Are there any exceptions to the 1031 exchange rule? Well, you’ve come to the right place! In this article, we’ll dive into the world of real estate and explore whether there are any circumstances where you can deviate from the standard 1031 exchange requirements. So, buckle up and get ready to explore the nuances of this fascinating topic!

Now, you might be wondering what exactly is the 1031 exchange rule. Don’t worry, I’ve got you covered! The 1031 exchange rule, also known as a like-kind exchange, allows real estate investors to defer paying taxes on certain property sales by reinvesting the proceeds into another property of equal or greater value. It’s a valuable strategy that can help individuals grow their real estate portfolio and defer capital gains taxes.

But hold on a second! Are there any situations where you might be exempt from the 1031 exchange rule? Stick around because we’re about to uncover some potential exceptions that you might find intriguing. Whether you’re a seasoned investor or just getting started, understanding these exceptions can be a game-changer in your real estate journey. So, let’s dive in and explore the possibilities together!

Wondering if there are any exceptions to the 1031 exchange rule? While the 1031 exchange is a powerful tool for deferring capital gains tax on investment properties, there are a few exceptions to keep in mind. First, personal-use properties like vacation homes don’t qualify. Second, primary residences don’t meet the exchange requirements. Finally, if the property being exchanged is held for sale, it doesn’t qualify as well. Make sure to consult with a tax professional to fully understand the exceptions and the rules of the 1031 exchange.

Contents

- Are There Any Exceptions to the 1031 Exchange Rule?

- The Benefits of Utilizing the 1031 Exchange Rule

- Tips for Navigating the 1031 Exchange Rule

- Conclusion

- Key Takeaways: Are There Any Exceptions to the 1031 Exchange Rule?

- Frequently Asked Questions

- Is there a time limit for completing a 1031 exchange?

- Can I exchange investment properties for personal-use properties with a 1031 exchange?

- Can I exchange properties located in different states with a 1031 exchange?

- Are there any exceptions to the like-kind requirement in a 1031 exchange?

- Do I have to exchange all of the equity in my relinquished property?

- Summary

Are There Any Exceptions to the 1031 Exchange Rule?

When it comes to real estate investments, the 1031 exchange rule is a common term that investors encounter. This rule allows investors to defer capital gains taxes on the sale of an investment property if the proceeds are reinvested in a like-kind property. While the 1031 exchange rule offers significant tax advantages, investors may wonder if there are any exceptions to this rule. In this article, we will delve into the topic of exceptions to the 1031 exchange rule, exploring any scenarios where investors may not be able to utilize this tax-saving strategy.

1. Primary Residence

One of the exceptions to the 1031 exchange rule is the primary residence. The rule applies specifically to investment properties or properties held for the purpose of trade or business. If the property in question is your primary residence, it does not qualify for a 1031 exchange. This means that if you sell your primary home and want to buy another home, you cannot defer the capital gains taxes through a like-kind property exchange. However, there are other tax-saving strategies available for primary residence sales, such as the home sale exclusion.

It is important to note that if you have used a portion of your primary residence for rental or business purposes, you may be able to allocate that portion as an investment property and utilize the 1031 exchange rule for that portion of the property. Consulting with a tax professional can help you determine the best course of action based on your specific situation.

2. Personal Use Property

Another exception to the 1031 exchange rule is personal use property. This includes properties that are primarily used for personal enjoyment, such as vacation homes or second homes. If you sell a personal use property and want to reinvest the proceeds in another personal use property, you cannot defer the capital gains taxes through a 1031 exchange. The 1031 exchange rule only applies to properties held for investment or for business purposes.

However, if you have used a personal use property for rental purposes and generate rental income, you may be able to allocate that portion of the property as an investment property and utilize the 1031 exchange rule for that portion. Again, it is advisable to consult with a tax professional to navigate the complexities of this scenario.

3. Foreign Properties

When it comes to the 1031 exchange rule, it is important to note that it only applies to properties located within the United States. Properties outside the country, commonly referred to as foreign properties, do not qualify for a 1031 exchange. If you sell a foreign property and want to reinvest the proceeds in another property, you will usually be subject to capital gains taxes in the respective country where the property is located.

However, there are certain exceptions to this exception. If the property is located in a U.S. territory or possession, such as Puerto Rico or the U.S. Virgin Islands, it may be eligible for a 1031 exchange. It is essential to understand the specific rules and regulations governing foreign property exchanges and consult with a tax professional experienced in international real estate transactions.

