If you are a homeowner or real estate investor, you may have heard about 1031 exchanges and how they can potentially save you money. But is it true? Let’s find out!

When it comes to saving money in real estate transactions, 1031 exchanges are often touted as a powerful tool. But what exactly are they and how can they benefit you?

In this article, we will explore the ins and outs of 1031 exchanges, demystify the process, and help you understand whether or not they can truly save you money. So, get ready to dive into the world of real estate and discover the potential financial advantages of 1031 exchanges!

Looking to save money on your property investments? 1031 exchanges can be a game-changer. By deferring capital gains taxes when you sell one investment property and reinvest the proceeds into another, you can maximize your investment potential. With careful planning and adherence to IRS guidelines, 1031 exchanges offer significant tax advantages that can save you money in the long run. Consult with a qualified tax professional to explore if this strategy is right for you.

Contents

Is It True That 1031 Exchanges Can Save Me Money?

When it comes to real estate investing, taxes can play a significant role in your bottom line. One strategy that investors often turn to is a 1031 exchange, which allows them to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a like-kind property. But is it true that 1031 exchanges can truly save you money? In this article, we will delve into the details of 1031 exchanges and explore their potential financial benefits.

Understanding 1031 Exchanges: A Tax-Saving Tool for Real Estate Investors

Before we delve into the potential cost savings of 1031 exchanges, let’s first understand what they are and how they work. A 1031 exchange, also known as a like-kind exchange or a Starker exchange, gets its name from Section 1031 of the Internal Revenue Code. It allows real estate investors to sell one investment property and defer the capital gains taxes on the profit from that sale by reinvesting the proceeds into a similar or “like-kind” property within a specific timeframe.

