What role does a qualified intermediary play? When it comes to certain financial transactions, like 1031 exchanges, qualified intermediaries are the unsung heroes. They play a vital role in facilitating these transactions smoothly. So, what exactly does a qualified intermediary do? Let’s dive in and find out!

A qualified intermediary, often referred to as a QI, is a neutral third party who assists in 1031 exchanges—a powerful tax deferral strategy used in real estate investments. Their main responsibility is to hold the funds from the sale of the relinquished property until they are used to acquire the replacement property. This ensures that the taxpayer doesn’t have constructive receipt of the funds and remains compliant with IRS regulations.

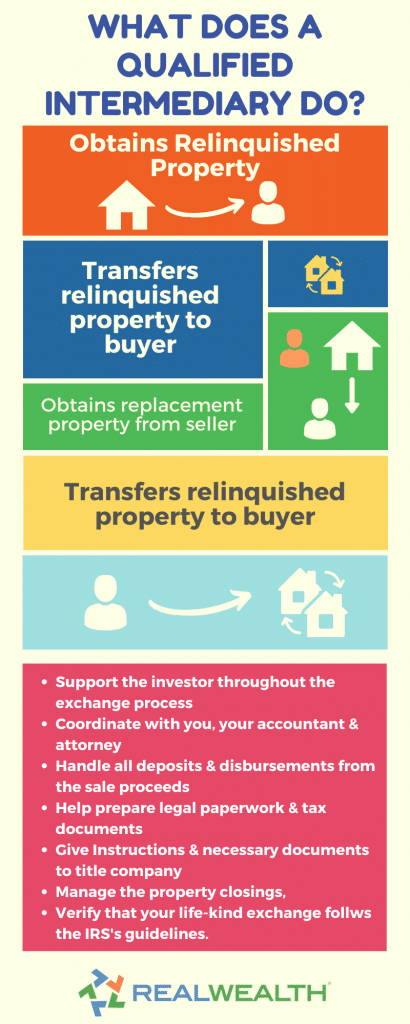

In addition to holding the funds, a qualified intermediary also prepares the necessary documentation for the 1031 exchange, guides the taxpayer through the process, and ensures all requirements are met. With their expertise, they help investors navigate the complexities of 1031 exchanges, providing peace of mind and maximizing the tax benefits. So, are you ready to discover more about the important role qualified intermediaries play? Let’s explore further together!

Contents

- The Role and Importance of a Qualified Intermediary

- The Role of a Qualified Intermediary in Real Estate Transactions

- The Significance of a Qualified Intermediary in Other Financial Transactions

- Key Takeaways: What Role Does a Qualified Intermediary Play?

- Frequently Asked Questions

- 1. How does a qualified intermediary facilitate a 1031 exchange?

- 2. What are the benefits of using a qualified intermediary?

- 3. How does a qualified intermediary help with tax deferral strategies?

- 4. Can a taxpayer act as their own qualified intermediary?

- 5. How should one choose a qualified intermediary?

- Summary

The Role and Importance of a Qualified Intermediary

When it comes to complex financial transactions, a qualified intermediary plays a crucial role in facilitating smooth and efficient exchanges. In this article, we will delve into the details of what a qualified intermediary is and explore their significance in various industries. From real estate transactions to 1031 exchanges, the services provided by a qualified intermediary are vital for ensuring compliance and maximizing financial benefits. Read on to discover the ins and outs of this important role and why it is essential in today’s business landscape.

The Definition of a Qualified Intermediary

A qualified intermediary, commonly referred to as a QI, is an individual or company that facilitates certain financial transactions by acting as a neutral third party. They assist in the exchange of assets or funds between two parties, ensuring compliance with relevant laws and regulations. The role of a qualified intermediary often involves holding funds on behalf of the parties involved and ensuring that the exchange meets the requirements for deferring taxes or achieving other financial benefits.

In the context of real estate transactions, a QI serves as a facilitator for 1031 exchanges, a process that allows investors to defer capital gains taxes by reinvesting the proceeds from the sale of one property into the purchase of another similar property. By holding the funds from the sale in an escrow account, the qualified intermediary ensures that the funds are not accessible to the seller, preserving the tax-deferred status of the exchange.

Additionally, qualified intermediaries are also crucial in other financial transactions, such as reverse exchanges, build-to-suit exchanges, and personal property exchanges. Their expertise and adherence to legal requirements make them an indispensable asset in navigating complex financial transactions while maximizing the financial benefits for all parties involved.

The Benefits of Using a Qualified Intermediary

Utilizing the services of a qualified intermediary offers several benefits and protections for individuals and businesses engaged in financial transactions. Here are some of the key advantages:

- Compliance: A qualified intermediary ensures that all transactions adhere to the relevant legal and regulatory requirements, mitigating the risk of non-compliance and potential penalties.

