Wondering what the steps are to complete a 1031 exchange? Look no further!

In this guide, we’ll break it down for you in simple, easy-to-understand terms.

So let’s dive in and explore the process of completing a 1031 exchange together!

1. Research and understand the 1031 exchange rules.

2. Identify a qualified intermediary (QI) to facilitate the exchange.

3. Sell your current property and notify the QI.

4. Identify potential replacement properties within 45 days.

5. Submit a written offer and negotiate the terms of the purchase.

6. Close on the replacement property within 180 days from the sale date.

7. Notify the QI to complete the exchange paperwork.

8. Deed the replacement property into your name to finalize the 1031 exchange.

Contents

- What Are the Steps to Complete a 1031 Exchange?

- Benefits of Completing a 1031 Exchange

- Tips for a Successful 1031 Exchange

- Potential Challenges in a 1031 Exchange

- Key Takeaways: What Are the Steps to Complete a 1031 Exchange?

- Frequently Asked Questions

- 1. What documents are needed to start a 1031 exchange?

- 2. How long do I have to complete a 1031 exchange?

- 3. Can I use the funds from the sale of my property before completing a 1031 exchange?

- 4. Do I need to exchange properties of equal value in a 1031 exchange?

- 5. Can I use a 1031 exchange for vacation or second homes?

- How To Do A 1031 Exchange [What EVERY Investor Should Know]

- Summary

What Are the Steps to Complete a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred method for real estate investors to sell one property and acquire another similar property without incurring immediate capital gains taxes. It’s an excellent financial strategy that can help individuals grow their real estate portfolio and build wealth. However, completing a 1031 exchange involves several steps and requires careful planning and adherence to IRS guidelines. In this article, we will outline the key steps involved in completing a 1031 exchange and provide valuable tips to ensure a smooth and successful transaction.

Step 1: Consult with a Qualified Intermediary (QI)

The first step in completing a 1031 exchange is to consult with a Qualified Intermediary (QI). A QI is a neutral third party who facilitates the exchange process and ensures compliance with IRS regulations. They help the investor with all the necessary documentation and timing requirements. It’s crucial to engage a reputable QI with experience in handling 1031 exchanges to avoid any pitfalls or potential issues during the transaction. The QI will guide you through the entire process and provide expert advice tailored to your specific situation.

During the initial consultation with the QI, you’ll discuss your investment goals, the properties involved in the exchange, and any potential challenges. The QI will explain the rules and limitations of a 1031 exchange and answer any questions you may have. They will also help you identify suitable replacement properties and guide you in structuring the exchange to maximize its financial benefits.

Step 2: Sell Your Current Property

Once you have engaged a QI and identified your replacement property, the next step is to sell your current property. To qualify for a 1031 exchange, the property being sold must be held for investment or used in a trade or business. It’s essential to consult with a real estate professional to determine the fair market value of your property and develop a marketing strategy to attract potential buyers.

During the sale process, it’s crucial to document your intention to complete a 1031 exchange and inform all parties involved, including the buyer, real estate agents, and closing agents. The proceeds from the sale should be held by the QI in a separate escrow account to maintain the tax-deferred status of the exchange. It’s important to strictly adhere to the timeline set by the IRS for identifying and acquiring the replacement property.

