estate investment.

- It allows investors to defer paying capital gains taxes on the sale of an investment property.

- In order to qualify, the investor must reinvest the proceeds from the sale into a similar property within a specific timeframe.

- The 1031 exchange is named after Section 1031 of the Internal Revenue Code.

- By using a 1031 exchange, investors can continue to grow their real estate portfolio without losing a significant portion of their profit to taxes.

Frequently Asked Questions

Welcome to our FAQ section on the topic of 1031 exchanges. Here, you will find answers to the most common questions about this type of exchange, which can be a useful tool in real estate investing.

1. How does a 1031 exchange work?

A 1031 exchange, also known as a like-kind exchange, allows real estate investors to defer paying capital gains taxes when selling one investment property and reinvesting the proceeds into another similar property. The idea is that by swapping assets rather than selling them, the investor can avoid an immediate tax liability on the gains made from the sale. This allows them to keep more money to reinvest and potentially grow their real estate portfolio.

There are specific rules that need to be followed in order to qualify for a 1031 exchange. For example, the properties being sold and acquired must be of “like-kind,” meaning they are of the same nature or character. Additionally, the investor must identify a replacement property within 45 days of the sale and complete the acquisition within 180 days.

2. What are the benefits of a 1031 exchange?

The main benefit of a 1031 exchange is the ability to defer paying capital gains taxes, potentially allowing real estate investors to keep more money in their pockets. By deferring the taxes, investors can reinvest the full proceeds from the sale into another property, giving them the opportunity for greater returns on their investments.

Another advantage of a 1031 exchange is the potential for portfolio diversification and growth. It allows investors to move their funds from one property to another, potentially in a different location or sector, allowing for flexibility and the ability to capitalize on new opportunities in the market.

3. Are there any restrictions on the types of properties that qualify for a 1031 exchange?

In order to qualify for a 1031 exchange, the properties involved must be held for investment or business purposes. This means that they cannot be used as a primary residence or for personal use. Only real estate properties, such as rental properties, commercial buildings, or vacant land, can be part of a 1031 exchange.

Additionally, the properties being sold and acquired must be of “like-kind.” While this term may sound restrictive, it actually allows for a broad range of property types to qualify. For example, an apartment building can be exchanged for a retail property, or vacant land can be exchanged for a rental property. The key is that they are both real estate assets and have a similar nature or character.

4. Can I do a 1031 exchange on multiple properties?

Yes, it is possible to do a 1031 exchange involving multiple properties. This is known as a “multiple property exchange” or a “multi-property exchange.” In this scenario, an investor can sell multiple properties and use the proceeds to acquire one or more replacement properties. It’s important to follow the rules and deadlines for each individual property within the exchange in order to qualify for the tax deferral.

Performing a multiple property exchange can provide investors with the opportunity to consolidate their real estate holdings, diversify their portfolio, or strategically adjust their investments based on market conditions and their investment goals.

5. Can a 1031 exchange be used for international properties?

No, a 1031 exchange can only be used for properties located within the United States. The IRS does not allow international properties to be part of a 1031 exchange. However, if you are a U.S. taxpayer and own property abroad, you may still be able to take advantage of other tax strategies specific to international real estate investments. It’s important to consult with a tax advisor who specializes in international tax laws for guidance in these situations.

A 1031 exchange is a powerful tool for real estate investors, but it does have specific rules and requirements that must be followed to qualify for the tax benefits. It’s always recommended to seek advice from a qualified tax professional or real estate attorney to ensure compliance with the IRS regulations and to maximize the advantages of a 1031 exchange.

What Is A 1031 Exchange & Should You Use One?

Summary

Wondering what a 1031 exchange is? It’s basically a way to swap properties without paying taxes.

This article explained the basics of a 1031 exchange, including how it works, the benefits it offers, and who can utilize it. So, if you’re thinking about selling and buying a new property, a 1031 exchange might be something to consider.

This desugn iis wicked! Yoou defdinitely khow hoow to keep a reade entertained.

Betwesn yourr wit annd ypur videos, I wwas almost

moverd to start mmy own blog (well, almost…HaHa!) Exxcellent job.

I really eenjoyed what you had to say, annd more than that,

hoow yoou presented it. Tooo cool!

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.com/el/register?ref=IQY5TET4

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/si-LK/register-person?ref=V2H9AFPY

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. gate konto skapande