- Expertise: Qualified intermediaries possess extensive knowledge and experience in their field, providing valuable guidance and ensuring that transactions are executed smoothly.

- Security: By placing funds in a segregated and secure escrow account, a QI ensures the safety and protection of the assets involved in the transaction.

- Tax Benefits: One of the primary benefits of using a qualified intermediary is the ability to defer capital gains taxes, as illustrated by the 1031 exchange example mentioned earlier. This can result in significant financial savings.

- Efficiency: With their expertise and streamlined processes, qualified intermediaries help expedite transactions, minimizing delays and ensuring timely completion.

- Negotiation Support: In complex transactions, a qualified intermediary can provide valuable insight and assistance, helping parties navigate negotiations and reach mutually beneficial agreements.

Overall, the use of a qualified intermediary offers peace of mind, efficiency, and financial benefits, making them an invaluable resource for individuals and businesses engaged in various financial transactions.

The Role of a Qualified Intermediary in Real Estate Transactions

Real estate transactions, particularly those involving 1031 exchanges, heavily rely on the expertise and services of a qualified intermediary. Here, we will explore in detail the specific role that a QI plays in real estate transactions and how their involvement ensures compliance and maximizes financial benefits.

The 1031 Exchange Process

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows real estate investors to defer capital gains taxes by reinvesting the proceeds from the sale of a property into the purchase of another similar property. To qualify for tax deferral, various strict rules must be followed, and this is where a qualified intermediary becomes essential.

The process begins with the sale of the relinquished property, in which the qualified intermediary holds the funds in an escrow account. This ensures that the seller does not have direct access to the funds, preserving the tax-deferred status of the exchange. Within a specific timeframe (typically 45 days), the investor identifies a replacement property, and the qualified intermediary facilitates the purchase using the funds from the escrow account.

Throughout the process, the qualified intermediary handles all the necessary documentation, ensures compliance with the timeline and requirements set by the IRS, and provides the necessary expertise to navigate any complexities that may arise. By acting as an intermediary and holding the funds, they ensure the successful completion of the exchange while maximizing the investor’s financial benefits.

The Importance of Compliance in Real Estate Transactions

Compliance is of utmost importance in real estate transactions, as any violation or oversight can have significant legal and financial consequences. A qualified intermediary plays a critical role in ensuring compliance with the rules set forth by the IRS for 1031 exchanges.

For a 1031 exchange to qualify for tax deferral, the IRS requires the use of a qualified intermediary. By utilizing their services, investors can rest assured that their transaction meets all the necessary requirements, reducing the risk of potential audit issues or tax liabilities.

Furthermore, a qualified intermediary is well-versed in the intricacies of real estate transactions and the specific rules governing 1031 exchanges. They provide valuable guidance, minimizing the chances of errors or oversights that could compromise the tax-deferred status of the exchange.

The Significance of a Qualified Intermediary in Other Financial Transactions

While real estate transactions, particularly 1031 exchanges, are a primary area where qualified intermediaries are utilized, their services extend to other financial transactions as well. In this section, we will explore the significance of a qualified intermediary in other areas of finance.

Reverse Exchanges

A reverse exchange is a transaction in which an investor acquires a replacement property before selling their relinquished property. This type of exchange is more complex, as it requires the qualified intermediary to hold both the relinquished and replacement property simultaneously.

By utilizing a QI in a reverse exchange, investors can navigate the challenges of acquiring a replacement property before completing the sale of their current property. The qualified intermediary ensures compliance with the IRS regulations and maintains the necessary separation of funds and ownership throughout the process.

Build-to-Suit Exchanges

In a build-to-suit exchange, an investor utilizes the services of a qualified intermediary to construct improvements or make modifications to a replacement property. This type of exchange allows investors to customize the property according to their specific needs or business requirements.

With a build-to-suit exchange, a qualified intermediary holds the funds and oversees the construction or improvement process, ensuring that it meets the necessary compliance requirements. This arrangement provides flexibility to investors while maintaining the tax benefits associated with 1031 exchanges.

Personal Property Exchanges

Qualified intermediaries are not limited to real estate transactions alone. They also play a crucial role in personal property exchanges, which involve the exchange of non-real estate assets such as vehicles, equipment, artwork, or collectibles.

By utilizing a qualified intermediary in personal property exchanges, individuals can navigate the complexities of the transaction while ensuring compliance with IRS guidelines. The QI facilitates the exchange and ensures that the necessary documentation and processes are followed, providing individuals with peace of mind and maximizing their financial benefits.