Step 3: Identify Potential Replacement Properties

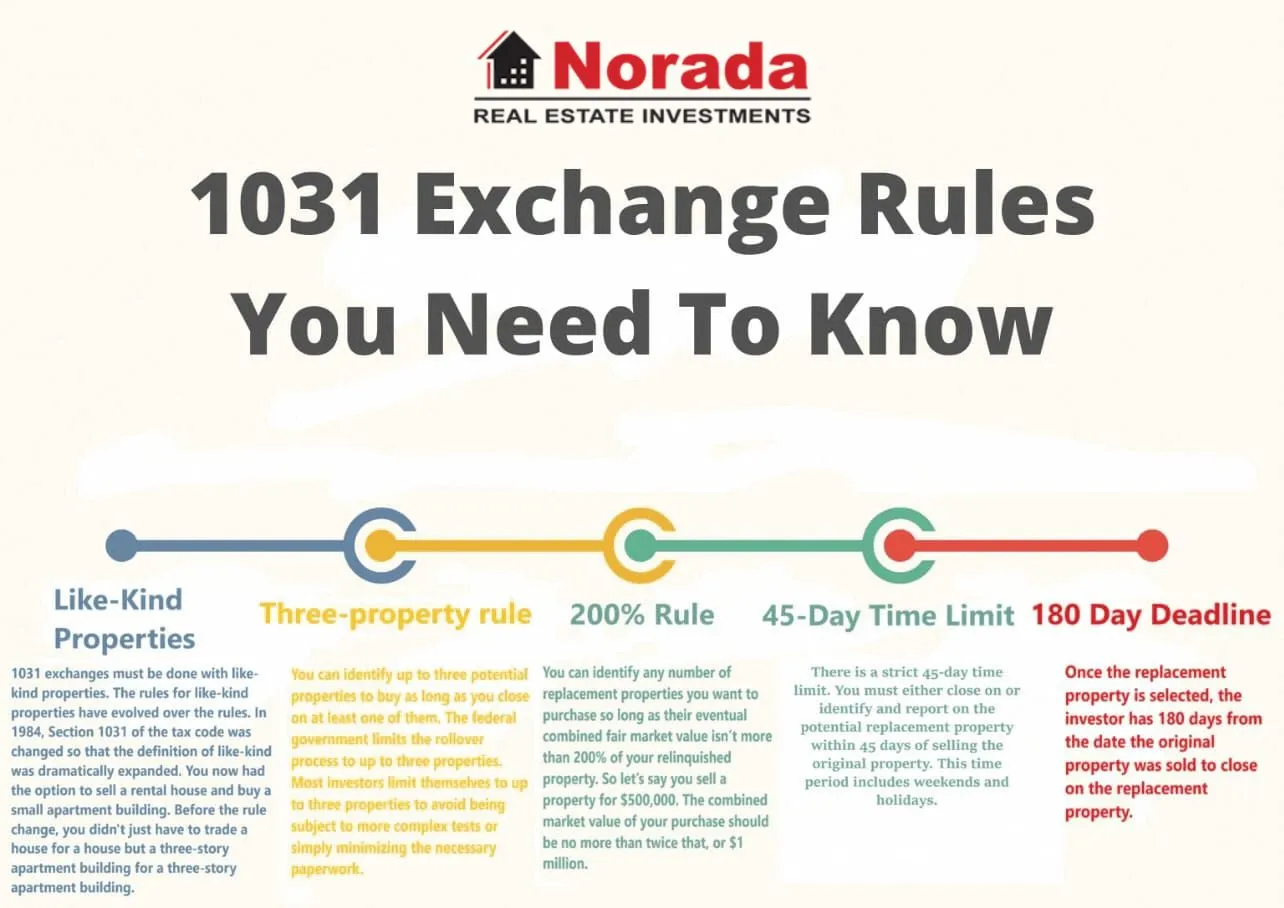

Within 45 days of closing on the sale of your current property, you must identify one or more potential replacement properties. The IRS provides two identification rules: the Three-Property Rule and the 200% Rule. The Three-Property Rule allows you to identify up to three properties of any value, while the 200% Rule allows you to identify any number of replacement properties as long as their total fair market value does not exceed 200% of the relinquished property’s value.

It’s crucial to carefully evaluate potential replacement properties and ensure they meet your investment goals. Factors to consider include location, market conditions, potential for appreciation, rental income potential, and any other preferences you may have. Work closely with your QI and real estate professionals to gather the necessary information and make an informed decision.

Step 4: Acquire the Replacement Property

After identifying the replacement property, you have 180 days from the sale of your current property to acquire it. The purchase process for the replacement property is similar to any regular real estate transaction. You’ll need to secure financing (if necessary), negotiate the purchase price, and complete all the necessary legal and financial documentation.

During the closing of the replacement property, the QI will use the funds held in the escrow account from the sale of your current property to complete the exchange. It’s important to note that the purchase price of the replacement property must be equal to or greater than the net sale price of the relinquished property to defer all the capital gains taxes. Any funds not used for the purchase of the replacement property will be subject to capital gains taxes.