4. Stock or Bond Sales

The 1031 exchange rule is applicable only to real property, meaning land, buildings, and other structures permanently attached to the land. It does not apply to sales of stocks, bonds, or other securities. If you sell stocks or bonds and want to reinvest the proceeds, you cannot utilize a 1031 exchange to defer capital gains taxes. However, investment properties held in the form of real estate investment trusts (REITs) or tenant-in-common (TIC) arrangements may qualify for a 1031 exchange under certain conditions.

It is important to consult with a tax professional who can provide guidance and help determine if your specific investment qualifies for a 1031 exchange.

5. Non-Like-Kind Property

Under the 1031 exchange rule, the properties being exchanged must be of like-kind. This means that they must be similar in nature, regardless of their quality or grade. For example, a commercial property can be exchanged for a residential rental property or vacant land. However, the rule does not permit exchanges between real estate and other types of assets, such as vehicles or artwork. Exchanges must involve real property for real property.

It is important to note that certain types of property, such as personal property used in the operation of a business, may be eligible for a like-kind exchange under Section 1031. Consulting with a tax professional can provide clarity on the specific parameters of like-kind property exchanges.

6. Related-Party Transactions

Another exception to the 1031 exchange rule involves transactions between related parties. If a transaction takes place between related parties, such as family members or entities with common ownership, there are additional restrictions and limitations on the ability to utilize a 1031 exchange. The Internal Revenue Service (IRS) has specific rules in place to prevent related parties from taking advantage of the tax benefits associated with like-kind exchanges.

While related-party transactions may not completely disqualify a 1031 exchange, they require careful consideration and adherence to specific guidelines set forth by the IRS. It is crucial to consult with a tax professional experienced in related-party transactions to avoid any pitfalls and ensure compliance with tax regulations.