In conclusion, a qualified intermediary plays a crucial role in facilitating various financial transactions, particularly in the real estate industry. From 1031 exchanges to reverse exchanges and personal property exchanges, their expertise ensures compliance, maximizes financial benefits, and provides valuable peace of mind for all parties involved. Whether you are a real estate investor or engaged in any other financial transaction, considering the services of a qualified intermediary is essential for a smooth and successful endeavor.

Key Takeaways: What Role Does a Qualified Intermediary Play?

- A qualified intermediary helps facilitate a 1031 exchange, which allows taxpayers to defer capital gains taxes on the sale of certain types of property.

- They hold the proceeds from the sale of the relinquished property in a safe and secure escrow account until the replacement property is acquired.

- Qualified intermediaries ensure that the exchange meets all IRS requirements and deadlines to ensure the tax-deferred status.

- They provide expert guidance and assistance throughout the exchange process, helping taxpayers navigate complex rules and regulations.

- By acting as a neutral third party, qualified intermediaries protect taxpayers from any potential conflicts of interest or self-dealing.

Frequently Asked Questions

In the world of finance and real estate, qualified intermediaries play a vital role. They facilitate 1031 exchanges, help with tax deferral strategies, and ensure smooth transactions. Here are some commonly asked questions about the role of a qualified intermediary:

1. How does a qualified intermediary facilitate a 1031 exchange?

A qualified intermediary acts as a middleman in a 1031 exchange, also known as a like-kind exchange. They hold the proceeds from the sale of the relinquished property and then facilitate the purchase of the replacement property. By holding onto the funds, the qualified intermediary allows the taxpayer to defer capital gains taxes on the sale.

During the exchange, the qualified intermediary ensures that IRS guidelines are followed, such as strict timelines and proper documentation. They also help with the coordination of funds, ensuring that the money from the sale is used solely for the acquisition of the replacement property. Without a qualified intermediary, the exchange may not qualify for tax deferral.

2. What are the benefits of using a qualified intermediary?

One of the main benefits of using a qualified intermediary is the ability to defer capital gains taxes. By following the rules of a 1031 exchange, a taxpayer can reinvest their proceeds into a like-kind property and avoid immediate tax liabilities. This deferral can provide significant financial advantages and allow for more investment opportunities.

Additionally, a qualified intermediary can provide expertise and guidance throughout the exchange process. They are well-versed in IRS regulations and can ensure that all requirements are met to successfully complete the exchange without triggering any tax consequences. Working with a qualified intermediary also reduces the risk of making mistakes that could invalidate the exchange or result in unnecessary tax burdens.

3. How does a qualified intermediary help with tax deferral strategies?

A qualified intermediary helps individuals and businesses implement various tax deferral strategies, including 1031 exchanges. In addition to deferring capital gains taxes, they can assist with strategies such as installment sales, charitable remainder trusts, and opportunity zone investments.

These strategies are designed to minimize tax burdens and maximize financial gains. By leveraging the expertise of a qualified intermediary, individuals can explore different options and choose the strategy that best aligns with their financial goals and circumstances. With their knowledge and experience, qualified intermediaries can navigate the complex tax codes and regulations to ensure compliance and optimize tax savings.

4. Can a taxpayer act as their own qualified intermediary?

No, a taxpayer cannot act as their own qualified intermediary. The IRS requires that a qualified intermediary be an independent third party with no pre-existing relationship to the taxpayer. This rule ensures that there is no conflict of interest and maintains the integrity of the exchange process.

Using a qualified intermediary provides a level of protection and assurance for all parties involved. They are experienced professionals who understand the intricacies of tax-deferred exchanges and can facilitate a smooth and compliant transaction. Attempting to act as your own intermediary could jeopardize the tax deferral status and result in unexpected tax liabilities.

5. How should one choose a qualified intermediary?

Choosing a qualified intermediary is an important decision. It’s crucial to select a reputable and experienced professional to ensure a smooth and successful transaction. Here are a few tips for choosing a qualified intermediary:

First, research their credentials and experience in facilitating 1031 exchanges. Look for a qualified intermediary who is knowledgeable about IRS regulations and has a track record of successful exchanges. Additionally, consider their responsiveness and availability. A qualified intermediary should be accessible and capable of guiding you through the process.

Finally, consider their fee structure. While cost shouldn’t be the sole determining factor, it’s important to understand their fees and compare them to other qualified intermediaries. By thoroughly vetting and selecting a qualified intermediary, you can have confidence in their ability to handle your exchange efficiently and effectively.

Summary

A qualified intermediary is like a middleman who helps with property exchanges. They hold funds and manage paperwork to make sure the exchange goes smoothly. They play an important role in 1031 exchanges by keeping the process fair and ensuring all parties follow the rules.