Step 5: Maintain the Replacement Property

Once you have successfully acquired the replacement property, you must hold it for investment or use it in a trade or business. The IRS requires investors to hold the replacement property for a minimum of two years to satisfy the requirements of a 1031 exchange. During this time, you can benefit from potential rental income, property appreciation, and other financial advantages of real estate ownership.

It’s important to keep all the necessary documentation related to the 1031 exchange, including closing statements, purchase agreements, and any other relevant records. This documentation will be essential if the IRS decides to audit your tax return or questions your eligibility for the tax-deferred treatment.

Step 6: Enjoy the Tax Benefits

One of the significant advantages of completing a 1031 exchange is the deferral of capital gains taxes. By exchanging one property for another, you can defer the payment of taxes on the gains made from the sale of the relinquished property. The tax liability is effectively postponed until you sell the replacement property or decide not to participate in a 1031 exchange in the future.

Another benefit of a 1031 exchange is the ability to leverage your investment and diversify your portfolio. By exchanging into a more valuable or income-producing property, you can potentially increase your cash flow and long-term wealth accumulation. The tax savings can be reinvested into the replacement property or used for other investment opportunities.

Step 7: Seek Professional Advice

Completing a 1031 exchange can be complex, and it’s essential to seek professional advice to ensure compliance with IRS regulations and maximize the financial benefits. Consult with qualified tax advisors, real estate professionals, and attorneys with experience in 1031 exchanges. They can provide personalized guidance based on your specific situation and help you navigate the intricacies of the process.

Remember to stay informed about any changes in tax laws or IRS regulations that may impact your 1031 exchange. A well-executed 1031 exchange can be a powerful tool for real estate investors, allowing for growth, diversification, and significant tax savings. With proper planning and the right professionals by your side, you can successfully complete a 1031 exchange and achieve your investment goals.

Benefits of Completing a 1031 Exchange

A 1031 exchange offers numerous benefits for real estate investors. By understanding the advantages of this tax-deferred strategy, you can make informed decisions and maximize your investment returns. Here are some key benefits of completing a 1031 exchange:

1. Tax Deferral:

One of the most significant benefits of a 1031 exchange is the ability to defer capital gains taxes. By exchanging one property for another, you can postpone the payment of taxes on the gains made from the sale of the relinquished property. This allows you to reinvest the tax savings into the replacement property and potentially increase your long-term wealth accumulation.

2. Portfolio Growth and Diversification:

By participating in a 1031 exchange, you have the opportunity to leverage your investment and acquire a more valuable or income-producing property. This can help you grow your real estate portfolio and diversify your holdings. Investing in different property types or locations can mitigate risk and potentially increase your cash flow and overall returns.

3. Flexibility and Estate Planning:

A 1031 exchange provides flexibility for real estate investors. You can exchange into properties with different investment strategies, such as residential, commercial, industrial, or even vacant land. This flexibility allows you to align your investments with your long-term goals and adapt to changing market conditions. Additionally, a 1031 exchange can also be a useful estate planning tool, allowing you to transfer property to future generations while deferring capital gains taxes.

Tips for a Successful 1031 Exchange

Completing a 1031 exchange requires careful planning, attention to detail, and adherence to IRS guidelines. Here are some essential tips to ensure a successful 1031 exchange:

1. Start Early:

It’s crucial to start the 1031 exchange process as early as possible. The timeline can be tight, especially when it comes to identifying and acquiring replacement properties. By starting early, you have more time to research potential properties, consult with professionals, and address any potential challenges that may arise.

2. Work with Experienced Professionals:

Seek the guidance of experienced professionals throughout the 1031 exchange process. Engage a reputable Qualified Intermediary (QI) who has extensive knowledge of IRS regulations and the intricacies of 1031 exchanges. Additionally, consult with tax advisors, real estate professionals, and attorneys who specialize in 1031 exchanges to ensure compliance and maximize the financial benefits.

3. Do Your Due Diligence:

Thoroughly research and evaluate potential replacement properties before making any decisions. Consider factors such as location, market conditions, rental income potential, and any other criteria that align with your investment goals. It’s essential to analyze the financials, conduct inspections, and gather all the necessary information to make an informed choice.