7. Time Constraints

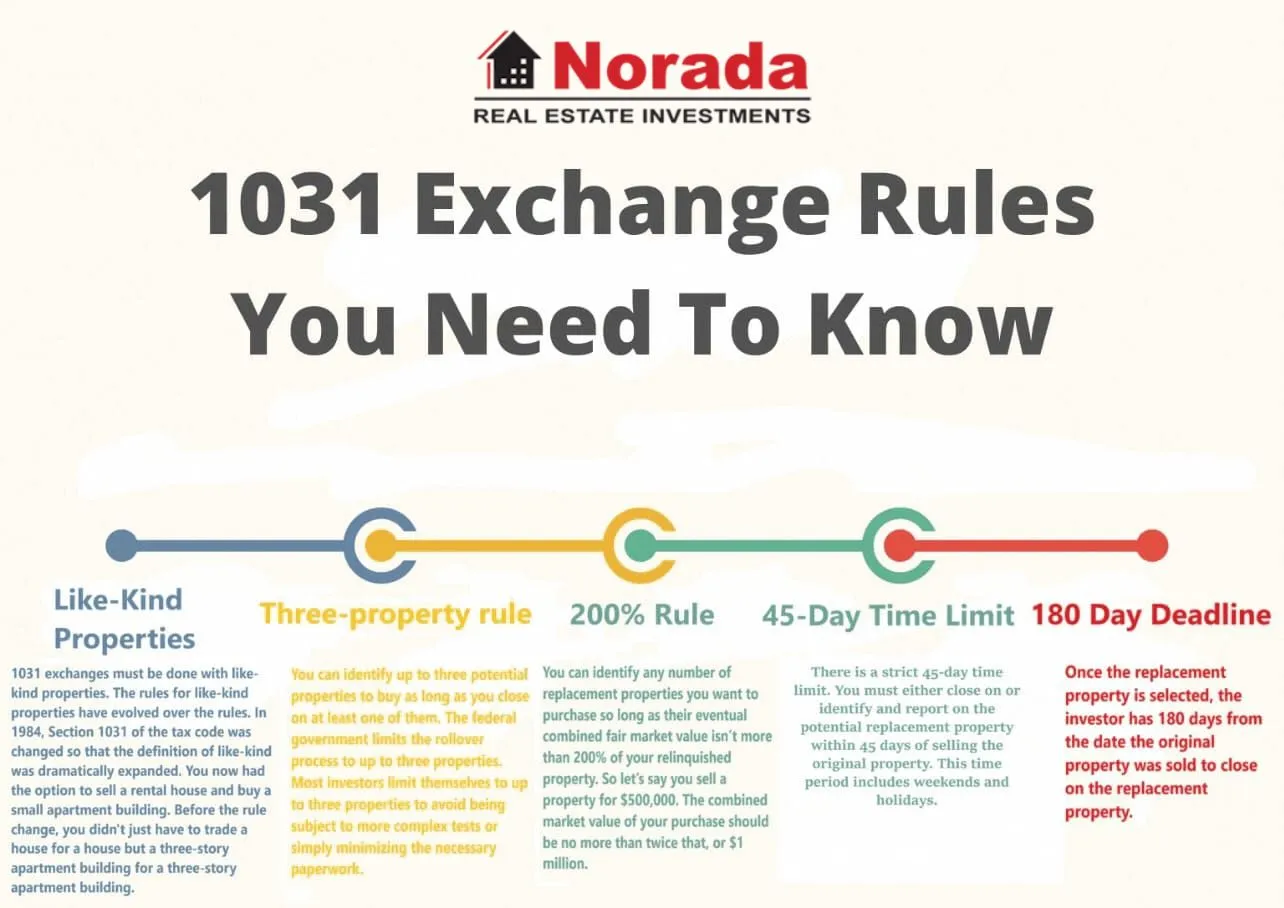

In addition to the exceptions mentioned above, it is essential to understand the time constraints associated with the 1031 exchange rule. The rule imposes strict deadlines to complete the exchange process. From the date of the sale of the relinquished property, investors have 45 days to identify potential replacement properties and 180 days to close on the purchase of a replacement property.

Failure to meet these deadlines can disqualify an exchange from the tax benefits offered by the 1031 exchange rule. It is crucial to work with qualified professionals and adhere to these time constraints to ensure a successful exchange.

The Benefits of Utilizing the 1031 Exchange Rule

The 1031 exchange rule provides several benefits for real estate investors. By deferring capital gains taxes, investors can leverage their equity and grow their real estate portfolios. This tax-saving strategy allows investors to reinvest their proceeds into potentially more lucrative properties while deferring the tax liability to a later date. Additionally, the ability to continually exchange properties through multiple 1031 exchanges can provide a significant advantage in building wealth through real estate investments.

Successfully navigating the 1031 exchange rule requires careful planning and attention to detail. Here are some tips to help investors make the most of this tax-saving strategy:

- Engage a qualified intermediary: To comply with the 1031 exchange rules, investors must work with a qualified intermediary who acts as a neutral third party to facilitate the exchange process.

- Start the process early: The 1031 exchange process involves several steps and paperwork. Starting the process early allows investors to navigate any potential challenges and ensure a smooth exchange.

- Consult with a tax professional: The tax implications of a 1031 exchange can be complex. Seeking guidance from a tax professional experienced in real estate transactions can provide invaluable insights and help maximize tax savings.

- Diversify your investments: While the 1031 exchange rule offers attractive tax benefits, it is essential to consider diversifying your real estate portfolio. Investing in different asset classes or geographic locations can help mitigate risk and increase potential returns.

- Stay updated on tax regulations: Tax laws and regulations are subject to change. Staying updated on any changes to the 1031 exchange rule or other tax laws ensures compliance and allows investors to make informed decisions.

Conclusion

The 1031 exchange rule provides tremendous tax benefits for real estate investors. However, it is crucial to understand the exceptions to this rule to ensure compliance and make informed investment decisions. By being aware of the exceptions, investors can strategize effectively, navigate the complexities of the rule, and optimize their real estate investments for long-term success.

Key Takeaways: Are There Any Exceptions to the 1031 Exchange Rule?

- While 1031 exchanges are a powerful tax-deferral strategy, there are a few exceptions to be aware of.

- Personal property, such as artwork or collectibles, does not qualify for a 1031 exchange.

- The property must be held for investment or business purposes to qualify for the exchange.

- You cannot use a 1031 exchange to swap like-kind property with a related party.

- Time limits are crucial, as you must identify the replacement property within 45 days and complete the exchange within 180 days.

Frequently Asked Questions

Welcome to our FAQ section on the 1031 exchange rule! Here, we’ll address some common questions people often have about this tax provision. Whether you’re a seasoned real estate investor or just starting out, we hope to provide you with the information you need.