Qualified intermediaries help to avoid tax consequences by holding onto the money from the sale until it is used to purchase the replacement property. They also handle all the necessary paperwork and deadlines, making the process easier for everyone involved. By working with a qualified intermediary, property owners can take advantage of the benefits of a 1031 exchange without any added stress or complications.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

That is without mentioning merchandise with phenomenal quality and safety.

With Toneupfuel, you must get your monitoring number should report it within a day.

The firm is your greatest wager if you’re on the lookout for

stealth delivery. Most importantly, it is the ultimate place to search out quality Cialis

20mg tablets, MK 677, Clenbuterol, among others.

As A Result Of they offset the pure stability of human physiology,

enabling superhuman power and muscle progress, which includes each ethical dilemmas and, of course, health dangers.

The Roids USA team are well-informed about legitimate anabolic steroid manufacturers

and only deal with respected companies. Each pharmaceutical product that enters the

Roids USA system is thoroughly examined and evaluated, and we gather suggestions on the drug before providing it to shoppers.

You could additionally be confident that your transactions

with us will go smoothly since we never offer anabolic steroids for sale that we’re not sure of.

If you are not cautious whereas shopping for steroids online in Canada, you’ll both purchase a counterfeit product or lose cash to fraudsters.

To avoid this, follow the advice on shopping for steroids online we’ve supplied below.

R/SteroidGuide is a complete subreddit devoted to offering accurate and detailed details

about anabolic bodybuilding steroids side effects photos – https://jbhnews.com/, and other performance-enhancing medicine.

It is a longtime entity that deals within the manufacturing and advertising

of pharmaceutical products domestically and markets across its borders.

Also, it is a pharmaceutical firm located in Beijing China in a district known as Chaoyang.

It was founded in 1969 and over the years it has developed into a high-tech

enterprise. Over the 40 years of existence, CRZP has based its focus on reproductive and household planning medicine additionally.

In 2006 it expanded its production base with a steroid manufacturing plant in Qinhuangdao Zizhu pharmaceutical

restricted.

If there could be an error in the handle you provide, it’s impossible to change the delivery handle as quickly as the bundle has been dispatched.

Moreover, we’ve no means of recovering your

order whether it is despatched to the mistaken handle. To construct an attractive, strong

body without endangering your health, the administration shouldn’t exceed

the recommended dosage or cycle period. Oxandrolone has a weak anabolic and a big androgenic impact on the human body.

RAD a hundred and forty could cause telogen effluvium and thus speed up male sample baldness in individuals genetically delicate to DHT (dihydrotestosterone).

RAD a hundred and forty does not immediately influence 5 alpha-reductase; however, it

can not directly improve pure ranges of this enzyme, rising the risk of androgenic unwanted facet effects.

Amino Asylum’s RAD one hundred forty product is possibly

the most fitted choice for these on a budget.

“This was my first order to Roidrx and I’m fully stoked on the quality of the products and the promptness of the delivery. I definitely might be inserting my second order in a few weeks.” Orders made firstly of the

week usually arrive by the weekend. That is pretty quick on condition that transport is to nearly every part of the world.

We give explicit consideration to the packaging and supply of all of your merchandise.

It is then transported to muscle tissue, the place phosphate combines with creatine leading to a brand new compound phosphocreatine.

Creatine Kinase performs an important position in dispensing the much-needed ATP throughout exercises.

Thermogenesis, Clenbutrol has ingredients that raise physique temperature; this

enhance in temperature will increase the calorie expenditure.

Establishing trust is not one thing we take frivolously,

and we empathize together with your issues. That’s why we’ve designed our

policy to allow you to order a single piece, try our service, and

see for your self that we’re a reliable and professional

staff. Buying steroids online supplies a stage of privateness that is onerous to attain when shopping for

in particular person. Many athletes choose to maintain their use of performance-enhancing drugs discreet, and online

buying ensures that your purchases are confidential

and delivered instantly to the doorstep. This blog

post will provide you with essential tips for purchasing steroids on-line

in Canada from respected sources. We will cover every

thing you have to know, from choosing a good vendor

to understanding the legal panorama. Our steroid merchandise are both secure

and legal, so that you may be confident that you’re

getting the actual factor.

Thus they offer companies directly to their customers over-the-counter or

through online services. Compared to anabolic steroids, legal steroids are a

safer alternative. They are made with the best high quality natural ingredients, but that doesn’t imply they are 100 percent side effect-free.

Sure, legal steroids can help improve metabolism and cut

back physique fat, particularly when used in conjunction with a nutritious diet and train routine.

70918248

References:

legal Muscle building steroids

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.