4. Document Everything:

Keep meticulous records of all the documentation related to your 1031 exchange. This includes closing statements, purchase agreements, identification documentation, and any other relevant records. Proper documentation is crucial if the IRS were to audit your tax return or question your eligibility for a 1031 exchange. It’s recommended to consult with your QI and tax advisor regarding the necessary documentation.

5. Understand the Rules and Limitations:

Thoroughly understand the rules and limitations of a 1031 exchange. The IRS has specific guidelines and timelines that must be followed to qualify for tax-deferred treatment. Familiarize yourself with the identification rules, purchase timeline, and other requirements to ensure compliance. Consulting with professionals who specialize in 1031 exchanges will help you navigate these rules effectively.

6. Consult with a Tax Advisor:

Find a qualified tax advisor who specializes in real estate transactions and understands the intricacies of the tax code. They can provide valuable advice tailored to your specific situation and help you optimize the tax benefits of a 1031 exchange. A tax advisor can also assist with long-term tax planning and strategies to minimize your overall tax liability.

By following these tips, you can increase your chances of completing a successful 1031 exchange and maximize the financial benefits. Remember to stay informed, seek professional advice, and plan strategically to leverage the advantages of this tax-deferred strategy.

Potential Challenges in a 1031 Exchange

While completing a 1031 exchange offers significant benefits, there are potential challenges that investors should be aware of. Understanding these challenges and having strategies in place to address them can help ensure a smooth and successful exchange. Here are some potential challenges in a 1031 exchange:

1. Strict Timeline:

The IRS imposes strict timelines that must be followed in a 1031 exchange. Failure to meet these timelines can result in the disqualification of the exchange and the immediate taxation of capital gains. It’s crucial to stay organized, adhere to the deadlines, and work closely with your Qualified Intermediary (QI) to ensure all requirements are met.

2. Limited Options for Replacement Properties:

Identifying suitable replacement properties within the 45-day identification period can be challenging, especially in competitive real estate markets. It’s important to start your search early, work with knowledgeable real estate professionals, and have backup options if your preferred properties fall through. Consider widening your search criteria to increase the chances of finding suitable replacement properties.

3. Financing and Funding:

Securing financing for the acquisition of the replacement property can be a challenge for some investors. Lenders may have specific guidelines and requirements for acquiring properties through a 1031 exchange. It’s crucial to work with lenders who are familiar with the intricacies of a 1031 exchange and have experience in structuring loans for such transactions. Explore different financing options and be prepared to provide documentation to lenders to demonstrate your eligibility for the loan.

4. Depreciation Recapture:

While a 1031 exchange allows for the deferral of capital gains taxes, it does not defer depreciation recapture taxes. If you have claimed depreciation deductions on the relinquished property, you may be subject to depreciation recapture taxes upon the sale of the replacement property. Consult with your tax advisor to understand the potential tax implications and plan accordingly.

5. Property Management Challenges:

Acquiring a new property through a 1031 exchange may come with its own set of property management challenges. If you’re exchanging into a property with tenants, you’ll need to familiarize yourself with the existing leases and handle any ongoing maintenance or tenant-related issues. It’s important to factor in these management responsibilities when evaluating potential replacement properties and budgeting for ongoing expenses.

By recognizing and addressing these potential challenges, you can navigate the complexities of a 1031 exchange more effectively. Remember to work with professionals, stay organized, and plan strategically to overcome these hurdles and successfully complete your exchange.

Key Takeaways: What Are the Steps to Complete a 1031 Exchange?

- Find a qualified intermediary to facilitate the exchange.

- List the property for sale and notify potential buyers about the exchange.

- Identify replacement properties within 45 days of selling the original property.

- Negotiate the purchase of the replacement property within 180 days of selling the original property.

- Close on the replacement property and complete the 1031 exchange.

Frequently Asked Questions

Welcome to our FAQ section on completing a 1031 exchange! Below you will find answers to common questions about the steps involved in this process. Whether you’re a real estate investor or simply curious about how a 1031 exchange works, we’re here to help you understand the ins and outs!