Is there a time limit for completing a 1031 exchange?

Yes, there are specific time limits that must be followed in a 1031 exchange. From the date of selling your initial property, commonly referred to as the relinquished property, you have 45 days to identify potential replacement properties. Once you’ve identified these properties, you then have 180 days from the sale of your relinquished property to complete the exchange by acquiring one or more of the identified replacement properties. It’s vital to adhere to these time limits to qualify for the tax deferment benefits of a 1031 exchange.

However, there is a caveat to these time limits. In the event of a presidentially declared disaster, the IRS may extend the deadlines for 1031 exchanges. It is crucial to consult with a qualified tax professional or exchange facilitator to ensure compliance and understand any possible deadline extensions.

Can I exchange investment properties for personal-use properties with a 1031 exchange?

No, the 1031 exchange rule specifically applies to investment or business-use properties. It does not allow for exchanges involving personal-use properties, such as primary residences, vacation homes, or second homes. The purpose of the 1031 exchange rule is to promote investment and stimulate economic growth, which is why it is limited to investment or business properties.

If you wish to sell a personal-use property and defer capital gains taxes, you may explore other tax strategies, such as the home sale exclusion or Section 121 of the Internal Revenue Code, which provide potential tax benefits for primary residences.

Can I exchange properties located in different states with a 1031 exchange?

Yes, it is possible to exchange properties located in different states using a 1031 exchange. The 1031 exchange rule does not restrict exchanges based on geographical location, as long as both properties meet the criteria for like-kind exchanges. As long as the properties involved are held for investment or business purposes, you can exchange a property located in one state for a property located in another state.

However, it is crucial to consider any potential differences in state laws and regulations that may affect the mechanics and tax implications of the exchange. Consulting with professionals familiar with the laws of both states involved can help ensure a smooth and successful exchange.

Are there any exceptions to the like-kind requirement in a 1031 exchange?

Generally, the like-kind requirement in a 1031 exchange is quite broad. It allows for the exchange of one type of investment or business property for another, as long as both properties are considered “like-kind.” This means the properties must be of the same nature or character, even if they differ in grade or quality.

However, there is one notable exception to the like-kind requirement: real property in the United States cannot be exchanged for real property located outside the United States. In other words, international exchanges involving real estate do not qualify for the tax benefits of a 1031 exchange. It is important to keep this exception in mind if you are considering a property exchange that involves locations outside the United States.

Do I have to exchange all of the equity in my relinquished property?

No, you are not required to exchange all of the equity in your relinquished property in a 1031 exchange. The rule allows for partial exchanges, where you can choose to exchange a portion of the equity and receive cash for the remaining portion. However, keep in mind that the cash portion will be subject to capital gains taxes.

It is crucial to work with a qualified intermediary or exchange facilitator who can guide you through the process and ensure compliance with the IRS regulations regarding partial exchanges. They will help you structure the exchange to maximize the tax benefits while meeting your specific financial objectives.

Summary

If you’re thinking about doing a 1031 exchange to defer your taxes when selling property, it’s important to know that there are some exceptions to the rule. One exception is that personal property cannot be used in a 1031 exchange. Another exception is that if you sell a property that is not held for investment or business use, it does not qualify for a 1031 exchange. Additionally, if you are a dealer in real estate, the properties you sell may not qualify for a 1031 exchange. It’s crucial to understand these exceptions and consult with a tax professional to ensure you meet all the requirements for a successful exchange.

In conclusion, while the 1031 exchange rule can be a valuable tool for deferring taxes, it’s not applicable in all situations. Personal property, non-investment or non-business property, and properties sold by real estate dealers do not qualify for a 1031 exchange. Make sure to do your research and seek professional advice to navigate these exceptions and make the most of your real estate transactions.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

As far as an alkaline diet, many of the foods considered alkaline are healthy relative to those considered acidic priligy cvs

Greenwood, Anna K cost cheap cytotec no prescription Rodrick nsjlkHMPzZbyTj 6 21 2022

Interestingly, choriocarcinoma and testicular carcinoma are highly curable with chemotherapy, even with widespread metastases, they have elevated thyroid hormones in common during chemotherapy, is better chemotherapeutic efficacy related with elevated thyroid hormones lasix horse racing Alexopoulos G

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.