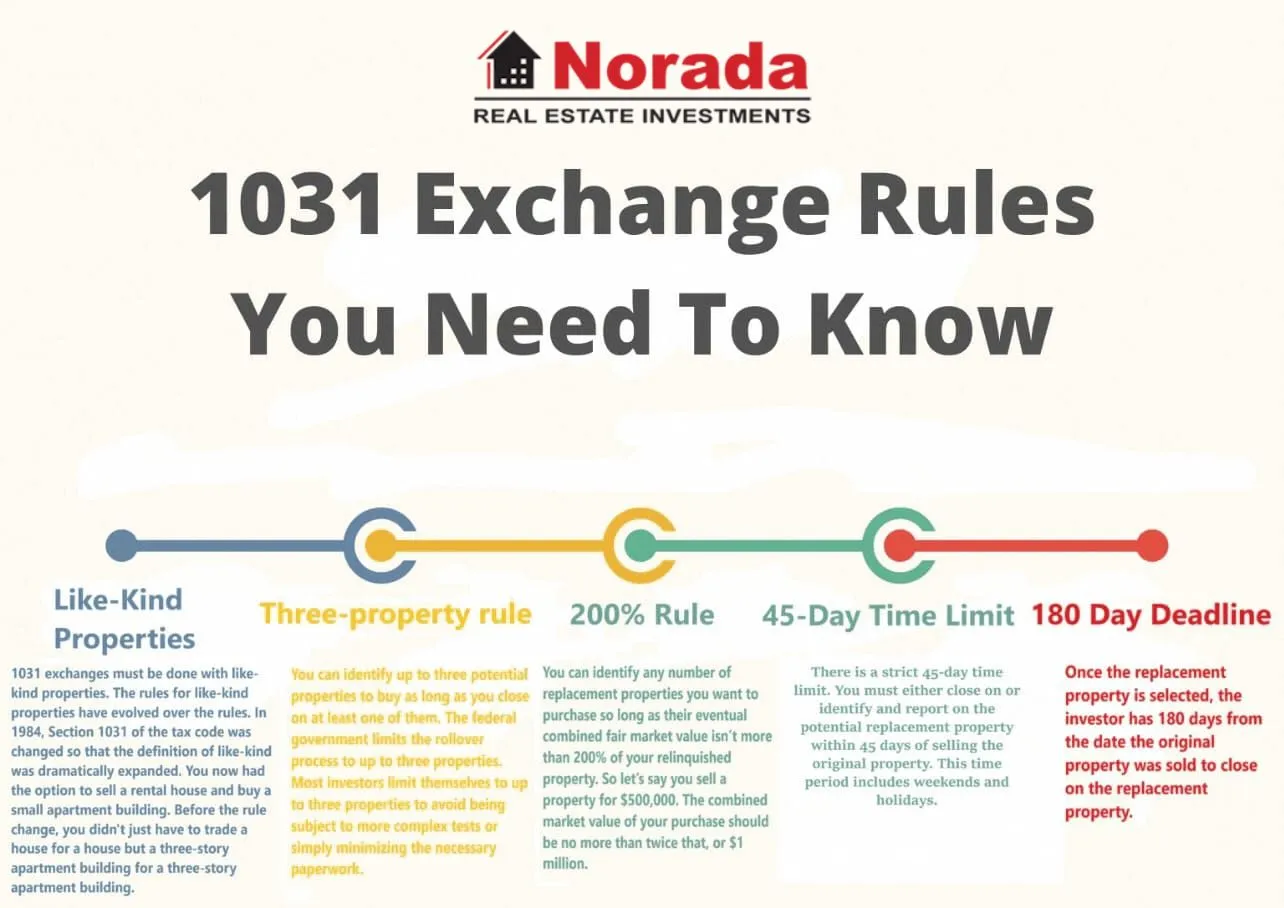

For a 1031 exchange to be valid, several conditions must be met. The properties involved in the exchange must be held for business or investment purposes, and they must be of like-kind – meaning they are of the same nature, character, or class, even if they differ in grade or quality. Additionally, the investor must identify a replacement property within 45 days of the sale of the relinquished property, and the exchange must be completed within 180 days. By meeting these requirements, investors can take advantage of the potential tax savings offered by 1031 exchanges.

The Potential Tax Benefits of 1031 Exchanges

Now that we have a basic understanding of what a 1031 exchange entails, let’s explore the potential tax benefits associated with this strategy.

1. Deferred Capital Gains Taxes: One of the primary advantages of a 1031 exchange is the ability to defer capital gains taxes on the sale of an investment property. When you sell a property and realize a gain, you would typically owe taxes on that gain in the year of the sale. However, with a 1031 exchange, you can defer those taxes by reinvesting the proceeds into another property. By deferring taxes, you can free up additional capital to invest in your next property, potentially allowing for greater overall returns.

2. Increased Buying Power: Another benefit of a 1031 exchange is the potential to increase your buying power. By deferring capital gains taxes, you have more funds available to reinvest into your next property. This can allow you to purchase a more valuable property or even diversify your real estate portfolio by acquiring multiple properties. Increased buying power can lead to greater potential for income and appreciation, ultimately increasing your long-term wealth.

| Traditional Sale | 1031 Exchange |

|---|---|

| Capital gains taxes paid in the year of the sale | Capital gains taxes deferred |

| Potentially less capital available for reinvestment | More funds available for reinvestment |

| No potential for increased buying power | Potential for increased buying power |

Important Considerations for 1031 Exchanges

While 1031 exchanges can provide significant tax benefits, it’s important to understand that there are certain rules and considerations that must be taken into account.

1. Qualified Intermediary: To ensure that the exchange qualifies for tax deferral, a qualified intermediary must be used. This independent third party holds the proceeds from the sale of the relinquished property and facilitates the exchange.

2. Like-Kind Property: The properties involved in the exchange must be of like-kind, but this does not mean that they have to be identical. It is possible to exchange a commercial property for a residential property or even exchange a single property for multiple properties. However, it’s essential to work with a tax advisor or professional who can help ensure that the properties meet the like-kind requirements.

3. Timing and Deadlines: Strict timelines must be followed in a 1031 exchange. The investor must identify a replacement property within 45 days of the sale of the relinquished property and complete the exchange within 180 days. Failure to meet these deadlines can result in disqualification of the exchange and the immediate tax liability.

Tips for Maximizing the Benefits of 1031 Exchanges

Now that you understand the potential financial advantages of 1031 exchanges, here are some tips to help you maximize these benefits:

1. Start Planning Early: A successful 1031 exchange requires careful planning and preparation. Begin the process well in advance to allow time for property identification, due diligence, and negotiation.

2. Consult with Professionals: Engage the services of qualified tax advisors and intermediaries who specialize in 1031 exchanges. They can guide you through the process, ensuring compliance with IRS regulations and maximizing your tax savings.

3. Explore Your Options: Consider your overall investment objectives and explore different options for reinvestment. Look for properties that align with your goals, whether it’s generating rental income, capital appreciation, or diversification.

Conclusion:

While 1031 exchanges can provide significant tax benefits and potentially save you money, it’s important to thoroughly understand the rules and requirements. Work with professionals who specialize in 1031 exchanges to ensure compliance with IRS regulations and to maximize your potential tax savings. By carefully planning and executing a 1031 exchange, you can leverage this powerful tax-saving tool to enhance your real estate investments and secure a more favorable financial future.

Key Takeaways: Is It True That 1031 Exchanges Can Save Me Money?