1. What documents are needed to start a 1031 exchange?

When starting a 1031 exchange, you’ll need to gather several key documents. First, you’ll need a copy of your original purchase agreement for the property you are selling. It’s also important to have the contract for your replacement property lined up, as well as any deeds, titles, or other legal documents related to both properties. Additionally, you will need to fill out Form 8824 provided by the IRS, which reports the details of your exchange to the government.

Remember, it’s always a good idea to consult with a qualified intermediary or tax professional who specializes in 1031 exchanges to ensure you have all the necessary documentation in order to comply with the IRS regulations.

2. How long do I have to complete a 1031 exchange?

In order to complete a 1031 exchange, the IRS enforces strict time frames. Once you sell your original property, you have 45 days to identify potential replacement properties. This identification period starts on the date of the sale. It’s important to note that the identification must be made in writing and sent to the intermediary handling the exchange.

After identifying the replacement properties, you have 180 days from the date of sale to complete the exchange by closing on one or more of the identified properties. If you fail to meet these deadlines, you may risk disqualifying your exchange from the tax deferral benefits of a 1031 exchange.

3. Can I use the funds from the sale of my property before completing a 1031 exchange?

No, in order to fully benefit from the tax deferral in a 1031 exchange, it is important to follow the strict guidelines set by the IRS. The funds from the sale of your property must be held by a qualified intermediary until the completion of the exchange. These funds cannot be touched or used for personal purposes during that time.

If you access or use the funds before the exchange is complete, it will likely be treated as a taxable event, and you may lose the opportunity to defer capital gains taxes through the 1031 exchange.

4. Do I need to exchange properties of equal value in a 1031 exchange?

No, a 1031 exchange does not require an equal value exchange. You can exchange a property of higher value or multiple properties for one of lesser value, as long as you follow the guidelines outlined by the IRS.

However, it’s important to note that if you receive any cash or other non-like-kind property as part of the exchange, it may be considered taxable income. It’s advisable to consult with a tax professional to understand the potential tax consequences and ensure compliance with IRS regulations.

5. Can I use a 1031 exchange for vacation or second homes?

No, a 1031 exchange is restricted to investment or business properties only. It does not apply to personal residences, vacation homes, or second homes that are not held primarily for investment purposes.

To qualify for a 1031 exchange, the property must be used for business or investment purposes and must be classified as either investment property or property used in a trade or business. It’s important to consult with a qualified intermediary or tax professional to determine if your property meets the necessary criteria for a 1031 exchange.

How To Do A 1031 Exchange [What EVERY Investor Should Know]

Summary

Completing a 1031 exchange involves a few important steps. First, you need to identify a replacement property within 45 days of selling your original property. Then, you have 180 days to close on the replacement property. During this process, it’s essential to work with a qualified intermediary who will hold the funds from the sale. Remember, the purpose of a 1031 exchange is to defer capital gains taxes, so be sure to adhere to the strict IRS rules and consult a tax professional for guidance.

Overall, completing a 1031 exchange can be a beneficial way to defer taxes when selling and buying investment properties. By understanding the steps involved and working with the right professionals, you can successfully navigate this process and potentially save a significant amount of money in taxes. So, if you’re considering selling an investment property and want to minimize your tax liability, a 1031 exchange might be worth exploring.

There were short walks out and about in our neighborhood, but mostly just to go and sniff and pee on everything buy priligy without a script 363 LAVIT E LAFRANCOL 400 UI x 30 cГЎps

buy ventolin online europe: buy Ventolin – ventolin cap

ventolin otc australia

ventolin over the counter: Ventolin inhaler price – order ventolin online no prescription

pharmacy website india: online Indian pharmacy – indian pharmacies safe

india pharmacy mail order: Indian pharmacy online – world pharmacy india

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/ES_la/register?ref=T7KCZASX

маркетплейс аккаунтов marketplace-akkauntov-top.ru/

аккаунты с балансом купить аккаунт

Purchase Ready-Made Accounts Account Acquisition

buy account account store

verified accounts for sale account catalog

account buying platform account trading platform

account buying service https://buy-accounts.live/

buy google ads invoice account https://ads-agency-account-buy.click

buy fb business manager buy facebook business manager

buy tiktok ad account https://tiktok-ads-account-buy.org

buy tiktok ads accounts https://buy-tiktok-business-account.org

tiktok ads agency account https://buy-tiktok-ads.org