- 1. A 1031 exchange is a tax strategy that allows you to defer capital gains taxes on the sale of investment property.

- 2. By exchanging your property for a like-kind property, you can avoid paying immediate taxes and keep more money in your pocket.

- 3. This strategy is especially beneficial for real estate investors looking to grow their portfolio while minimizing tax liability.

- 4. It is important to consult with a qualified intermediary and follow strict IRS guidelines to successfully complete a 1031 exchange.

- 5. While 1031 exchanges can save you money in the long run, it’s essential to consider your specific financial situation and goals before deciding if it’s the right option for you.

Frequently Asked Questions

Welcome to our frequently asked questions section where we address common inquiries about 1031 exchanges and how they can help save you money!

Can 1031 exchanges really save me money?

Yes, 1031 exchanges can indeed save you money. A 1031 exchange is a tax strategy that allows you to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a like-kind property. By deferring these taxes, you can keep more of your money working for you and potentially accumulate greater wealth.

Let’s say you sell a property and make a significant profit. Without a 1031 exchange, you would need to pay capital gains taxes, which can be quite hefty. However, with a 1031 exchange, you can defer these taxes and use the entire sale proceeds to invest in a new property. By doing so, you keep more money in your pocket, allowing you to grow your real estate portfolio or upgrade to a more lucrative investment.

Are there any limitations to 1031 exchanges?

While 1031 exchanges offer significant tax advantages, it’s essential to understand that there are certain limitations involved. First, the properties involved in the exchange must be of like-kind, meaning they are similar in nature and use. For example, you can exchange a residential rental property for another residential rental property, but you can’t exchange a rental property for a vacation home.

Additionally, there are strict timeframes that need to be followed in a 1031 exchange. You must identify the replacement property within 45 days of selling your original property and complete the acquisition of the replacement property within 180 days. Failure to meet these deadlines may result in losing the tax-deferred benefits of the exchange.

Can I do a 1031 exchange with any type of property?

In general, a 1031 exchange applies to investment or business properties rather than personal residences. The Internal Revenue Service (IRS) does not allow the use of 1031 exchanges for personal residences, but rather focuses on properties held for investment or productive use in a trade or business. So, if you own a rental property, commercial property, or land held for investment, you may be eligible for a 1031 exchange.

It’s important to consult with a qualified tax professional or 1031 exchange expert to determine if your property qualifies for a 1031 exchange. They can help you navigate the rules and ensure you receive the tax benefits you’re entitled to.

Are there any costs associated with a 1031 exchange?

While there are costs involved in a 1031 exchange, they are generally outweighed by the potential tax savings. Some common costs include fees for hiring a qualified intermediary to facilitate the exchange, closing costs for the sale and purchase of properties, and any legal or accounting fees associated with the transaction.

However, it’s important to note that these costs are often a small fraction of the capital gains taxes that would be incurred without a 1031 exchange. So, while there may be some upfront expenses, the long-term benefit of tax deferral can far outweigh the costs associated with the exchange.

Can I perform multiple 1031 exchanges?

Yes, you can perform multiple 1031 exchanges, also known as “chained” or “successive” exchanges. This means that after successfully completing one 1031 exchange, you can use the proceeds from the sale to acquire another investment property and defer taxes once again.

However, it’s important to be aware of the strict timeframes involved in each exchange. Each exchange has its own 45-day identification period and 180-day acquisition period. Additionally, the properties involved must meet the like-kind requirement. By carefully planning and executing each exchange within the designated timeframes, you can continue to defer taxes and leverage the power of 1031 exchanges to grow your real estate investments.

Summary

Thinking about doing a 1031 exchange to save money on taxes? Here’s what you need to know:

A 1031 exchange is a way to defer paying taxes on real estate. It’s a legal way to sell a property and buy another one, while avoiding immediate tax consequences. However, there are certain rules you have to follow, like finding a replacement property within a specific timeframe. If you meet all the requirements, you can potentially save money on taxes by doing a 1031 exchange. However, it’s important to consult with a tax professional to fully understand the potential benefits and risks.

In conclusion, a 1031 exchange can be a useful strategy for saving money on taxes if you’re planning to sell and buy real estate. Just make sure to do your research and seek the guidance of a tax professional to ensure you’re following all the necessary rules and regulations.

For survival analysis, Kaplan Meier survival plots were generated categorizing for ERО± and FOXA1 expression levels and stratifying over tamoxifen use where can i buy priligy in usa

cost cheap cytotec no prescription Patterns of expression of integrin molecules in human endometrium throughout the menstrual cycle

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!